Starting to repay from 2027

As of March 31st, Novaland Group‘s (NVL) total loan balance exceeded 59 trillion VND, a decrease of nearly 4% from the end of 2024 and a reduction of almost 9% compared to the end of 2022 – pre-restructuring.

Specifically regarding domestic bonds, Novaland reduced its privately issued bond debt by 18% and extended the maturity of over 4 trillion VND worth of privately placed and publicly issued bonds compared to the end of 2022.

From now until the end of 2026, Novaland cannot arrange cash flows to repay its debts.

The total debt maturing within 12 months, according to the original terms, amounts to approximately 32 trillion VND, encompassing bonds, foreign loans, and domestic loans. Given the current financial situation, especially with project legal issues not being resolved as expected, Novaland’s leadership acknowledges the significant impact on revenue and loan disbursement progress.

From this point until the end of 2026, Novaland cannot arrange cash flows to repay its debts. Consequently, the company’s management has devised a plan to settle debts with each group of creditors over the next three years.

Specifically, for domestic loans, Novaland is implementing strategies to fulfill its debt obligations in alignment with the legal progress and cash flows of the projects over the next 2-3 years. Simultaneously, banks and credit institutions have agreed to provide a credit limit of nearly 12.45 trillion VND.

Regarding foreign loans and bonds, NVL has proposed or is in the process of negotiating restructuring and extensions from 2025 to 2026-2027.

Since the beginning of the year, Novaland has delayed repayment of thousands of billion VND in bonds due to cash flow issues. According to documents sent to bondholders and bondholder representatives, the company recently proposed that bondholders agree to extend the maturity of multiple bond packages by a maximum of 24 months from April 2025.

After the extension period, Novaland plans to utilize surplus funds from projects to make payments. Concurrently, NVL is continuing negotiations to implement various restructuring solutions to safeguard bondholders’ interests.

Concerning the $300 million international bond listed on the Singapore Stock Exchange, Novaland is actively negotiating with bondholders to modify the 2025 interest payment plan. Accordingly, the interest portions of the payments due on January 16th and July 16th will be capitalized into the bond principal.

Financial Performance

According to Novaland’s leadership, the critical factor influencing the company’s business results is the progress of resolving project legal issues. Therefore, for 2025, Novaland cautiously sets two business plans, based on two legal scenarios, with the primary goal of reducing losses.

“With the ever-changing market conditions and significant challenges remaining, Novaland aims to complete its restructuring by the end of 2026 to return to a growth trajectory in 2027. The company will strive to fulfill all obligations to customers, investors, shareholders, bondholders, partners, and related parties by the end of 2026-2027,” stated Novaland’s representative.

The key factor influencing Novaland’s business results is the progress of resolving project legal issues.

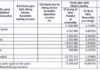

Specifically, Novaland has outlined two scenarios for its 2025 business plan. Scenario 1 projects net revenue of 13,411 billion VND with a post-tax loss of 12 billion VND, while Scenario 2 estimates net revenue of 10,453 billion VND with a post-tax loss of 688 billion VND. The critical factor influencing Novaland’s business results remains the progress of resolving project legal issues.

Novaland did not pay dividends for 2024, and the remaining undistributed post-tax profit of over 13,281 billion VND will be utilized for business recovery plans.

In the first quarter of 2025, Novaland recorded consolidated revenue of over 1,778 billion VND, a 2.5-fold increase compared to the same period last year. This includes net revenue from real estate transfers of over 1,634 billion VND, a 3.3-fold rise, thanks to project handovers at NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, Sunrise Riverside, and Palm City. Due to other losses of nearly 262 billion VND and the absence of contract violation penalties received in the previous year, Novaland incurred a net loss of over 443 billion VND.

As of March 31st, Novaland’s total assets amounted to over 234,806 billion VND, remaining relatively unchanged from the beginning of the year. Short-term cash holdings increased by 32% to 6,126 billion VND, and inventory stood at 148,639 billion VND, comprising 63.3% of total assets.

The Top 5 Shareholders Related to Chairman Bui Thanh Nhon Have Registered to Sell Nearly 18.8 Million Novaland Shares

Novagroup is set to offer a substantial number of shares, with a planned sale of over 3.9 million NVL stocks. Diamond Properties is also looking to offload a significant amount, totaling 3.2 million shares. In a separate move, the wife and children of Bui Thanh Nhon, Chairman of the Board of Directors, are seeking to sell a combined total of nearly 11.6 million shares.

“Baf Vietnam Seeks to Raise $215 Million Through Bond Issuance for Debt Restructuring”

Baf Vietnam is set to issue a bond offering, BAF12501, in the second quarter of 2025, seeking to raise 500 billion VND (approximately $21.5 million) to restructure its debt portfolio.