On May 7, F88 Joint Stock Investment Company announced to its shareholders and investors the completion of its public company registration. With F88’s disclosure of information prior to trading on the UpCom exchange, for the first time, the financial report of a pawnshop lending company was “revealed.”

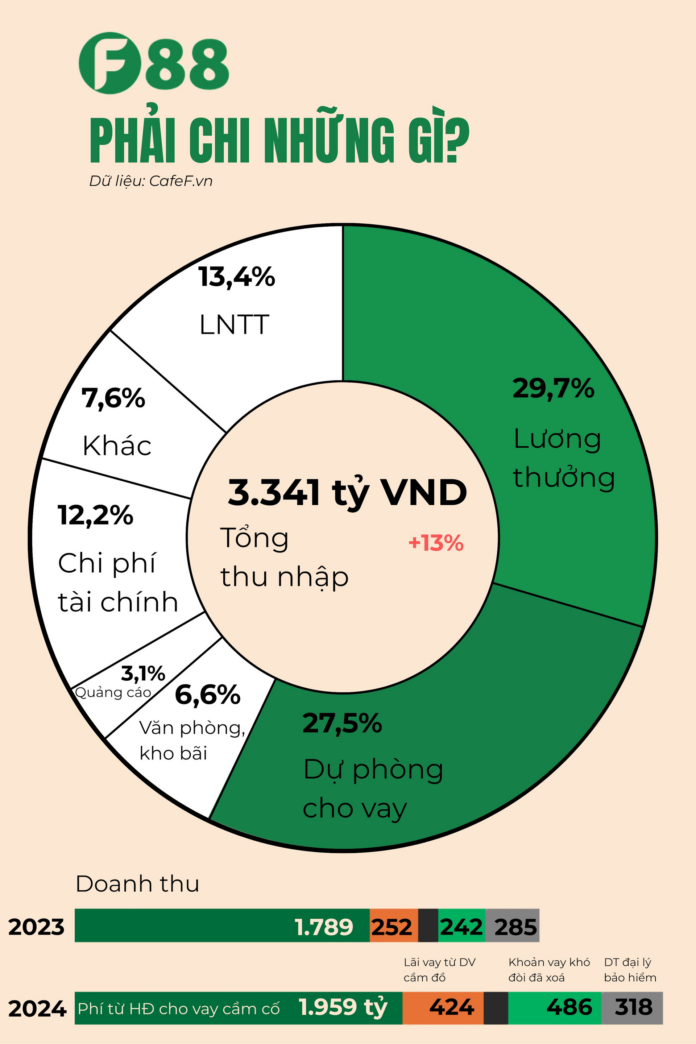

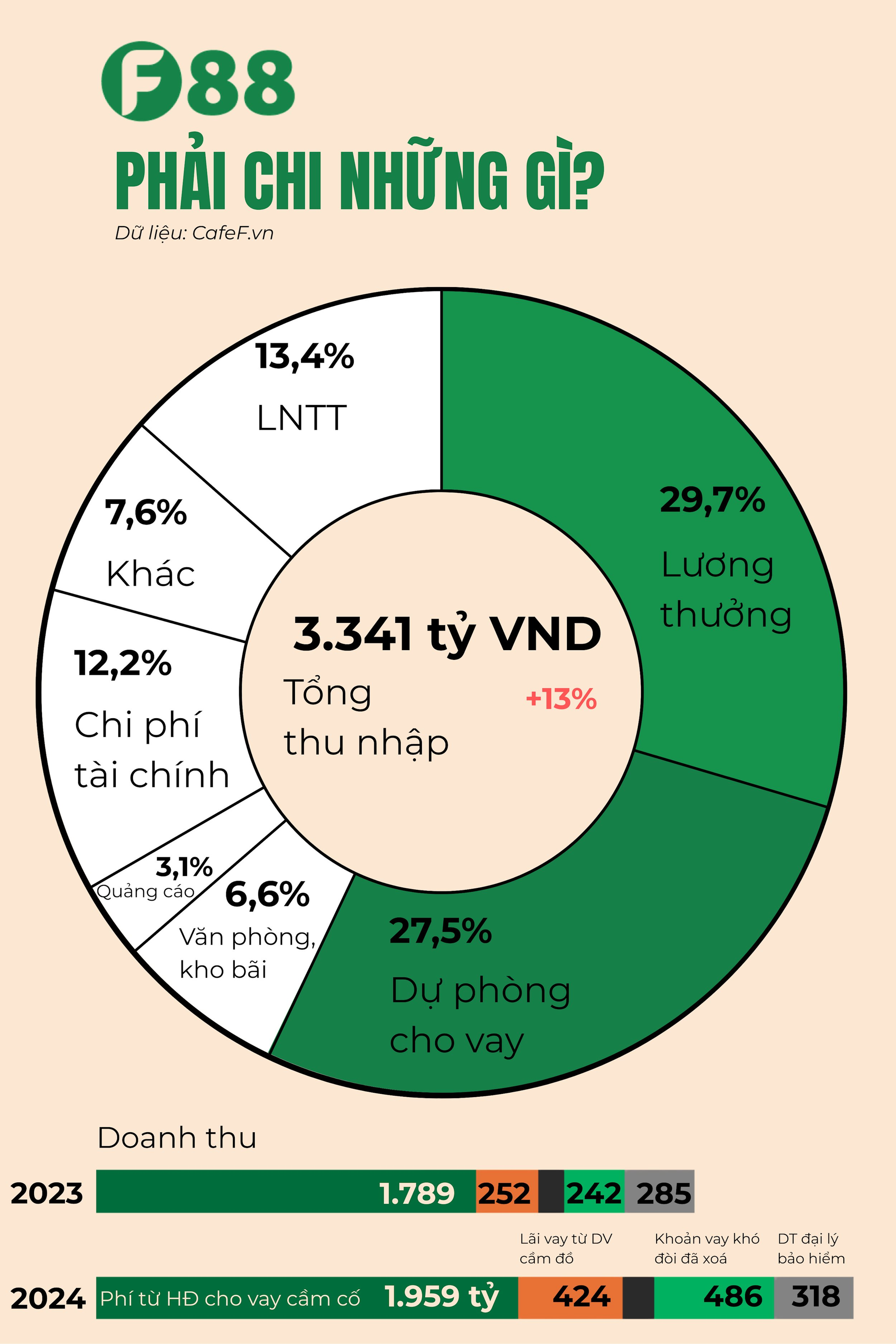

For every 10 dongs of revenue: 3 dongs are spent on employee salaries, 3 dongs on loan provisions, and slightly over 1 dong is left as profit

F88’s total revenue (including revenue from main business operations, financial revenue, and other income) in 2024 was VND 3,341 billion. The main source of revenue was fees and interest from pawnshop lending services. Additionally, a significant portion came from written-off difficult loans, i.e., recovering loans that had been removed from the balance sheet for off-balance sheet monitoring.

These are recurring amounts due to their association with F88 Business Joint Stock Company’s lending activities, but according to Vietnamese accounting standards, they are classified as other income.

F88’s largest expenses were personnel salary and bonus payments (29.7% of total income) and loan provisions (27.5%), meaning that out of every 10 dongs of revenue, nearly 3 dongs were spent on employee salaries, and nearly 3 dongs were set aside for loan provisions.

F88 aims for over 30% growth in revenue and profit this year, targeting a stable growth rate of over 30% annually in the next 5 years.

