On May 14, Viet Nam Textile and Apparel Corporation (Vinatex, UPCoM: VGT) held its May workshop, focusing on the developments in the textile and apparel industry and the new US tariff policies.

Overview of the Workshop

|

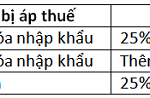

Mr. Hoang Manh Cam, Vice Chairman of Vinatex’s Board of Directors, shared that many countries exporting to the US have proactively negotiated tariff rates in response to the Trump administration’s proposals. Some countries have reached agreements, such as the UK signing on May 9. Korea, Japan, and Vietnam are still in negotiations. China has been granted a 90-day extension from May 14, during which the US will reduce tariffs from 145% to 30%, and China will reduce tariffs from 125% to 10%. The base tariff of 10% remains unchanged for all countries.

In this context, Vietnam’s textile and apparel exports in April 2025 reached $3.64 billion, a 15% increase year-over-year. The four-month cumulative exports reached $13.9 billion, an 11% increase. Key markets such as the US, Japan, and Europe showed positive growth, while the Chinese market decreased due to reduced demand for yarn imports amid US-China tensions.

Mr. Cam added that there are many positive signs: US-China relations are cooling down, transportation costs are decreasing, and the VND/USD exchange rate is more stable. According to Sourcing Journal, inventories in the US are very low, with many brands having enough stock for only 6-8 weeks. There is a market gap due to the lack of sweaters from China, and some competitive countries are facing challenges: Pakistan is politically unstable, Bangladesh is facing an energy crisis, and many yarn factories have shut down due to power shortages.

However, the Vietnamese textile and apparel industry still faces challenges. Tariff negotiations with the US have not yielded specific results; buying power from Korea and China has not significantly recovered; and the electricity price increase from May 10 has put pressure on production costs, especially for yarn companies.

|

Mr. Le Tien Truong, Chairman of Vinatex’s Board of Directors, assessed that from now until July 10, the US may announce temporary tariff policies for Vietnam, depending on the progress of negotiations between the Ministry of Industry and Trade and the government. Low inventories in the US could help maintain orders in the third quarter, but the fourth quarter of 2025 is expected to decrease by about 10% due to weak US consumer spending. Overall, US consumer spending is predicted to decline by 5% this year.

According to Mr. Truong, the current tariff policies are being negotiated by product groups, providing an opportunity for Vietnam’s textile and apparel industry to take advantage of its strong segments. “High tariffs and market fluctuations are not new to the Vietnamese textile and apparel industry. We have overcome tariff and quota barriers before the WTO, and we need to adapt proactively”, he emphasized.

In terms of financial performance, in the first quarter of 2025, Vinatex recorded a net profit of VND 172 billion, a 372% increase compared to the previous year. Revenue reached nearly VND 4,300 billion, an 8% increase. The gross profit margin improved to 12.1% from 8.7%. The yarn sector turned profitable due to cost reduction, while the garment sector remained fully booked until the second quarter. However, many customers are delaying third-quarter orders awaiting new policies from the US.

Major Textile and Apparel Exporters to the US Report Strong Profit Growth in Q1

– 10:37 15/05/2025

HSG: Estimated Accumulated Profit After Tax for the First Seven Months of the 2024-2025 Financial Year Reaches VND 460 Billion

The Hoa Sen Group Joint Stock Company (HOSE: HSG) has released an update on its operational and financial performance.

Deep Discounts, Stock Market Surges: 194,000 New Accounts Join the Fray.

As of April 2025, Vietnam’s stock market witnessed a significant surge in trading accounts, according to Vietnam Securities Depository (VSDC). The country’s stock market boasted over 9.88 million accounts, reflecting an increase of 194,023 accounts since March. This remarkable growth marks the highest increase in the past eight months.

Unlocking Solutions: Navigating Trade Tax Challenges with Industry Leaders

The Minister of Industry and Trade acknowledged the concerns, challenges, and suggestions raised by industry associations and businesses during the conference. He also outlined potential solutions and negotiation strategies to address these issues.

A Nuanced Look at Tariff Policies and Their Market Impact

The US trade policies and their tariffs could have a significant impact on global commerce. This move will undoubtedly affect Vietnam’s exports, a key driver of its economy. While the stock market may experience indirect and limited effects, it is not a primary driver of market trends and thus will not be significantly influenced.