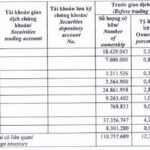

Mr. Ha Duc Hieu, a member of the Board of Directors of DXG Corporation (listed on HoSE: DXG), has reported the purchase of 5 million DXG shares between May 7 and May 15.

Following this transaction, Mr. Hieu’s holdings increased from 785,499 shares to nearly 5.8 million DXG shares, raising his ownership stake from 0.09% to 0.66%.

It is worth noting that Mr. Ha Duc Hieu was elected to the Board of Directors of DXG in July 2020. During the period from May 7 to May 15, DXG shares traded between VND 16,000 and VND 16,400 per share. It is estimated that Mr. Ha Duc Hieu invested more than VND 80 billion to acquire these shares.

Illustrative image

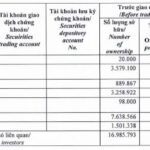

Regarding DXG share transactions, on April 11, the foreign fund Dragon Capital successfully purchased 1.8 million DXG shares through four member funds.

Specifically, Amersham Industries Limited bought 80,000 DXG shares, Hanoi Investments Holdings Limited purchased 1 million shares, Norges Bank acquired 400,000 shares, and Vietnam Enterprise Investments Limited bought 320,000 DXG shares.

Post-transaction, Dragon Capital’s ownership in DXG increased from over 103.8 million shares to more than 105.6 million shares, raising its stake in the DXG Corporation from 11.92% to 12.13%.

DXG Corporation recently held its Annual General Meeting on May 9. The meeting approved consolidated net revenue and profit-after-tax targets of VND 7 trillion and VND 368 billion for 2025, representing increases of 46% and 44%, respectively, compared to the previous year.

The meeting also approved a plan to increase capital by issuing bonus shares at a ratio of 17%, equivalent to over 148 million shares. These shares will not be restricted from transfer and are expected to be issued in 2025.

Additionally, the meeting agreed to proceed with a previously approved plan from the 2024 Annual General Meeting to privately offer 93.5 million shares to no more than 20 strategic investors. The minimum sale price is expected to be VND 18,600 per share, and the proceeds will be used to contribute additional capital and increase ownership in subsidiary companies.

What Did the Investment Fund Buy and Sell This Week?

Last week (May 5-9, 2025), the investment fund primarily announced transactions made towards the end of April.

‘Unusual’ Top-Tier Exporter of Wood, Stone, and More to the US: Stocks Soar Amid Tariff Turmoil

The Vietnamese stock market witnessed yet another brutal sell-off as President Trump imposed a 46% retaliatory tariff on Vietnamese goods, effective April 9th.