VietinBank Securities (CTS: Mã) has just announced a resolution by its Board of Directors to implement a stock dividend payment plan as per the resolution of the 2025 Annual General Meeting of Shareholders.

According to the plan disclosed by VietinBank Securities, the company will distribute a stock dividend with a ratio of 43%, meaning that for every 100 shares owned, shareholders will receive an additional 43 shares. In total, the securities arm of VietinBank will issue nearly 64 million new shares to increase its charter capital to nearly VND 2,127 billion.

The issuance is expected to take place in the second or third quarter of 2025, after the company receives written notification from the State Securities Commission regarding the receipt of the company’s stock dividend issuance report.

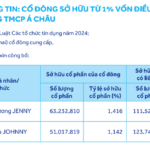

With a concentrated shareholder structure, VietinBank Securities is a subsidiary of Vietnam Industrial and Commercial Bank (CTG: Mã), which holds nearly 112.5 million shares, equivalent to 75.64% of the capital. After the issuance, VietinBank will own over 160 million shares.

At this year’s annual general meeting, VietinBank Securities’ shareholders approved a plan to pay dividends in stocks at a ratio of 43%. This is one of the highest ratios in the securities industry.

According to the management, the capital increase is a necessary step to expand the business limit and meet the capital requirements for future development plans. Enhancing the charter capital and owner’s equity will not only help VietinBank Securities optimize capital costs but also increase competitiveness, consolidate market share, and enhance its image and position in both domestic and international markets.

Regarding the company’s business performance, VietinBank Securities reported impressive results for the first quarter of the year with a surge in profit. According to the first-quarter financial report, the realized profit for the first quarter of 2025 reached VND 214.4 billion, up 175.5% from VND 77.8 billion in the same period last year. This is the highest growth rate among securities companies with profits exceeding VND 100 billion in the past quarter.

For securities companies, realized profit (also known as actual profit) is the basis for building profit distribution plans for shareholders, which differs from book profit recorded in accounting books.

At the annual general meeting of shareholders held at the end of April, Mr. Tran Phuc Vinh, Chairman of the Board of Directors of VietinBank Securities, shared that the company did not adjust its business plan after the first-quarter profit surge for three reasons.

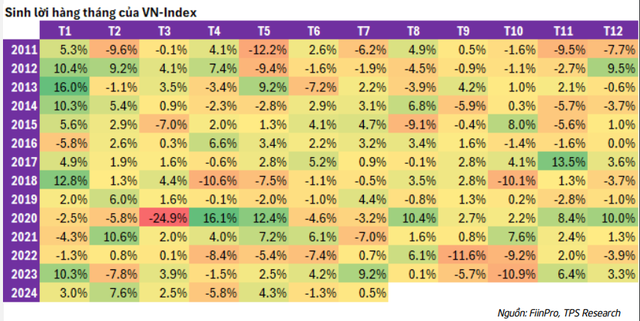

Firstly, while there are upcoming favorable factors, the market also faces certain risks. Although the total margin debt of the market has increased, the profit from margin lending activities of all parties is declining. The high competitiveness of the industry will erode the profits of securities companies.

Secondly, information about tariffs forecasts challenges for businesses, and investment decisions will be made with more caution. Securities companies will join hands to support enterprises in the coming time.

Finally, VietinBank Securities also needs to research and plan investments in technology projects to align with the government’s digital transformation agenda to remain competitive in the market.

The Magic of Words: Transforming Titles with Artistry and Precision

“German Chemicals Giant Infuses $20 Million into its Real Estate Venture”

“With a substantial investment of 5000 billion VND, Duc Giang Chemicals plans to boost the charter capital of Duc Giang Real Estate to an impressive 1000 billion VND in the second quarter of 2025. This significant capital increase from 500 billion VND will undoubtedly propel the company’s growth and expansion in the real estate industry.”