Today (May 14th) marks the fourth consecutive session of gains, pushing the VN-Index to its highest level since the beginning of the year. Bank stocks led the market, with the main drivers being VCB, BID, VPB, and TCB.

VPB was the center of attention as it closed at the ceiling price of VND 18,900 per share. Trading volume surged with over 95.5 million shares changing hands. Foreign investors poured money into VPB, with a net buy value of more than VND 321 billion. Foreign capital has been aggressively buying this bank stock in the last two sessions. VPBank shareholders are about to receive a 5% cash dividend on May 23rd.

Not only in the financial market, but VPBank is also making headlines with an upcoming music festival featuring top K-pop artists. A large number of fans are eagerly awaiting the return of G-Dragon, the leader of BigBang, to Vietnam for the first time in 12 years as a solo artist.

VPB surges with liquidity of over 95 million shares.

Apart from the banking group, stocks related to the Bamboo Capital ecosystem also had vibrant trading sessions. Codes such as BCG, TCD, and DGW witnessed large ceiling buy orders. Speculative money seems to be returning to these stocks, which had continuously “hit the floor” in the previous period. However, their contribution to the overall market rise was not significant due to their small market capitalization.

VPL of Vinpearl also made a considerable contribution to pushing the VN-Index above the 1,300-point threshold. The stock continued its ceiling price rally after its listing, reaching VND 91,400 per unit. More than 2.1 million shares were traded. However, as the listing time has not yet reached six months, HoSE has added VPL to the list of stocks that do not meet the conditions for margin trading.

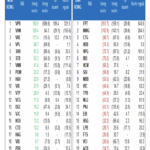

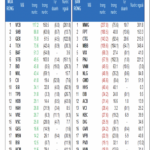

Another record set in today’s session was foreign trading. After a previous turnaround in net buying, foreign capital continued its enthusiasm, aggressively accumulating FPT, VPB, MWG, HPG, and PNJ. The net buying value was the highest since the beginning of the year, at over VND 2,257 billion. FPT was net bought for VND 540 billion, VPB for over VND 321 billion, MWG for VND 284 billion, and HPG, PNJ, CTG, BID, and MBB all for over VND 100 billion.

At the close, the VN-Index rose 16.3 points (1.26%) to 1,309.73 points. The HNX-Index increased by 0.95 points (0.44%) to 218.88 points. The UPCoM-Index climbed 0.34 points (0.36%) to 94.89 points. Liquidity edged slightly higher, with the HoSE matching value reaching nearly VND 22,800 billion.

According to experts, investor sentiment has been improving significantly, especially as bank stocks and Vin group stocks take the lead in the uptrend. However, the market recovery remains highly differentiated, as many sectors have not returned to their pre-correction levels since April 2nd.

The Foreigners’ Net Buying Surge: A Record High Since the Year’s Start

The domestic stock market continued its upward trajectory today (May 13th), with the VN-Index inching towards the 1,300-point mark. Bank stocks painted the town green, providing a significant boost to the overall market. Foreign investors recorded their strongest net buying session since the start of the year.

Expert Insights: A Market Correction May Be Imminent, Exercise Caution With Margin Trading

“The market needs a breather to consolidate after a sharp rally last week to digest the influx of bargain buys,” said Mr. Hinh.

Foreign Block Buys a Record High of Over VND 1,100 Billion, Large-cap Stocks Lift VN-Index Past 1300 Points

The blue-chip stocks witnessed a surprising boost this morning, with foreign investors’ buying power accounting for nearly 21% of the total liquidity in the VN30 basket. Foreign capital drove a 25.5% surge in liquidity for blue-chip stocks, taking it to the highest level in 20 sessions, while trading on the HoSE floor dipped 7.5% compared to yesterday’s morning session.