The A- rating reflects VNDIRECT’s above-average standalone credit profile and a low expectation of support from its parent company or the government if needed. The stable outlook also indicates VIS Rating’s view that VNDIRECT’s credit profile will remain stable over the next 12-18 months.

The rating could be upgraded if VNDIRECT successfully implements its strategy to mitigate risks, improves the quality and stability of profits from its fixed-income instruments, or raises new capital to strengthen its risk absorption buffer (e.g., consistently maintaining a leverage ratio below 1.3x).

Conversely, the rating may be downgraded if high-risk assets continue to increase or the credit quality of held bonds deteriorates significantly; profitability declines materially (ROAA consistently falls below 3%); or the company becomes more vulnerable to liquidity risk.

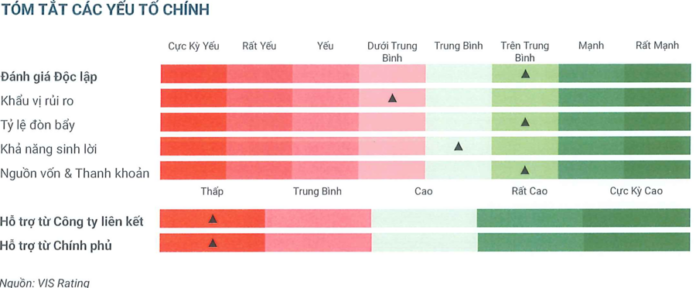

In terms of VNDIRECT’s standalone assessment, leverage, funding profile, and liquidity are rated “Above Average.” Profitability is noted as “Average,” and risk appetite is “Below Average” relative to peers.

Regarding profitability, VIS Rating expects the company’s return on average assets (ROAA) from its core businesses (margin lending and fixed-income instruments) to remain stable, with lower income volatility compared to the industry.

In 2024, the company’s ROAA improved to 4.0% from 3.2% in 2022, mainly due to favorable bond market conditions, offsetting declines in margin lending and brokerage amid intense competition and a cyberattack early that year. Notably, fixed-income instruments contributed 52% of VNDIRECT’s operating profit over the past three years.

For risk appetite, the “Below Average” rating reflects the company’s holdings of high-risk assets (on average, 30% of total assets), including corporate bonds, unlisted equities, and bond repurchase commitments. While VNDIRECT’s corporate bond portfolio includes some bonds with payment delays, the management has plans to mitigate risk by applying stricter criteria for bond underwriting and shifting focus to financial institution bonds. Risks from margin lending are well-managed.

In terms of leverage, VNDIRECT is rated “Above Average,” indicating its strong ability to access new capital to support growth. The company’s leverage ratio has significantly decreased from 3.9x in 2020 to 2.4x at the end of 2024 (below the industry average) after raising nearly VND 10 trillion in capital during 2020-2024. This leverage ratio is expected to remain stable going forward.

VNDIRECT’s funding profile and liquidity are also rated “Above Average,” reflecting its diverse funding structure, good access to domestic and foreign bank loans, and a large buffer of liquid assets. The company plans to issue up to VND 2 trillion in unsecured bonds with 1-3 year maturities in 2025, which is expected to positively impact its funding structure. Liquidity risk arising from the use of short-term borrowings is well-managed, with a cash inflow-to-outflow ratio of 101% at the end of 2024.

The Stock Market’s Resilience Surges: Pinetree Unveils Interest-Free Margin and Derivatives Packages

In March, Pinetree introduced a range of interest-free and fee-waiving policies for margin loans and derivatives trading. These policies were designed to cater to the needs of experienced investors, offering them a more cost-effective way to leverage their investments and engage in more complex trading strategies.

How Are Banks Preparing for the End of Circular 02?

Circular 02, effective until late 2024, has provided a much-needed reprieve for banks and businesses to recalibrate their strategies and financial restructuring. However, as this policy nears its end, the focus shifts to the lingering challenges of non-performing loans and risk governance within the financial system. Maintaining stability requires banks to not only optimize their bad debt coverage ratios (LLR) in balancing profitability and risk but also demands prudence in crafting their lending portfolios in the forthcoming period.

The Reluctant Dividend-Payer: A State-Owned Enterprise ‘Postpones’ Payouts, Remains Delisted After Eight Years of Unpaid Dividends and Consecutive Years of Losses.

Thus, even after more than 8 years, SD6 is yet to pay dividends from 2016. A lingering issue that raises questions about the company’s financial health and stability.