VN-Index experienced a sharp decline at the beginning of April 2025 following President Trump’s announcement of high retaliatory tariffs on Vietnamese goods. However, the index gradually recovered and recouped most of its losses during the month, aided by easing trade tensions between the US and China.

A recent strategy report by Maybank Securities (MSVN) revealed that corporate profits in Q1/2025 maintained positive growth momentum with a 13.2% increase year-on-year. Leading enterprises continued to capitalize on the current context to expand their scale and gain market share.

“With the US-Vietnam trade negotiations becoming increasingly clear, we believe that negative external factors will gradually subside and be counterbalanced by the government’s supportive measures as well as the agility of listed companies,” the report stated.

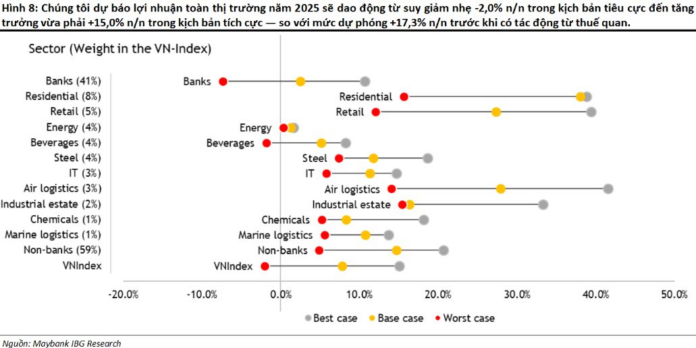

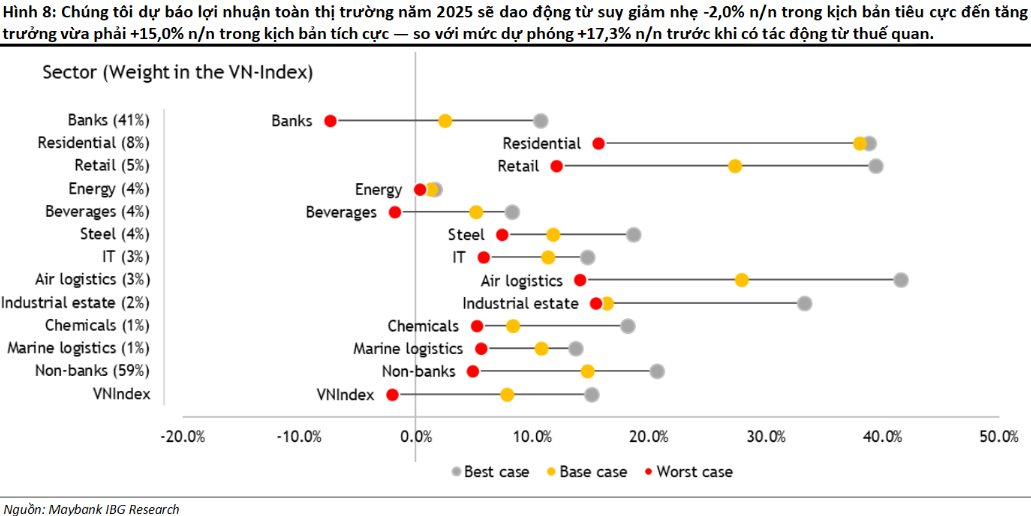

Moreover, the de-escalation of trade tensions continues to be a supportive factor for market valuation. Accordingly, the MSVN analytics team adjusted their profit forecast for the entire market and VN-Index target for the year upward by 5%-10%.

Specifically, Maybank raised the year-end VN-Index target to 1,300 points (base case), 1,500 points (best-case scenario), and 1,050 points (worst-case scenario). Market-wide profits are expected to increase by 7.7%-7.8% in the base case, 15%-15.7% in the best-case scenario, and contract in the negative scenario.

Regarding stock investment strategies, investors continue to focus on high dividend-paying stocks, sectors with stable long-term demand (IT, aviation logistics), and industries benefiting from policies such as real estate and steel.

Best-Case Scenario: The US Imposes 20–25% Retaliatory Tariffs on Vietnam

Regarding the tariff situation, MSVN noted that Vietnam has continued to demonstrate goodwill in the negotiations. However, the government is also pursuing a strategy of patience and caution due to geopolitical constraints and negotiation pressures.

The US’s final decision on tariffs is likely to depend on two factors: (1) the growing opposition from US corporations and domestic consumers, and (2) the outcome of US trade negotiations with Vietnam’s major investors, such as Japan, South Korea, and especially China.

Recent positive developments in US-China relations increase the likelihood of the 20–25% tariff scenario (best-case scenario). On the other hand, the US-UK trade agreement points to a different approach – sector-specific taxes instead of blanket tariffs, which could set a precedent for Vietnam.

In parallel, the government is prioritizing administrative procedure reforms and introducing new fiscal support packages to stimulate investment and consumption. Maybank estimates that the approved or proposed fiscal measures are valued at approximately 2.7–2.9% of GDP, which should help mitigate the negative impact of tariffs in 2025–2026.

The VN-Index Surges Past 1,300: Investors Rush to Take Profits as Foreigners Buy in Unprecedented Numbers, Netting Nearly VND 2,500 Billion.

Foreign investors today bought a net $97.7 million, with a net buy of $103.6 million in matched orders alone.

The Foreigners’ Net Buying Surge: A Record High Since the Year’s Start

The domestic stock market continued its upward trajectory today (May 13th), with the VN-Index inching towards the 1,300-point mark. Bank stocks painted the town green, providing a significant boost to the overall market. Foreign investors recorded their strongest net buying session since the start of the year.