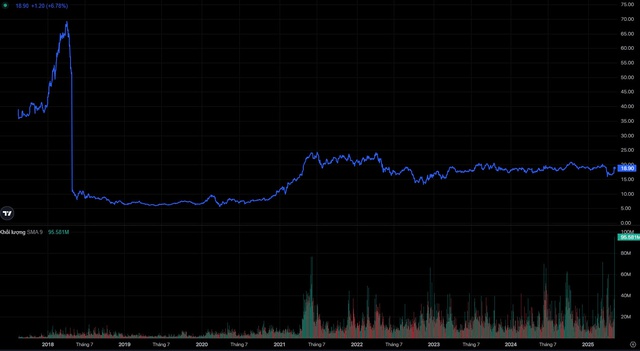

The trading session on May 14 witnessed a notable development in the shares of VPB, the Vietnam Prosperity Joint Stock Commercial Bank (VPBank). At the close, this stock surged by the maximum allowed limit of 6.78% to reach VND 18,900 per share, with liquidity peaking at nearly 95.6 million units since its listing on the stock exchange.

With this performance, VPB emerged as the strongest gainer within the VN30 group and topped the market in terms of trading volume.

VPB stock price movement during the May 14 session. (Source: HSC)

The surge in VPB shares occurred ahead of May 15, which is the ex-dividend date for cash dividend eligibility. With a payout ratio of 5% of par value (VND 500 per share), VPBank plans to distribute approximately VND 3,967 billion in cash dividends.

This marks the third consecutive year of VPBank’s cash dividend payments. In 2024, VPBank disbursed VND 7,934 billion in cash dividends to shareholders at a rate of 10%. Over the past three years, the budget allocated for cash dividends has reached nearly VND 20,000 billion.

Previously, VPBank’s management had announced their commitment to maintaining a cash dividend policy for five consecutive years, starting from 2023.

At the 2025 Annual General Meeting, VPBank’s Chairman, Ngo Chi Dung, shared that the dividend distribution aims to balance the needs of shareholders while ensuring sufficient capital to sustain relatively high growth as per the bank’s strategy.

Mr. Dung also emphasized the importance of capital in the banking sector and the need to strike a balance between long-term growth objectives and shareholders’ expectations for cash dividends. He highlighted VPBank’s dedication to shareholder returns, stating that the bank has allocated nearly VND 20,000 billion in cash dividends over the past three years, meeting shareholder expectations while maintaining sufficient capital for high growth in the following years.

According to Mr. Dung, VPBank will continue its cash dividend policy for the next two years. However, the specific payout ratio will depend on business performance, capital mobilization, and growth in each year.

“I can assure you that VPBank will definitely maintain cash dividend distributions for the fourth and fifth years,” Mr. Dung asserted.

VPB stock price movement since its listing. (Source: HSC)

As per the Q1/2025 financial report, VPBank is the largest private bank in terms of asset size, second only to state-owned banks such as BIDV, Agribank, VietinBank, Vietcombank, and MB.

As of March 31, 2025, VPBank’s total assets exceeded VND 994,000 billion, an increase of 8% compared to the end of 2024. In the second quarter of 2025, the bank’s total assets are expected to reach the milestone of VND 1,000,000 billion. Following VPBank in terms of asset size are Techcombank, ACB, SHB, Sacombank, and HDBank.

“An Exciting Dividend Announcement: A 100% Cash Payout and a 50% Stock Surge”

“The company is expected to dish out a substantial sum of 184 billion VND to shareholders come June. This upcoming payout is certainly a notable event for investors to keep an eye on.”

I hope that captures the essence of your request, showcasing a fluent and engaging writing style.

“NDC Announces Shareholder Approval for a Dividend of VND 3,000 per Share”

Joint Stock Company Nam Duoc (UPCoM: NDC) is pleased to announce a cash dividend for the year 2024 with an attractive ratio of 30%, equivalent to VND 3,000 per share. The ex-dividend date is set as May 23rd, offering a lucrative opportunity for investors.