“State-Owned Banks’ Positive Real Estate Signals”

Specifically, the “Other Income” of state-owned banks reflects positive signals from the real estate market.

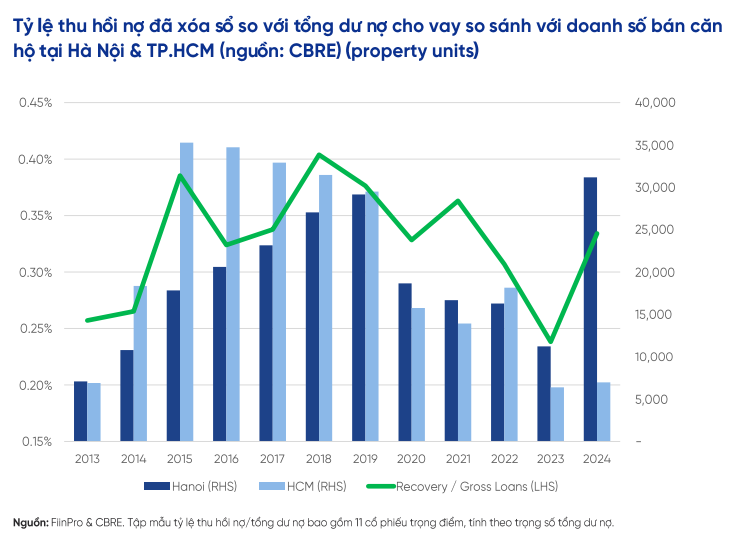

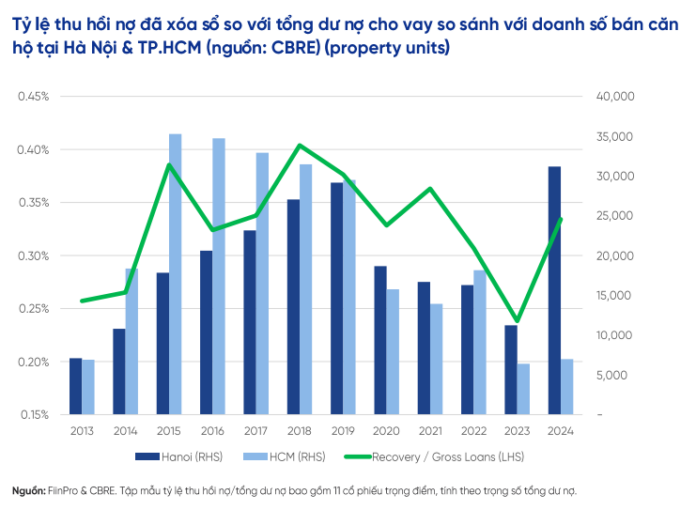

Historically, income from bad debt resolution has been a barometer of the health of the real estate market (where collateral is heavily concentrated). The 2024 audited financial statements provide a detailed breakdown of “income from other activities” in the income statements, allowing for an accurate assessment of bad debt recovery performance. Although the Q1 2025 reports are unaudited, the “other income” items of the SOCBs have shown signs of value for reference, although they may not fully reflect the situation compared to private banks.

In the 2024 financial year, income from bad debt resolution accounted for 84% of Vietcombank’s other income, 88% of BIDV’s, and 79% of VietinBank’s. These are also the three banks with the largest balance sheet scale in the group of 11 analyzed banks.

In Q1 2025, this item for the three listed state-owned banks increased by 51% year-on-year and increased by 2 basis points as a ratio of loan balances.

VPBankS stated that there were no significant developments regarding non-performing loans (NPLs) in Q1 2025. The NPL ratio of the 11 bank stocks within the analysis scope increased by 20 basis points compared to the previous quarter, while Group 2 debt remained unchanged. The NPL ratio in Q1 2024 also recorded a similar increase of 20 basis points from the previous quarter.

The provision expenses of the 11 banks within the analysis scope reached 0.24% of loan balances in Q1 2025, compared to 0.30% in Q1 2024. This corresponds to the view expressed in the previous report that Vietnamese banks are making low provisions compared to potential risks, even though the adoption of the IFRS international accounting standards is imminent.

The banks that recorded the sharpest year-on-year declines in provision expenses include Vietcombank, Sacombank, TPBank, and VIB.

However, the reduction in provision expenses mainly aimed to “offset” the weak growth of operating income (TOI). Therefore, VPBankS believes that instead of looking at net profit after tax (NPAT), TOI is currently a better indicator of the industry’s performance. The banks that recorded double-digit TOI growth in Q1 2025 include: HDBank (retail), VPBank (retail), MB, and Sacombank.

Unlocking Property Potential: Navigating the Real Estate Credit Conundrum

The real estate sector remains an attractive avenue for investment, with banks loosening their grip on real estate credit. However, lending in this sector is still being cautiously monitored and controlled.

The Final Stop: How Metro Hoa Lac’s Land Prices Were Inflated, Leaving Investors High and Dry

The mere mention of the Metro Hoa Lac line’s terminus on paper has caused land prices in the area to skyrocket. Investors rushed in to ride the wave, but their dreams shattered as the market stalled, leaving them stranded with billions locked in investments.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)