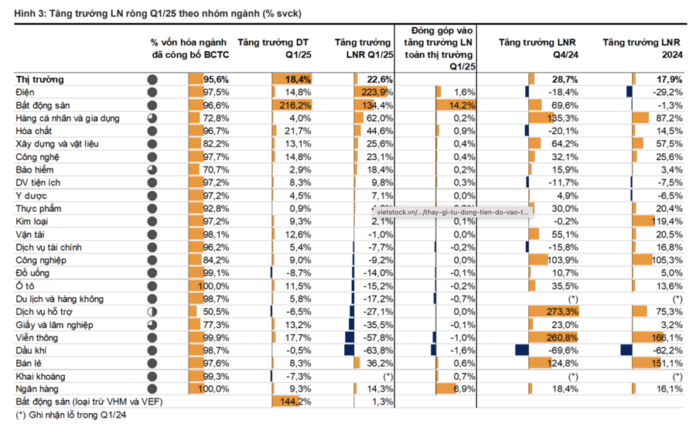

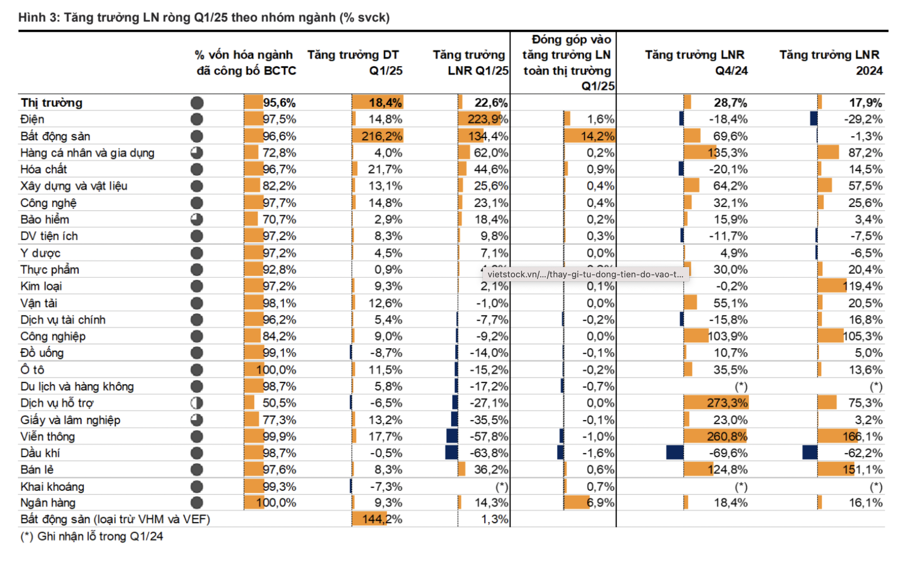

The latest earnings reports from 961 companies, accounting for 95.6% of the total market capitalization, reveal interesting insights into the health of Vietnam’s economy. VnDirect estimates a 22.6% year-on-year increase in net profits for listed companies in the first quarter of 2025, thanks to both a low base in Q1 2024 and improved business fundamentals.

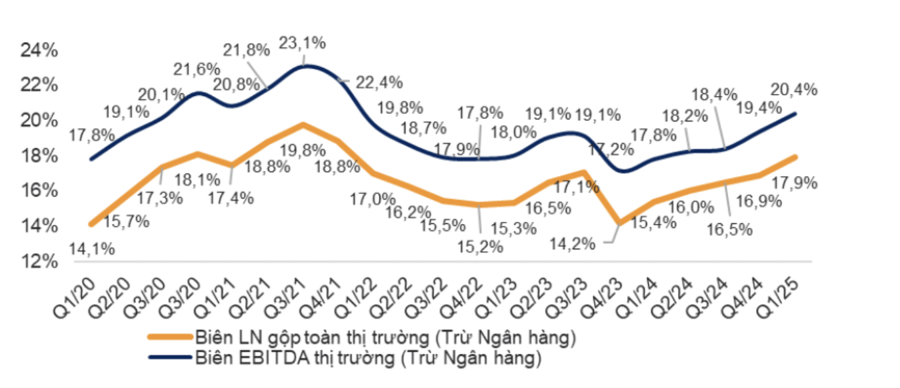

Notably, the EBITDA margin improved from 15.4% to 17.9%, indicating better cost control and management. Additionally, a low-interest-rate environment has also played a part in boosting profit growth.

The power and real estate sectors stood out with impressive performances. Power sector profits surged by 223.9% year-on-year, as gas-fired power plants recovered from low production levels last year, and hydroelectric power generation rebounded due to the El Niño effect in Q1 2024. Meanwhile, the real estate sector posted a 134.4% profit increase, marking the third consecutive quarter of growth, driven by supportive policies, low-interest rates, and attractive sales programs from developers.

Personal and household goods companies also saw a significant profit increase of 62% year-on-year, benefiting from rising export demand amid concerns over potential tariffs from the Trump administration on Vietnamese goods.

