Vietnam Airlines’ Extraordinary General Meeting Approves Capital Increase and Narrow-body Aircraft Purchase

On May 15, 2025, Vietnam Airlines (Vietnam Airlines – stock code HVN) held an extraordinary General Meeting of Shareholders (GMOS) to approve two important plans: a Phase 1 capital increase of VND 9,000 billion and a project to purchase 50 narrow-body aircraft.

The meeting also approved the resignation of Mr. Daisuke Suzuki from the Board of Directors and elected Mr. Hidekazu Isone, Deputy General Director in charge of Strategy, ANA Holdings, to the company’s Board of Directors.

Issuing 900 million shares to existing shareholders at VND 10,000 per share

Mr. Le Hong Ha, CEO of Vietnam Airlines, presented the plan to offer shares to existing shareholders with an expected volume of 900 million shares, an offering price of VND 10,000 per share, and a total value of VND 9,000 billion. The entitlement ratio as of the record date is 40.6% (100 rights entitle the holder to purchase 40.64 newly issued shares).

The proceeds will be used to repay short-term and long-term debts to suppliers and lenders, with a portion going towards refinancing.

Vietnam Airlines is expected to carry out the share offering in the last six months of 2025 after obtaining a certificate of public offering from the SSC.

Mr. Le Hong Ha, CEO of Vietnam Airlines

Previously, in November 2024, the National Assembly agreed to allow Vietnam Airlines to increase its charter capital by a maximum of VND 22,000 billion through share offerings to existing shareholders, subject to the provisions of the Securities Law.

This VND 22,000 billion will be raised in two phases through the issuance of new shares. Phase 1 involves issuing 9,000 billion shares in 2025, followed by a maximum of 13,000 billion shares in 2026 for Phase 2.

The increase in charter capital will improve Vietnam Airlines’ liquidity, enhance its financial indicators, and reduce its debt ratio. It will also facilitate the company’s access to capital for fleet development, service quality improvement, and long-term strategic initiatives.

Investing in 50 narrow-body aircraft and 10 spare engines

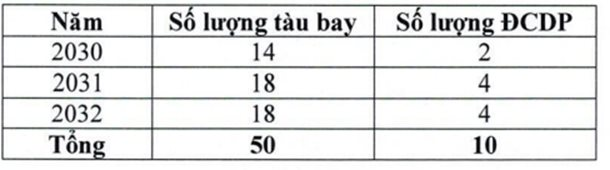

The meeting approved a plan to invest in 50 narrow-body aircraft with fewer than 200 seats (>160 seats), equivalent to A320Neo/B737Max8, including wing-mounted engines and optional equipment, along with 10 spare engines (DEPs), for a total investment of nearly USD 3.6 billion (equivalent to more than VND 92,300 billion).

Owner’s equity accounts for 46% of the investment, while borrowed capital makes up the remaining 54%. The new aircraft will be 100% directly sourced from the aircraft manufacturer. This plan may be adjusted as needed during implementation.

The aircraft and engines are scheduled for delivery and operation between 2030 and 2032, as illustrated below:

Mr. Ta Manh Hung, a member of the Board of Directors, presented the investment report for the 50 narrow-body aircraft project, stating that since 2017, Vietnam Airlines has been working on reports for competent authorities as part of the investment procedures outlined in the 2014 Law on Investment. This pertains to the investment phase for the 2021-2025 period, which includes 50 new narrow-body aircraft from the A320Neo Family or B737Max Family.

Accordingly, Resolution No. 02/ĐHĐCĐ of the General Meeting of Shareholders of the National Aviation Corporation, dated May 10, 2019, approved the investment policy for the project to purchase 50 narrow-body aircraft during the 2021-2025 period.

However, due to the impact of the Covid-19 pandemic, which severely affected business operations and resulted in a significant surplus of aircraft during 2020-2021, Vietnam Airlines had to halt the implementation of this investment project and adjust its fleet development plans for the 2021-2025 period.

The project to purchase narrow-body aircraft is a key component of the comprehensive solution proposed in the Proposal on Overall Solutions to Overcome Difficulties Caused by the Impact of the Covid-19 Epidemic, aiming to help Vietnam Airlines recover and develop sustainably during the 2021-2035 period. It is also a critical step toward achieving the company’s goals for fleet expansion during the 2025-2035 period and its vision for 2040, enhancing its domestic and regional route network.

“Currently, there is a high global demand for commercial aircraft. If we place an order for narrow-body aircraft from BOEING now, the delivery will only be made in 2032,” shared Mr. Dang Ngoc Hoa, Chairman of the Board of Directors of Vietnam Airlines.

Mr. Hoa affirmed that Vietnam Airlines is determined to seize this period of recovery and robust growth in the aviation industry.

“During the period of 2030–2045, the Vietnamese aviation industry will require thousands of new aircraft to meet demand. Therefore, when opportunities arise and our financial situation improves, Vietnam Airlines will expand its fleet and network. This year alone, we plan to launch 15 new international routes, connecting Vietnam to the world – a move that we consider a ‘soft border’ in the country’s era of advancement,” emphasized Mr. Dang Ngoc Hoa.

Mr. Dang Ngoc Hoa, Chairman of the Board of Directors of Vietnam Airlines

According to the Chairman of Vietnam Airlines, the aircraft are expected to be delivered between 2030 and 2032. However, the company is negotiating to expedite the delivery. In the meantime, Vietnam Airlines has arranged to lease aircraft during the period of 2027–2029 to ensure uninterrupted operations and transport capacity.

The Profitable Stockbroking Company: Leading the Industry with a 43% Dividend Payout

“VietinBank Securities has announced a dividend plan that will see shareholders receive a substantial return on their investment. In a move that underscores the company’s commitment to rewarding its shareholders, it has been revealed that for every 100 shares owned, shareholders will be entitled to an additional 43 shares. This generous dividend policy highlights VietinBank Securities’ strong financial performance and its dedication to creating value for its investors.”

The Magic of Words: Transforming Titles with Artistry and Precision

“German Chemicals Giant Infuses $20 Million into its Real Estate Venture”

“With a substantial investment of 5000 billion VND, Duc Giang Chemicals plans to boost the charter capital of Duc Giang Real Estate to an impressive 1000 billion VND in the second quarter of 2025. This significant capital increase from 500 billion VND will undoubtedly propel the company’s growth and expansion in the real estate industry.”