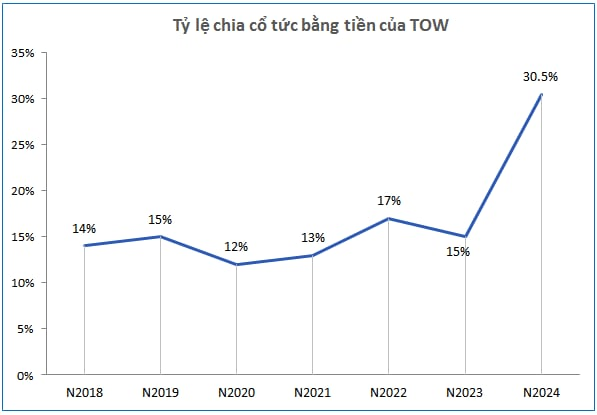

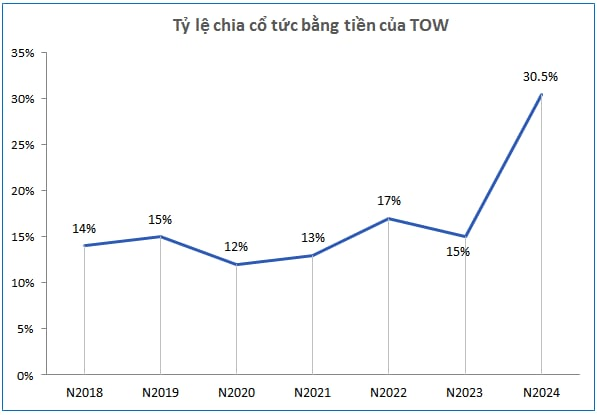

Accordingly, dividends were paid at a rate of 30.5% (equivalent to VND 3,050/share). With nearly 8 million shares outstanding, TOW expects to spend more than VND 24 billion to complete the dividend payment. The payment is expected to start from August 29, 2025.

Source: VietstockFinance

|

This is the highest dividend that TOW has ever paid, far exceeding the levels of previous years (ranging from 12-17%), as the company has just gone through a brilliant year in terms of business performance.

|

TOW’s Financial Performance Over the Years

|

In 2024, TOW recorded revenue of over VND 103 billion, up 41% from 2023. Cost of goods sold increased slightly by 11%, leading to a 73% jump in gross profit to nearly VND 61 billion. Net profit also hit a record high of VND 37 billion, up 95% from 2023.

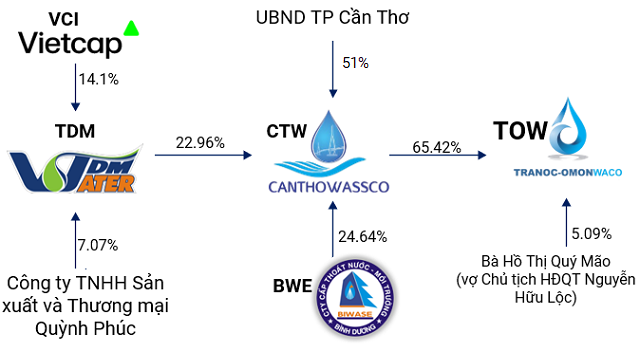

With these results, the parent company – which is also a major shareholder – Can Tho Water Supply and Drainage JSC (UPCoM: CTW), holding 65.42% of the capital – is expected to receive nearly VND 16 billion in dividends. In addition, the family of Chairman of the Board of Directors Nguyen Huu Loc will also receive more than VND 1.4 billion. This includes VND 1.24 billion from his wife, Ho Thi Quy Mao, who owns 5.09% of the shares, and VND 169 million from his daughter, Nguyen Thi Nguyet Que, who owns 0.69%.

|

Notable Shareholders of TOW

Compiled by the author

|

In 2025, TOW targets water consumption of 10.45 million cubic meters, a slight increase of 3% from the previous year. Revenue is expected to reach VND 106 billion, equivalent to the level in 2024, while after-tax profit is estimated at VND 36.8 billion, a slight decrease of 2%.

| TOW’s Share Price Performance from the Beginning of 2024 to May 15, 2025 |

In the market, TOW’s share price has seen a strong upward trend over the past year. From VND 14,900/share at the beginning of 2024, the market price had surged to VND 36,300/share by the end of the trading session on May 15, 2025, more than 2.4 times higher.

– 17:23 15/05/2025

“VietinBank Securities to Issue Nearly 64 Million Shares as Dividends”

On May 13, the Board of Directors of Vietnam Industrial and Commercial Bank Securities Joint Stock Company (HOSE: CTS) approved a plan to issue nearly 64 million new shares to pay dividends, with a ratio of 100:43. The share issuance is scheduled for the second or third quarter of 2025.

“Sotrans CEO on the 54% Profit Growth Plan: What’s the Strategy?”

Despite aiming for over a 50% growth in after-tax profits in 2025, the leadership of Southern Logistics Joint Stock Company (Sotrans, HOSE: STG) believes that this is not an unrealistic expectation. This confidence is based on positive business signals since the beginning of the year and significant improvements in previously challenging operational areas.

“US Electronics Manufacturer Witnesses a Tenfold Revenue Surge: A North Vietnamese Province’s Economic Success Story.”

The Fukang Technology plant (owned by Foxconn) is an impressive venture with a massive investment of over VND 12,507 billion. With an annual capacity of 16 million products, the factory will be a powerhouse for Apple, manufacturing a diverse range of their sought-after goods.