Saigon Water Infrastructure Joint Stock Company (SII) was listed on the HOSE since 08/22/2012 and used to be a stable business enterprise in the water infrastructure field. However, since it was acquired by DNP Water Industry Joint Stock Company (DNP) with a 50.61% ownership stake in 2023, a series of concerning decisions have taken place.

Selling the best assets to “rescue” perennial losses

On 11/11/2024, SII issued Resolution 14/2024/SGW/HĐQT-NQ on the approval of the plan to divest capital from Tan Hiep Water Investment Joint Stock Company (THW), the investor of Tan Hiep 2 Water Plant, and B.O.O Thu Duc Water Joint Stock Company (TDW) with a total divestment value of no less than 900 billion VND.

The total divestment value of the two investments in THW and TDW accounted for 41.23% of the total asset value as of 09/30/2024, according to the consolidated financial statements of SII for Q3 2024.

| At the meeting with investors in February 2025, the leadership of Binh Duong Water – Environment Joint Stock Company (Biwase, HOSE: BWE) announced information about the purchase of 43% of THW shares. Although it does not hold a controlling stake of over 50%, Biwase stated that it is still the largest shareholder and holds the position of Chairman, ensuring an important role in the operation of THW. |

After nine consecutive years of profits (2012-2020), SII recorded a streak of losses from 2020-2023, forcing it to be delisted from HOSE and moved to UPCoM. Profits returned in Q4 2024 due to the sale of the company’s best asset, a 40.85% stake in the Tan Hiep 2 Water Plant.

What is puzzling is why a water infrastructure company, which is thirsty for profits and in need of long-term consolidation, would sell Tan Hiep 2 – an asset that brought a net profit margin of 45% in 2024 and maintained an average of 42% over the past five years, according to the 2024 annual report. Tan Hiep 2 has a capacity of 300,000 cubic meters/day, accounting for more than 70% of total water production when combined with the rest of SII‘s operations.

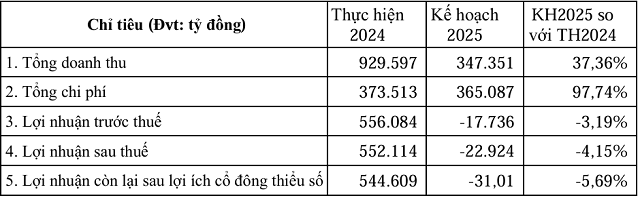

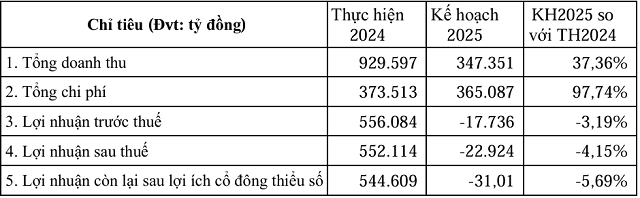

In addition, SII‘s 2024 annual report mentioned the company’s 2025 business plan, which projected a post-tax loss of over 22 billion VND. This raises questions about whether the money obtained from the sale of the Tan Hiep 2 Water Plant will actually be used for the company’s core activities.

(Excerpt from the 2024 Annual Report)

|

Is the sale of the best assets when the company is in trouble a sign of a lack of strategic direction or serving some other private interest?

Using asset sale proceeds to lend to multiple parties

The total proceeds from the sale of shares in Tan Hiep Water Investment Joint Stock Company (THW) caused SII‘s total assets to surge to 2,851 billion VND in Q4 2024, a 25% increase compared to 2,182 billion VND in Q3 2024.

