From a global economic perspective, PHS anticipates that the US dollar will continue its downward trend in May and June, supported by expectations of Fed rate cuts. However, trade negotiations are unlikely to yield quick results within the next 1-2 months, implying that financial markets will remain volatile with wide swings based on negotiation updates.

Additionally, the rise in bond yields amid a declining global economic and profit outlook is concerning. There is a present risk of a global stock market re-rating, making a strong breakthrough more challenging. Investors should remain cautious, focusing on risk management and flexible investment strategies.

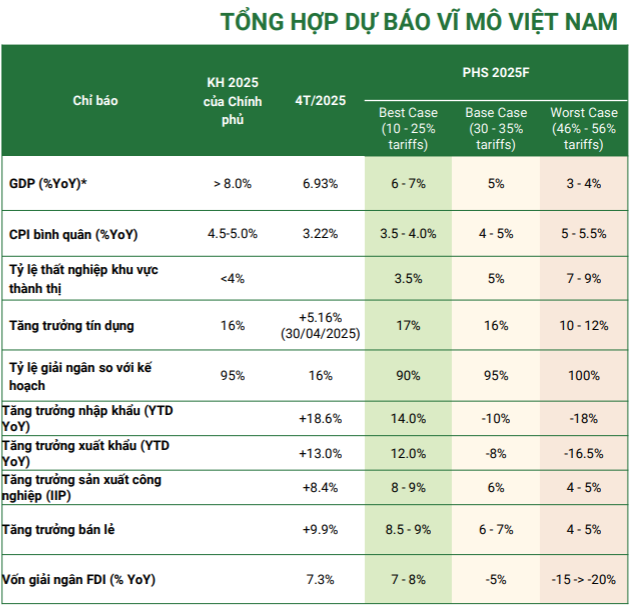

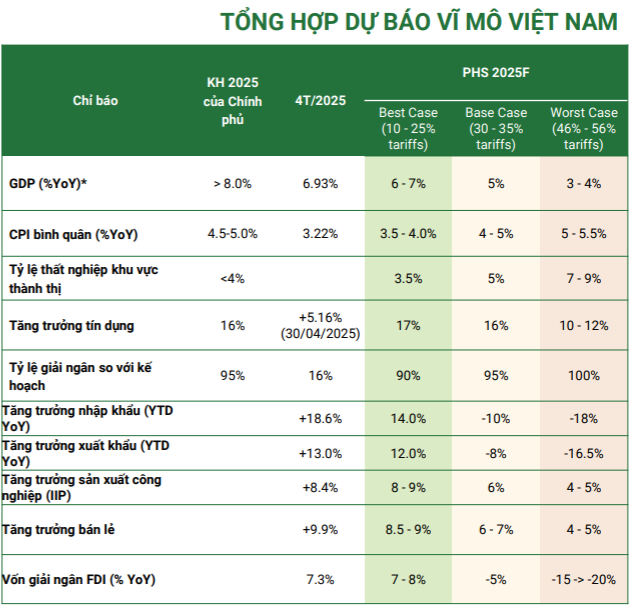

Domestically, as the tariff war starts to take its toll, Vietnam’s economic landscape has revealed significant challenges. While the 10% tariff rate is lower than the initial expectation of 46%, it has still created a cautious sentiment, leading to signs of production slowdown.

Notably, the disbursement of public investment capital has not met expectations, indicating difficulties in implementing critical projects. However, PHS maintains optimism about the government’s efforts to expedite disbursement, especially after stabilizing personnel and provincial mergers in Q2. The Vietnamese government understands the importance of infrastructure development and continuously undertakes institutional reforms to facilitate economic growth.

Resolution 68 of the Politburo on private economic development is a significant milestone, demonstrating open-mindedness and a commitment to fostering sustainable private sector growth. This not only strengthens trust between the state and private sector but also opens up vast opportunities for domestic enterprises.