The chemical sector recorded a 44.6% profit increase due to improved gross profit margins, as input costs decreased while selling prices remained stable. Retail profits surged by 44% in Q1 2025, largely driven by strong revenue growth from MWG. The electronics division witnessed improved sales per store after restructuring, while the grocery segment continued its expansion.

Despite a lower gross profit margin compared to the previous year, net profits rose by 71.3% due to efficient cost control, particularly lower depreciation and the absence of abnormal costs from downsizing.

The oil and gas sector continued to face headwinds due to low oil prices, with profits plunging by 63.8% year-on-year, mainly attributed to an 8.9% drop in average oil prices in Q1 2025 compared to the same period last year. This negatively impacted stocks with selling prices linked to oil prices, such as BSR, PLX, and OIL.

When analyzing performance by market capitalization, all stock groups, except small-cap stocks, witnessed profit growth in Q1 2025. Large-cap stocks outperformed mid- and small-cap stocks in the first quarter, although their growth rate slowed compared to Q4 2024.

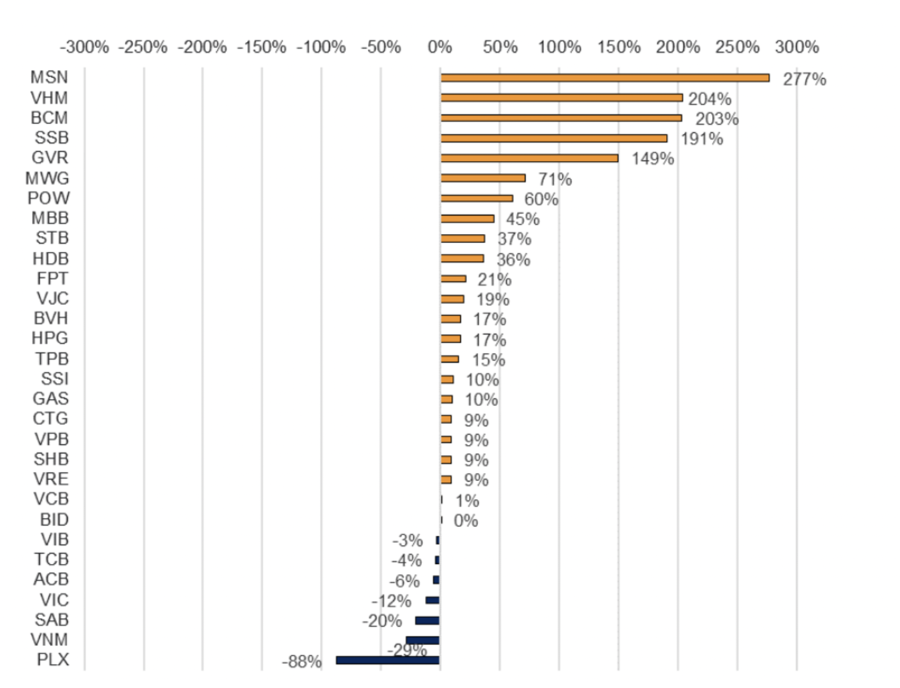

MSN, VHM, BCM, SSB, GVR, and MWG were the top performers, with the VN30 group’s net profit increasing by 12.8% year-on-year, and 22 out of 30 businesses experiencing growth. MSN (+277%), VHM (+204%), BCM (+203%), SSB (+191%), and MWG (+149%) led the pack, while PLX saw an 88% profit decline due to lower oil prices.

The overall market gross profit margin for Q1 2025 rose by 1 percentage point to 17.9%, driven by improvements in the Transport (+6.7 percentage points) and Tourism & Aviation (+6 percentage points) sectors.

Both leverage ratios and borrowing costs decreased in Q1 2025, with the latter falling to 6.1% (-0.5 percentage points compared to the previous quarter). During this period, the D/E ratio also dropped to 71.9%, a decrease of 3.5 percentage points. According to VnDirect, in an environment of declining deposit interest rates and subsequent reductions in lending rates for businesses, credit demand has lessened as companies restructure their capital in an increasingly volatile economic landscape.

“Profit-Taking Pressure Mounts, Blue Chips Push VN-Index Down to Near 1,300 Points”

The sell-off by both domestic and foreign investors dominated Friday’s session, with the stock market breadth heavily skewed towards decliners. Foreign investors withdrew nearly VND 957 billion net, following three consecutive net buying sessions, and sold particularly heavily in the VN30 basket, offloading VND 1,127 billion. Only a few large-cap stocks managed to keep the VN-Index afloat, while banking stocks witnessed a steep decline across the board.

The Foreign Block: A Surprising Sell-Off of Nearly VND 1,000 Billion, With Personal Investors Holding Steady

The foreign bloc reversed course and locked in profits after a record-breaking buying spree. Today, they offloaded 970.7 billion VND, with a net sell-off of 771.4 billion VND in matched orders alone.

“The Power of Pillars: Market Shifts and Foreign Capital Inflows”

The pressure to secure profits this morning was widespread, coupled with weakness in some large-cap stocks, which caused significant market volatility. On the bright side, cash flow remains positive, particularly from foreign investors. As the VN-Index approaches its previous peak, a divergence of opinions is only natural.