Saigon-Hanoi Commercial Joint Stock Bank (SHB) Surges in Trading Session on May 15th, Supported by Strong Foreign Investment

The stock market on May 15th witnessed a breakthrough performance from Saigon-Hanoi Commercial Joint Stock Bank (SHB) shares. Prices surged to touch the ceiling before narrowing gains slightly. By 2:25 pm, SHB’s share price had increased by 5% to reach VND 13,650/share.

Notably, trading volume surpassed 160 million units, the second-highest in history, marking the 6th session since the beginning of 2025 where SHB’s liquidity exceeded 100 million shares. The corresponding transaction value was approximately VND 2.2 trillion.

SHB Share Price Performance on May 15, 2025

Within the same ecosystem, shares of Saigon-Hanoi Securities (SHS) also witnessed a vibrant trading session, climbing to VND 13,000/share. This marked the highest price for this securities stock in the past 7 months.

SHS Share Price Performance on May 15, 2025

The upward momentum of SHB shares was further bolstered by foreign investor participation. During this session alone, foreign investors poured nearly VND 300 billion into net purchases of SHB shares. Similarly, SHS also recorded its third consecutive session of net buying by foreign investors.

Business Performance: In 2025, SHB aims for a pre-tax profit of VND 14,500 billion, representing a 25% increase from the previous year. Credit balance is expected to grow by 16%, with a focus on key production and business sectors and industries with sustainable potential, positively contributing to the national economy. In Q1/2025, SHB recorded a pre-tax profit of nearly VND 4,400 billion, equivalent to 30% of the full-year plan.

Additionally, SHB shareholders will receive a dividend for 2024 with a total ratio of 18%, higher than the previous year, including 5% in cash and 13% in shares.

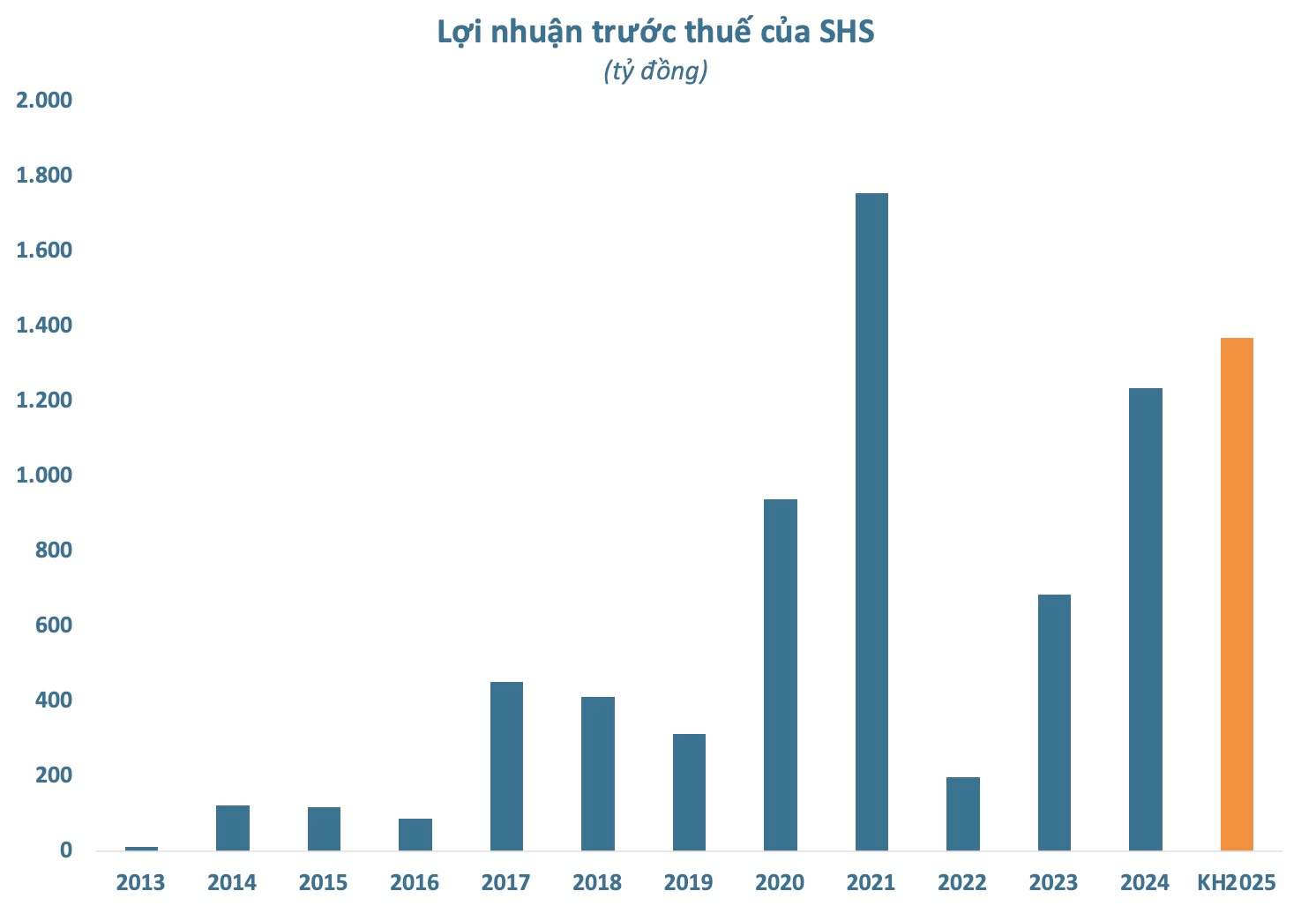

As for SHS, the securities firm has set its 2025 business plan with a total revenue target of VND 2,261.9 billion and a pre-tax profit of VND 1,369.1 billion. In the first quarter of the year, SHS reported a pre-tax profit of VND 325.7 billion, completing 24% of its annual target.

According to SHS, the growth drivers for 2025 will come from policies to boost public investment and the recovery of domestic demand, along with the continued expansion of the manufacturing industry, leveraging the diversification of global supply chains. Sharing the medium- to long-term strategy, Chairman of the Board of Directors, Do Quang Vinh, stated that SHS remains committed to its strategic orientation of becoming a leading financial investment group in accordance with international standards.

Notably, in April 2025, SHS finalized its list of shareholders to implement a 2024 cash dividend payment at a rate of 10% (VND 1,000 per share). The total expected payout exceeded VND 830 billion. This was the first time in four years (since 2020) that the securities firm distributed cash dividends to its shareholders.

SHS’s Cash Dividend Payment for 2024

The Coal Mining Company Stakes a Claim for Dividend Splits, Yielding a Whopping 400% Payout

Joint Stock Company 397 (UPCoM: BCB) is pleased to announce a cash dividend for the year 2024. The ex-dividend date is set for May 29th, marking an important milestone for shareholders.

Unlocking NCB’s Future: Embracing Dynamic Targets for 2025 and Beyond

On March 29, 2025, the Joint Stock Commercial Bank NCB (HNX: NVB) successfully held its Annual General Meeting of Shareholders for the year 2025. The meeting approved the 2025 business plan with positive targets, including a capital increase, and other proposals.