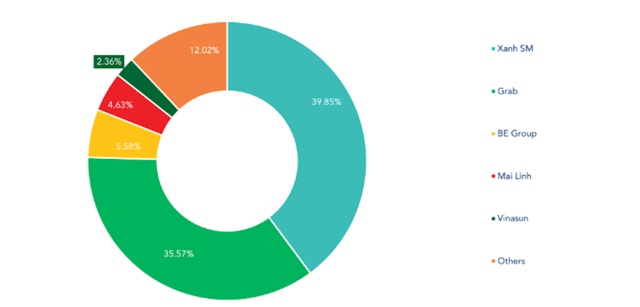

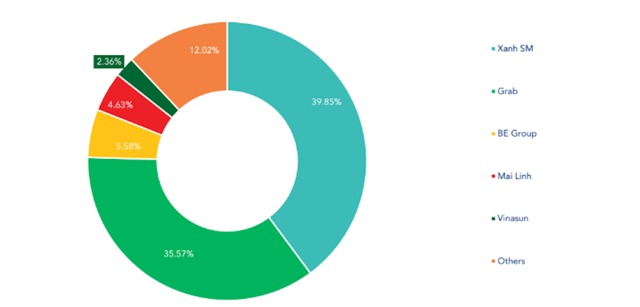

According to the Vietnam ride-hailing market research report by Mordor Intelligence, the market share of leading brand Xanh SM in Q1/2025 was 39.85%, while that of Grab, the second-place contender, was 35.57%. This indicates a widening gap between the two brands over the past three months, up from 37.41% and 36.62% in Q4/2024, respectively.

Solidifying its Number One Position

A year ago, in Q4/2023, Xanh SM’s market share stood at 18.17%, surpassing Be and Gojek to secure the second position in the market, just seven months after its official launch. Grab, meanwhile, maintained its dominant position with a market share of over 50%.

However, in just one year, with its rapid network expansion and strategic partnerships with nearly 100 local partners, Xanh SM has achieved a remarkable turnaround, claiming the top spot in market share in Q4/2024. This lead has since widened to over 4% by the end of Q1/2025.

Market share of taxi and ride-hailing services in Vietnam in Q1/2025. Source: Mordor Intelligence.

Given the nature of the ride-hailing market and the development strategies of the two brands, experts believe that this gap is likely to widen further in the coming periods. Xanh SM has already achieved nationwide coverage and is continually gaining the trust and favor of consumers. The research results from Mordor Intelligence also show that Xanh SM is leading in all three critical operating indicators: the number of trips per day, willingness to pay, and customer satisfaction.

The emergence and ascendancy of Xanh SM also signify that the Vietnamese ride-hailing market has moved past the stage of competition through “cash burning and market occupation,” which had persisted for over a decade. The market has now entered a new phase where quality of service is the primary differentiator. Customers are no longer solely focused on affordability but are willing to pay a premium for a service that offers a comfortable and satisfying travel experience.

Competing on Quality and Expanding Beyond Borders

Xanh SM’s rapid success is attributed to its strategic decision to initiate and lead a new consumption trend that aligns with the country’s development orientation and receives widespread support from the people.

Rather than pursuing expansion at all costs, Xanh SM has built a solid operational foundation based on a “three-legged stool” model: its owned fleet of electric vehicles, an open platform for individual electric vehicle drivers (Xanh SM Platform), and partnerships with traditional taxi companies transitioning to electric (Xanh SM Partner).

XanhSM’s entry into the food delivery market promises to expand its empire in Vietnam.

This model enables the company to expand rapidly while maintaining service quality control, a challenge many competitors face as they scale. In the opinion of Associate Professor Dr. Dinh Trong Thinh, one of the key reasons for Xanh SM’s market share gains is its focus on providing clean, high-quality, and safe vehicles, coupled with the professional attitude of its drivers. “In this age of technology and fierce competition, the differentiating factor is service quality, and Xanh SM excels in this regard,” he noted.

In reality, before Xanh SM’s arrival, the ride-hailing market had reached a saturation point, with vehicle and service quality stagnating or even deteriorating. According to Associate Professor Dr. Dinh Trong Thinh, Vietnamese customers long for high-quality products and services, and Xanh SM’s success lies in meeting this practical need, earning it strong support. This leading economic expert believes that with its winning formula and promising new initiatives, Xanh SM is cementing its number one position in the ride-hailing market.

Contrasting Xanh SM’s rapid growth is Grab’s slowing momentum. Grab Holdings Ltd.’s 2024 annual report showed that revenue in Vietnam for the year reached $228 million, a nearly 23% increase from $185 million in 2023. While still a double-digit growth rate, it pales in comparison to the 70% growth achieved in 2023 ($108 million to $185 million), indicating a noticeable slowdown.

Vietnam accounted for only about 8.15% of Grab’s total regional revenue in 2024, significantly lower than that of other key markets. Notably, Grab’s revenue growth in Vietnam was largely driven by its food delivery business, a sector currently dominated by only two players: Grab and Shopee, following the exit of Gojek and Baemin. However, with Xanh Ngon’s planned entry into this market, the competition is expected to intensify.

According to Mr. Alejandro Osorio, CEO of Grab Vietnam, one of the main growth drivers for Grab in 2024 was the expansion into new provinces and cities where Grab previously had no presence, with a growth rate of 63% compared to 2023. However, this impressive figure pales in comparison to Xanh SM’s lightning-fast expansion across all provinces and cities nationwide within just over a year, translating to an estimated growth rate of up to several thousand percent in new markets.

Masan-Owned Phuc Long: Brewing Up a Storm with Over $200,000 in Daily Revenue and a Network of 170+ Stores

According to the financial report of Masan Group Joint Stock Company (MSN), in 2024, Phuc Long recorded a revenue of VND 1,621 billion, up 5.6% compared to the same period last year. This corresponds to a daily revenue of over VND 4.4 billion for the popular tea brand.

The Battle for Survival: A Small Ride-Hailing App’s Struggle

Despite their best efforts to stay afloat, smaller ride-hailing apps are finding it challenging to gain traction and break through in the market. The odds are stacked against them as they compete with well-established players who have a head start in terms of resources, brand recognition, and network effects. It seems an uphill battle for these smaller players to make a significant dent in the industry and capture a substantial market share.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-218x150.jpg)