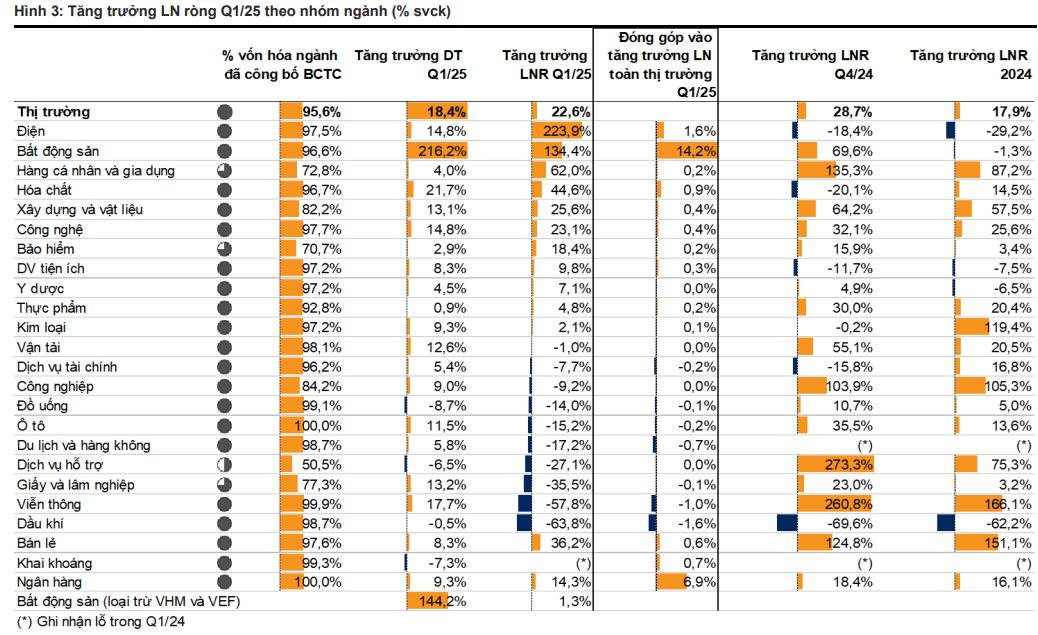

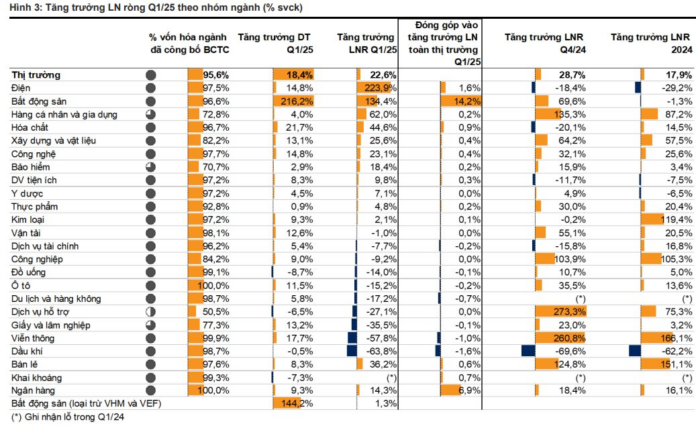

Vietnam’s listed companies saw a 22.6% year-on-year increase in net profits for Q1 2025, according to a recent report by VNDirect Securities. This growth was supported by both a low base effect and improved business fundamentals.

Notably, EBITDA margin increased from 15.4% to 17.9%, reflecting better cost control and management. Additionally, a low-interest-rate environment also contributed to profit growth.

VNDirect’s analysts identified the power and real estate sectors as the top performers in the past quarter . Power sector profits surged by 223.9% year-on-year, as gas-fired power plants recovered from low generation volumes in the previous year, and hydropower plants benefited from a low base effect due to El Niño in Q1 2024.

For the real estate sector, profit growth reached 134.4% year-on-year, marking the third consecutive quarter of growth. This was driven by a market recovery fueled by supportive policies, low-interest rates, and attractive sales programs offered by developers.

Ranking third in profit growth was the personal & household goods sector, with a 62% increase driven by rising export demand due to concerns over potential tariffs from the Trump administration on Vietnamese goods.

Meanwhile, the chemicals sector recorded a 44.6% profit increase due to improved gross profit margins as input costs decreased while selling prices remained stable.

Retail sector profits rose by 36% in Q1 2025, largely attributable to strong revenue growth by MWG. The electronics segment witnessed improved sales per store after restructuring, while the hypermarket segment continued its expansion. Despite lower gross profit margins compared to the previous year, net profits increased by 71.3% due to efficient cost control, particularly lower depreciation, and the absence of abnormal costs from store network rationalization.

Additionally, the banking sector reported profit growth of over 14% in the past quarter.

Contrarily, the oil & gas sector experienced a 63.8% decline in profits year-on-year, mainly due to a nearly 9% drop in average oil prices in Q1/25 compared to Q1/24. This negatively impacted stocks with selling prices linked to oil prices, such as BSR, PLX, and OIL.

Among the large-cap VN30 stocks, net profits for Q1 grew by nearly 13% year-on-year, with 22 out of 30 companies reporting growth. The top performers were MSN (+277%), VHM (+204%), BCM (+203%), SSB (+191%), and MWG (+149%). In contrast, PLX saw an 88% decline in profits due to the aforementioned decrease in oil prices.

The Interbank Interest Rate Plunge

“The recent cut in the OMO rate and halt in bill issuance by the SBV have led to a significant drop in interbank interest rates compared to the beginning of September.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)