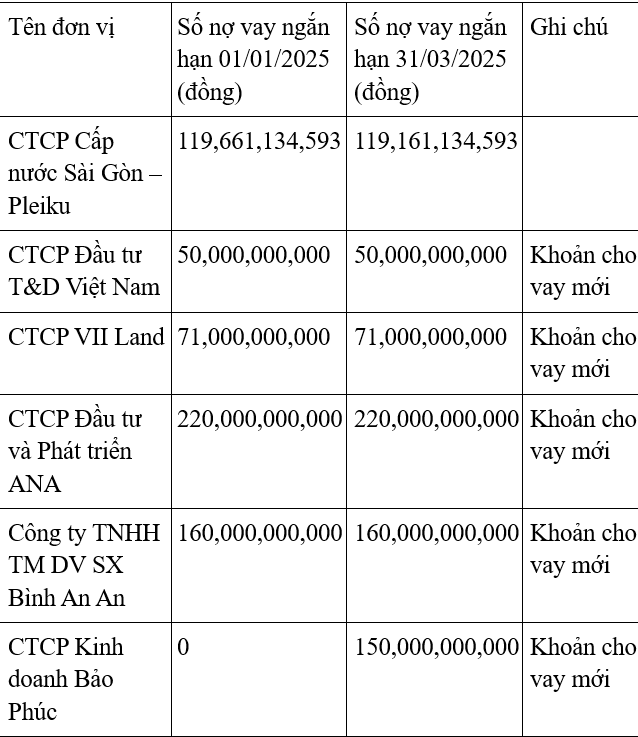

However, instead of using this money for core business operations, the company issued short-term loans in the same period it received the proceeds from the THW share sale in Q4 2024. As a result, the value of short-term loans increased from 127 billion VND at the end of Q3 to 620 billion VND in Q4.

Source: Consolidated

|

What’s notable about these loans?

The borrowing parties are all recorded by SII as “Capital Support” with interest rates ranging from 8.5%-11%/year, maturing in June and December 2025, and there is no recorded collateral in the financial statements for these loans.

Source: Consolidated

|

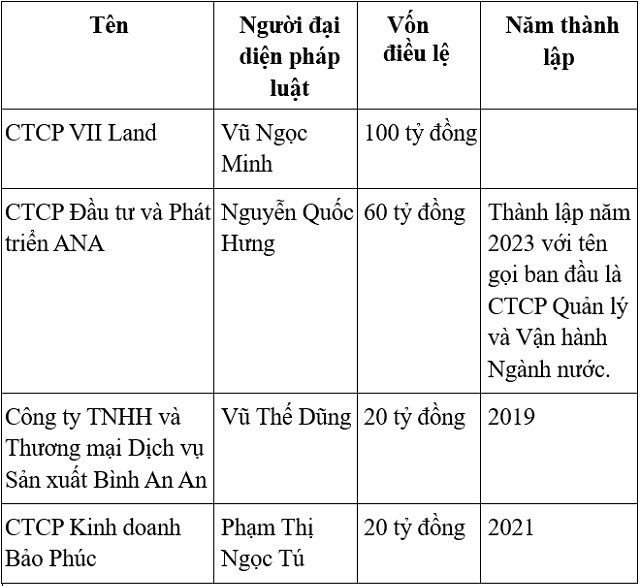

Another noteworthy point is that most of the companies that SII lent money to are related to DNP Water Industry Joint Stock Company (DNP Water) – the parent company of SII.

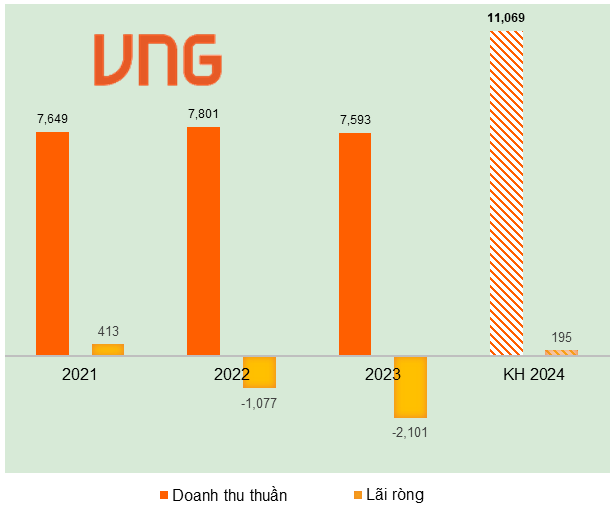

The Ultimate Guide to Stock Market Success: Withdrawing from the Genesis Fund Early

On May 14, Joint Stock Commercial Bank for Investment and Development of Vietnam (CSI) announced its decision to withdraw its entrusted capital ahead of schedule from Genesis Asset Management JSC (GFM). The transaction value amounted to VND 35 billion, equivalent to 21% of CSI’s total assets.

The Strategic Capital Retreat: Biwase Members Plan Massive Divestment from Vwaco

Biwase Installation – Electricity Joint Stock Company (Biwelco) has registered to sell 7.1 million VLW shares of Vinh Long Water Supply Joint Stock Company (Vwaco, UPCoM: VLW) from May 13 to June 6, expecting to reduce its ownership from over 9.7 million shares (33.7%) to over 2.6 million shares (9.1%).

The Cement Industry’s Grey Outlook: Can Public Investment Turn Things Around?

The cement industry painted a grim picture in Q1 of 2025, with only a handful of businesses emerging from the red. However, with a boost in public investment and improving market demand, there’s a glimmer of hope on the horizon.