The real estate market still has bottlenecks that need to be addressed. Photo: M.Sang.

Shift in Capital Flows

According to Techcombank’s Q1 2025 financial report, the bank currently holds the highest outstanding loans to real estate businesses in the system, totaling almost VND 214,800 billion.

Ho Hung Anh, Chairman of Techcombank’s Board of Directors, assessed that the market is gradually overcoming difficulties thanks to strong housing demand, recovering purchasing power, and the government’s continued infrastructure investment.

Techcombank’s leadership shared that the bank is providing interest rate support to some real estate businesses. As the economy recovers and the market stabilizes, interest rates will be adjusted accordingly.

In addition to Techcombank, many other banks are offering preferential loan packages to support young people in owning homes and promoting social housing development.

Mr. Nguyen Quoc Anh, Deputy General Director of PropertyGuru Vietnam, also stated that the market is highly anticipating a loosening of credit policies for real estate purchases. In response to a Q1 2025 survey by Batdongsan.com.vn, 67.1% of brokers expected a “loosening of credit policies for real estate purchases,” 47.9% anticipated a “reduction in taxes and real estate transaction fees,” and 43.4% hoped for a “faster legal progress.”

This year, credit growth is projected to increase to 16%, and lending rates for real estate purchases continue to decline.

What Should Enterprises Pay Attention To?

According to economist Dr. Can Van Luc, capital flows into the real estate market are witnessing notable shifts. As of the end of 2024, outstanding loans for real estate were estimated at approximately VND 3.2 quadrillion, accounting for nearly 21% of the economy’s total outstanding loans. Specifically, credit for real estate business activities surged by 18%, while credit for housing needs increased by about 6.5%, bringing the overall real estate credit growth to around 12%.

In addition to domestic capital, foreign direct investment (FDI) in real estate has also been positive. In the first four months of 2025 alone, FDI registered in this sector reached USD 1.5 billion (accounting for 26.9% of total registered capital), with an estimated disbursement of about USD 533 million (7.9%).

According to data from the State Bank of Vietnam – Branch of Region II, by the end of Q1 2025, total outstanding credit for real estate had surpassed VND 1 quadrillion, a 1.15% increase compared to the end of 2024. Within this, housing credit increased slightly by 0.67%.

Many experts believe that while credit policies have become more relaxed, banks still closely monitor loans related to real estate. Circular No. 06/2023/TT-NHNN, amending Circular No. 39/2016, is currently in effect to reduce risks to the financial banking system and support the real estate market’s purification process. Specifically, this regulation helps eliminate enterprises with projects lacking legal conditions and those overly dependent on financial leverage, while prioritizing support for enterprises with healthy finances and experience in project deployment.

For consumers, Circular 06 also tightens the procedures and conditions for home loans, especially for large-value loans. Borrowers must meet comprehensive requirements regarding documents, capital usage plans, and repayment schedules.

Experts recommend that real estate enterprises and investors proactively adjust their strategies to adapt to changes in credit policies. Specifically, enterprises should focus on developing segments that cater to the actual needs of the majority of the population, such as social housing and mid-range apartments, to easily access loans and improve product consumption.

For individual investors, the use of financial leverage should be carefully considered. Instead of chasing “overpriced” products, investors are advised to prioritize areas with realistic development potential, complete infrastructure, and high actual demand to ensure long-term investment efficiency.

The Greenback’s Future: Forecasting USD’s Fate

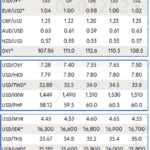

The Market and Global Economics Research team at UOB Bank (Singapore) has released its May strategy report on exchange rates and interest rates. The bank’s forecast for the upcoming quarters is as follows: 26,100 VND/USD for Q2, 26,300 VND/USD for Q3, 26,000 VND/USD for Q4, and 25,800 VND/USD for Q1 2026.

“Reduced Interest Rates on the VND 120,000 Billion Package for Social Housing Purchases”

According to a report by the Ministry of Construction, the disbursement of the VND 120 trillion credit package for social housing reached VND 3.4 trillion, with over VND 550 billion disbursed in the first four months of this year. Lending rates have decreased by more than 2% over the past two years, falling to 6.1% per annum.

Gold Recovers After US Inflation Data, SPDR Gold Trust Dumps Almost 3 Tons

The buying power at the relatively low price range propelled gold prices to rebound after a 2.6% dip on Monday.