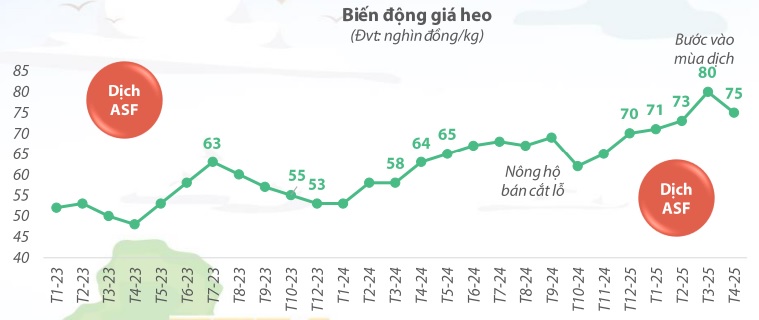

Since the beginning of 2025, pork prices in Vietnam have remained high, rarely dipping below 70,000 VND/kg. In Q1, prices even surged to 80,000 VND/kg in March before settling back to 75,000 VND/kg.

This is in stark contrast to the same period last year, when prices averaged between 53,000-58,000 VND/kg, representing a significant increase of nearly 40%.

|

Pork prices in Vietnam from 2023 to Q1 2025

Source: BAF

|

This price hike can be attributed to a decrease in pork supply, largely due to diseases, especially the complex evolution of the African Swine Fever (ASF) with thousands of new outbreaks. Farmers and even large companies had to sell their pigs to prevent further losses, causing short-term price drops and affecting the overall supply. Additionally, the impact of Typhoon Yagi in October 2024 damaged many farms, slowing down the repopulation process for smallholders. The new Livestock Law, which came into effect at the beginning of 2025, also led to a significant relocation of farms that didn’t meet the new standards, further affecting pork supply and prices.

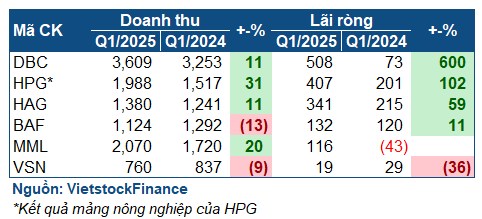

The high pork prices have been particularly beneficial for pork farming enterprises, ensuring substantial profits. According to VietstockFinance, most pork farming businesses reported significant growth in Q1, with some even announcing record-breaking profits.

|

Financial performance of pork farming enterprises in Q1/2025

|

Leading the growth is Dabaco (HOSE: DBC) with a net profit of over 508 billion VND, seven times higher than the same period last year. While it’s true that the comparative base from last year was relatively low, this is still the highest quarterly profit ever achieved by the “farming giant.”

The company attributed this success to their effective control of diseases among livestock and poultry, as well as their proactive repopulation efforts. Higher pork prices and improvements in other sectors, such as vegetable oil, also contributed to this remarkable profit increase.

Hòa Phát’s (HOSE: HPG) agricultural segment also experienced significant growth, with a post-tax profit of 407 billion VND, double that of the previous year. HPG currently holds a leading market share in egg production in Northern Vietnam and owns a herd of nearly 25,000 sows. At the 2025 Annual General Meeting of Shareholders, Chairman Tran Dinh Long revealed that agriculture was the segment with the highest profit margin for Hòa Phát in 2024, and this herd of 25,000 sows alone contributed 125 billion VND in profit in Q1/2025.

On the other hand, BAF, known for its “vegetarian pigs,” saw a more modest profit increase of 11%, reaching 132 billion VND. However, their revenue decline is a positive sign, as BAF has almost entirely discontinued its animal feed business, meaning that their Q1/2025 revenue and profit were derived mostly from pork farming. BAF’s pig sales volume for the period exceeded 160,000 pigs, with a significant majority being meat pigs, reflecting a nearly 50% growth compared to the previous year.

| BAF’s Business Performance |

It’s worth noting that BAF’s profit could have been 3.4 times higher if not for the one-off gain of over 100 billion VND from the sale of land in Mai Chi Tho, Thu Duc City, Ho Chi Minh City, in Q1 of the previous year. Excluding this one-off gain, BAF’s profit from pig farming in Q1/2025 is the highest ever recorded since its listing.

HAG, owned by businessman Bầu Đức, is a unique case. While their profit increased significantly by 59% to 341 billion VND, this growth was mainly driven by banana sales (nearly 1 trillion VND, accounting for 72% of net revenue, up 12%). In contrast, the pig farming segment brought in only 76 billion VND in revenue, a decrease of 3.8 times compared to the previous year.

HAG reduced its herd size in 2022-2023 due to declining pork prices. However, according to the documents of the 2025 Annual General Meeting of Shareholders, the company focused on repopulation in 2024. Chairman Đoàn Nguyên Đức revealed that the results of these efforts will be evident this year.

Two companies in the processing sector, Vissan (UPCoM: Vissan) and Masan MeatLife (UPCoM: MML), experienced contrasting results. Vissan’s profit decreased by 36% to 19 billion VND due to higher pork prices and land lease costs, resulting in lower profit margins. On the other hand, MML recorded a net profit of 116 billion VND, a significant improvement from the 43 billion VND loss in the previous year. This turnaround can be attributed to the growth in their chilled meat, processed meat, and farm segments, along with optimized production costs.

Pork prices are unlikely to decrease in the near future. During an investor relations event on May 9, 2025, BAF’s Deputy General Director, Mr. Ngô Cao Cường, shared his insights: “It’s unlikely that pork prices in Vietnam will drop below 60,000 VND/kg, and they may even increase to 80,000 VND/kg. The main reason is the complex situation with diseases, especially ASF. While mass selling by farmers due to disease outbreaks can lead to temporary price drops, once their herds are sold off, supply decreases, and prices rise again. Vietnam has already lost about 20-30% of its total herd, and farmers are struggling to repopulate due to the high cost of piglets. Moreover, large companies like BAF do not sell piglets externally.”

Pork prices are expected to remain high in 2025. Illustrative image

|

Mr. Cường also addressed the impact of import tariffs from the US: “While increased pork imports from the US may seem concerning, it’s important to understand that Vietnamese consumers rarely opt for frozen pork unless it’s through channels like HoReCa. Imported pork is mostly frozen, and while it may be cheaper, it’s not a preferred choice for most Vietnamese consumers. Even chilled meat faces challenges in terms of consumer communication. Therefore, imported pork from the US or other countries is unlikely to significantly impact the domestic market.”

[Châu An]

– 09:00 17/05/2025

Recall of Shampoo Batch with “Exaggerated” Medicinal Claims by Ho Chi Minh City-based Company

(NLĐO) – Authorities have recalled a particular shampoo product due to misleading labeling and inaccurate ingredient listing, which could potentially confuse consumers. The label erroneously suggests therapeutic benefits akin to medication, and the actual ingredients differ from those declared in the official filing. This discrepancy has prompted the recall to ensure consumer protection and maintain transparency in the marketplace.