Pawnshop Interest Rates: Maximum of 7.5%/month

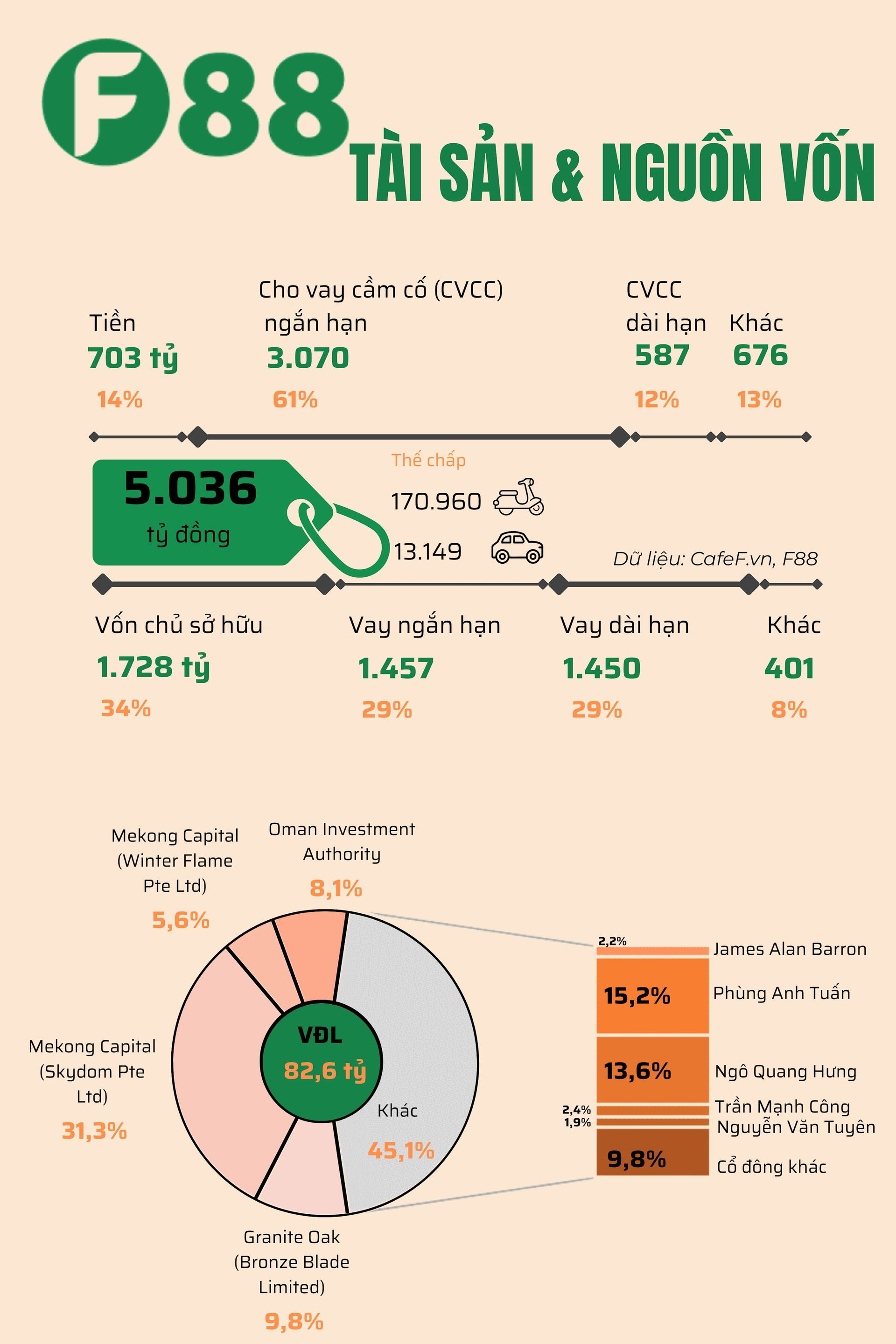

As of December 31, 2024, the company’s total assets reached VND 5,036 billion, an increase of over VND 1,080 billion compared to the previous year. 170,960 motorcycles and 13,149 automobiles are currently being used as collateral, but F88 still allows customers to use them.

Regarding F88’s asset structure, 61% is comprised of short-term pawn lending, valued at VND 3,070 billion. Long-term pawn lending accounts for VND 587 billion, or 12% of total assets.

As of December 31, 2024, the VND 3,070 billion in short-term pawn lending was the principal balance of auto and motorcycle pawn loans with remaining terms of 1 to 12 months (short-term and long-term due) and remaining terms of over 12 months to 36 months (long-term) with interest rates ranging from 1.1%/month to 1.6%/month and service fees ranging from 2%/month to 6.5%/month.

F88 stated that if the interest rate applied is 1.6%, the highest fee for that loan would not exceed 5.9%. Thus, the maximum pawnshop interest rate at F88 is 7.5%/month.

Meanwhile, F88’s short-term and long-term borrowings totaled VND 1,457 billion and VND 1,450 billion, respectively, with a maximum borrowing rate of 12%/year.

Specifically, VND 660 billion in short-term bonds issued by F88 Business Joint Stock Company are due between April 2025 and December 2025, with fixed interest rates ranging from 10.5% to 11.5%/year. Bond interest is paid quarterly.

Short-term borrowings of VND 309 billion and long-term borrowings of VND 1,450 billion in USD incur interest rates ranging from 10.5% to 15%/year.

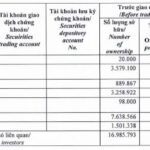

As of December 31, 2024, the chartered capital of F88 Investment Joint Stock Company was VND 82.6 billion, with 334 shareholders.

Just 6 major shareholders held 84.04%, including Skydom (an entity of the investment fund Mekong Capital) holding 31.3%; Winter Flame (also of Mekong Capital) holding 5.6%; Granite Oak (Bronze Blade Limited) owning 9.8%; Oman Investment Authority holding 8.1% of the chartered capital. The individuals, Mr. Phung Anh Tuan – Chairman of the Board of Directors, and Mr. Ngo Quang Hung – Non-Executive Member of the Board of Directors, respectively hold 15.2% and 13.6% of the chartered capital.

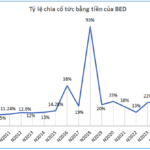

“Harec Building Owner Locks in 30.5% Dividend Yield.”

The Harec Investment and Trading JSC (UPCoM: HRB), owner and operator of the prestigious Harec Building in Hanoi, has announced the record date for shareholders to receive cash dividends for the year 2024. Shareholders on record as of May 21st, 2025, will be eligible to receive this dividend payment.