Vietnam’s stock market experienced significant volatility during the May 15 session, which also marked the derivatives expiry. The VN-Index closed up 3.47 points to 1,313.2. Foreign exchange transactions remained a bright spot, with a net buy of VND 891 billion across the market.

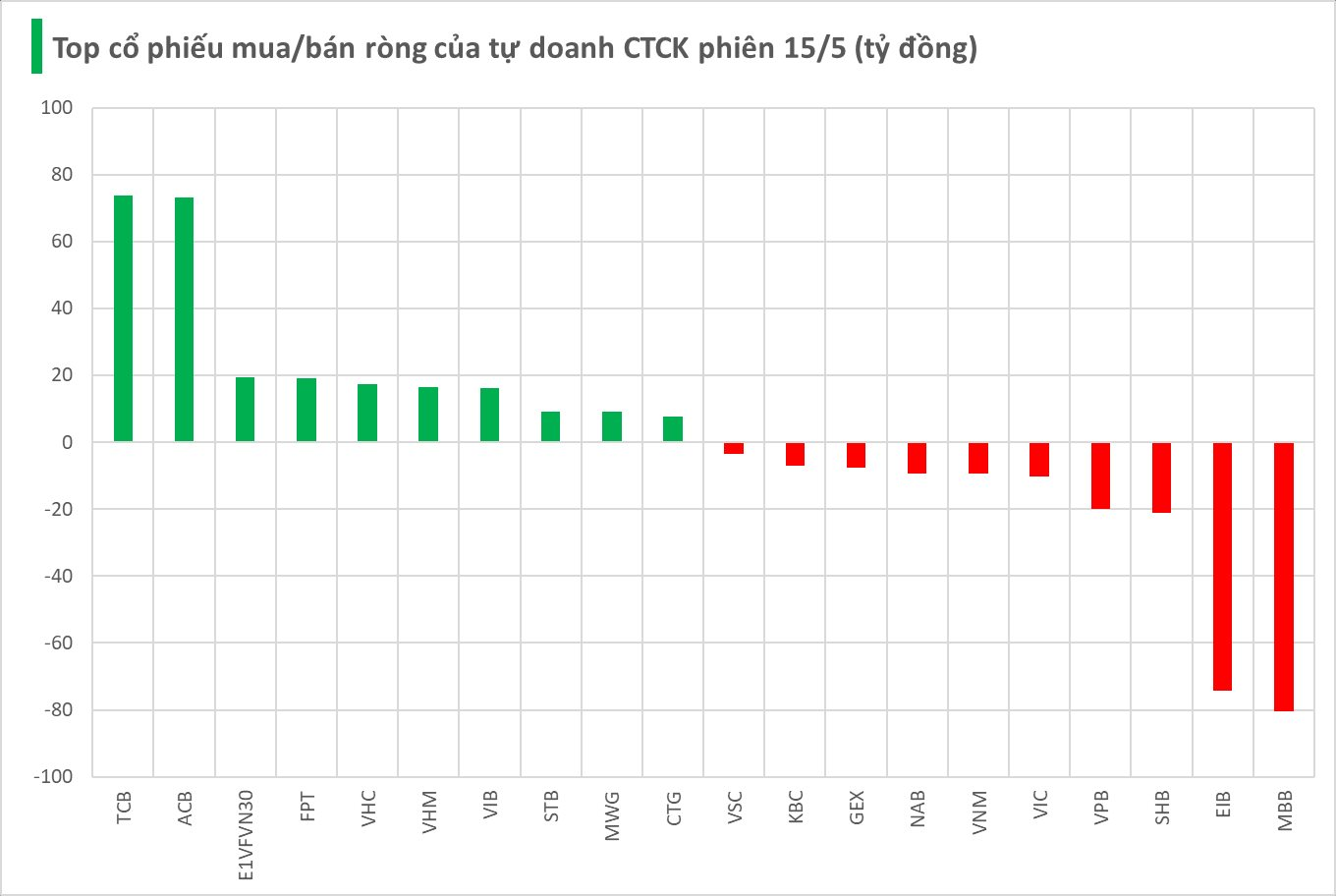

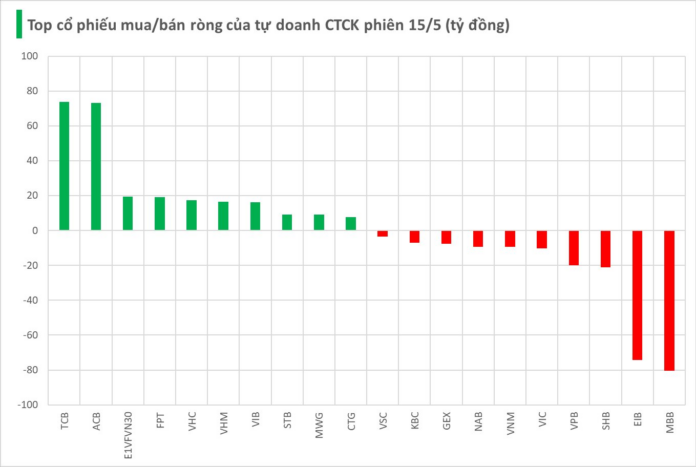

Securities companies’ proprietary trading recorded a net buy of VND 33 billion on the HoSE.

Specifically, securities companies’ transactions net bought TCB and ACB with values of VND 74 billion and VND 73 billion, respectively. Other codes that were net bought included E1VFVN30, FPT, VHC, and VHM…

On the other hand, securities companies’ most substantial net sell was observed in MBB, with a value of VND 80 billion. Other stocks that experienced net selling during today’s session included EIB, SHB, VPB, and VIC…

Breaking News: Foreign Investors Pour in Nearly VND 2.3 Trillion, Sending VN-Index Soaring Past 1,300 Points

The FPT stock witnessed a significant surge in buying activity during the afternoon trading session, with a staggering net buy value of VND 541 billion, making it the most actively bought stock across the market. This was followed by several other stocks that also experienced substantial net buying in the hundreds of billions of VND.

“Rookie” Vinpearl (VPL) Surges with Three Consecutive Upper Limit Gains, Market Capitalization Increases by Over VND 45,000 Billion

Introducing Vinpearl Joint Stock Company’s (VPL) impressive performance on the Ho Chi Minh Stock Exchange (HoSE) on May 13th, 2025. With a third consecutive daily limit-up, VPL’s market capitalization surged by an astonishing VND 45,000 billion. This remarkable achievement underscores the strong investor confidence in Vinpearl and sets a new milestone for the company’s future growth prospects.

The Billion-Dollar Question: Unraveling the Foreign Block’s Strategy in Banking Stocks

Foreign transactions continue to be a bright spot, extending the net buying streak. Foreign capital inflows into the banking group, with MBB leading the way with net purchases of over 554 billion VND, followed by SHB with over 292 billion VND, and VPB, BID, STB, and LPB also among the top performers.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)