Measures such as reducing business conditions, simplifying administrative procedures, and providing tax exemptions for small and medium-sized enterprises are practical steps that alleviate cost burdens and enhance businesses’ competitiveness. Especially, the orientation to develop a minimum of 20 large enterprises participating in the global value chain underscores the role of the private sector and lays the foundation for deeper integration into the world economy.

On international trade, PHS maintains a cautious stance. While negotiations are expected to lower tariffs to around 20%, short-term pressures remain, particularly amid a volatile global landscape. Recently, a shift towards India has been gaining traction among multinational corporations, including Apple, Samsung, and LG, to leverage labor advantages, potential consumer markets, and lower reciprocal taxes of 26% compared to rival countries in the ASEAN region as per Trump’s list.

Nevertheless, Vietnam retains unique advantages in terms of geographical location, resources, political stability, skilled labor, and investment environment, and it will remain an attractive investment destination once the situation stabilizes. Thus, PHS remains optimistic about Vietnam’s long-term prospects. Public investment, real estate, technology, and large private corporations will continue to be key growth drivers.

In summary, PHS believes that the government and the State Bank of Vietnam possess a range of tools to support the economy, from maintaining a low-interest-rate environment to reducing taxes and fees, expediting disbursement, and promoting innovation. This facilitates businesses’ expansion, enhances their competitiveness, and mitigates external instability impacts. However, in the short term, the economy in May is likely to continue facing challenges unless there are new developments in the negotiations.

Regarding exchange rates, PHS maintains its assessment that the USD/VND exchange rate will stabilize around 25,850 – 26,100. PHS anticipates a 0.25% Fed rate cut in June, which could push the exchange rate below 25,800 if Vietnam promptly concludes an agreement with the US. Conversely, if tariff rates surpass 25%, the exchange rate may reach 26,200.

Source: PHS

|

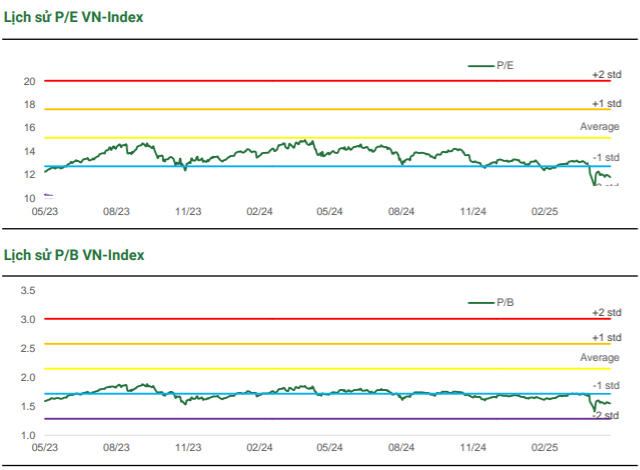

In the stock market, after a shocking decline, the market has entered a positive recovery phase. Attractive market valuations and a stable macroeconomic foundation drive the VN-Index’s recovery trend. Additionally, the launch of the KRX system marks a turning point for the Vietnamese market, aiming towards an upgrade in market status. Foreign investors have also resumed net buying since the official operation of KRX.

However, investors should remain cautious about external uncertainties. The outcome of tariff negotiations with the US will significantly impact Vietnam’s economic growth prospects this year. Therefore, investors are advised to maintain a long-term investment horizon while refraining from excessive leverage during this period.

Source: PHS

|

– 16:37 16/05/2025

The Power of Private Enterprise: Unlocking Vietnam’s Economic Potential through Resolution 68-NQ/TW.

“The Resolution 68/NQ-TW emphasizes the role and significance of the private sector as a vital force in the national economy, as stated by Cao Thi Ngoc Quynh.”

How to Instill Confidence in People to Invest Their Money?

The proposal to develop a Law on Private Economic Development is an exciting and much-anticipated development. This law has the potential to revolutionize the economic landscape, offering a unified policy framework and resolving long-standing contradictions and overlaps that have hindered businesses. With this law, we can expect a new era of economic growth and a more conducive environment for private enterprises to thrive.