Viettel Global’s leadership changes as key members step down

On May 14, 2025, Viettel Global, the International Investment Joint-Stock Corporation (coded VGI on the stock exchange), received resignation letters from two key members of its board of directors and the chief controller.

Specifically, Mr. Phung Van Cuong and Mr. Le Xuan Hung, board members, and Mr. Le Quang Tiep, chief controller, will step down from their positions effective June 5, 2025. All three have cited the same reason for their departure: being nominated by the Viettel Group for new assignments.

Earlier, in February 2025, Viettel Global appointed Ms. Nguyen Thi Hoa (born in 1980) as their new CEO, replacing Mr. Phung Van Cuong. Following his departure from Viettel Global, Mr. Cuong was appointed as the new CEO of Viettel Post, taking over from Mr. Hoang Trung Thanh.

Mr. Cuong began his career at Viettel Group in July 2004 as a staff member and later became the head of the Billing Department at the Mobile Phone Company. He has since held various leadership positions within the group’s member units. In June 2019, he was appointed as the CEO of Viettel Cambodia, and in September 2022, he took on the role of CEO of Viettel Global.

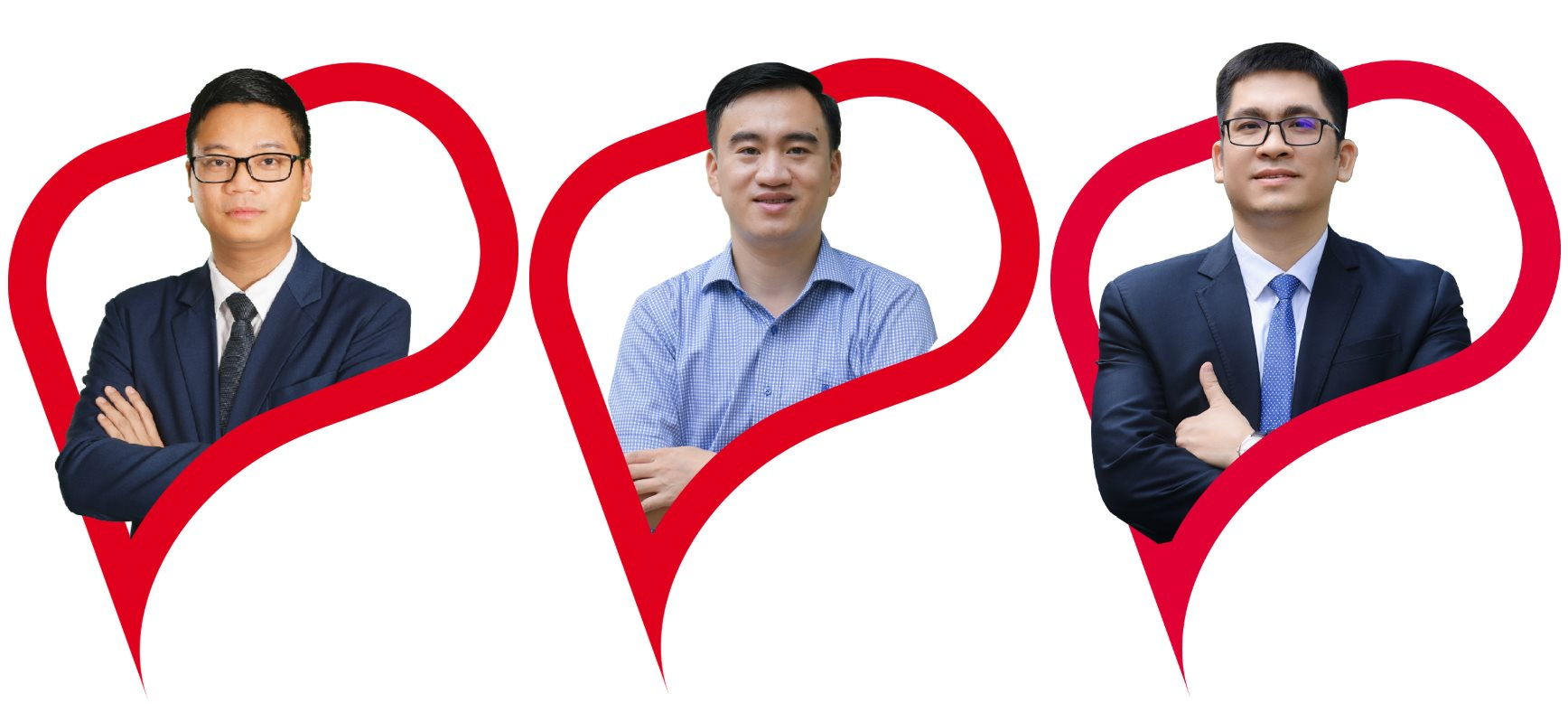

From left to right: Mr. Phung Xuan Cuong, Mr. Le Xuan Hung, and Mr. Le Quang Tiep – Image source: Viettel Global

Mr. Le Xuan Hung brings over a decade of experience in finance and accounting. He has held positions as the Head of Finance at Viettel Peru S.A. and as the Head of Planning and Budgeting at the Group’s Finance and Accounting Department. He became a member of VGI’s board of directors in June 2021.

Mr. Le Quang Tiep has over a decade of experience in auditing. He started his career at AASC, a financial consulting and accounting firm, and later joined the Military-Telecom Industry Group, where he worked as an audit specialist. Since 2018, he has been a member of VGI’s Supervisory Board.

In terms of financial performance, according to VGI’s consolidated financial statements for Q1 2025, the company’s revenue from sales and services reached VND 9,657 billion, a 22% increase compared to Q1 2024. The consolidated pre-tax profit was VND 1,310 billion. This marks the sixth consecutive quarter of revenue growth above 20% for the company.

In Q1, all of Viettel Global’s markets experienced significant growth, with standout performances from Viettel Burundi (38% increase), Viettel Tanzania (29%), Viettel Haiti (28%), and Viettel Mozambique (23%).

In addition to the strong performance in traditional telecommunications, Viettel Global’s e-wallet companies also achieved impressive growth. Lumicash in Burundi grew by 59%, Halopesa in Tanzania by 47%, Emoney in Cambodia by 42%, and M_Mola in Mozambique by 27%.

VGI’s stock closed at VND 72,600 per share on May 16, with a market capitalization of over VND 220,000 billion (approximately USD 8.5 billion). The company is currently the fifth-largest by market capitalization on the stock exchange.

“VietinBank Securities to Issue Nearly 64 Million Shares as Dividends”

On May 13, the Board of Directors of Vietnam Industrial and Commercial Bank Securities Joint Stock Company (HOSE: CTS) approved a plan to issue nearly 64 million new shares to pay dividends, with a ratio of 100:43. The share issuance is scheduled for the second or third quarter of 2025.

“DIC Corp Announces Plans to Release Nearly 36.6 Million Shares as 2024 Dividend”

“DIC Corp is set to release almost 36.6 million shares as a dividend for its shareholders for the year 2024, with a distribution ratio of 100:6. The record date for the allocation of rights is May 30, 2025. This move by DIC Corp showcases their commitment to rewarding their shareholders and fostering a culture of long-term investment.”

“The Novaland Group Defaults on Debt Payments”

Novaland Group is on a path to recovery, but there are still risks associated with debt negotiations and restructuring. The group has communicated its current financial limitations, stating that it is not yet in a position to settle its debts. As a result, the majority of its loan and bond obligations will be addressed from late 2026 to 2027.