VinaCapital’s 2025 Annual Investor Conference

|

Profits Reflect Short-Term Challenges

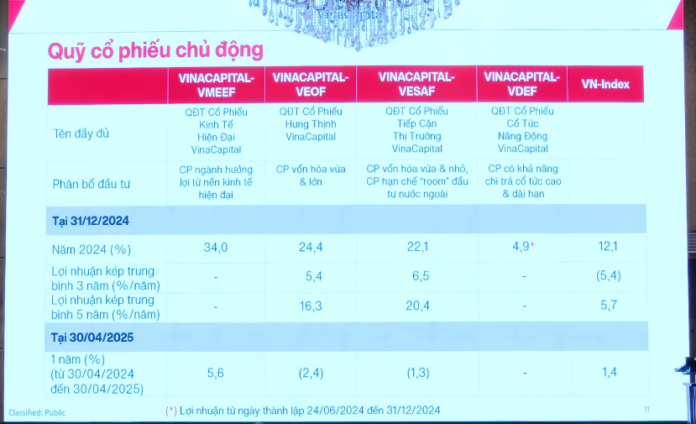

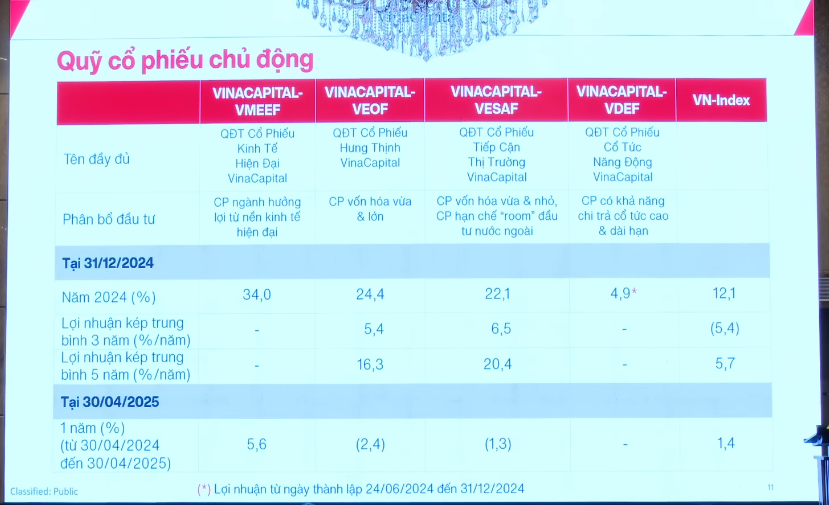

Kicking off the conference, National Sales Director Nguyen Anh Kiet provided an update on the profit picture of the funds managed by VinaCapital.

For actively managed equity funds, VMEEF, VEOF, and VESAF outperformed the VN-Index in 2024, achieving impressive returns of 34%, 24.4%, and 22.1%, respectively, while the newly established VDEF fund in June 2024 also generated a profit of nearly 5%.

However, in the first four months of 2025, with unfavourable information, especially in April, there was an impact on the stock market and fund profits. Over the past year (as of April 30, 2025), VMEEF’s profit stood at 5.6%, while VEOF and VESAF witnessed slight losses of 2.4% and 1.3%, respectively.

National Sales Director Nguyen Anh Kiet shares at the conference

|

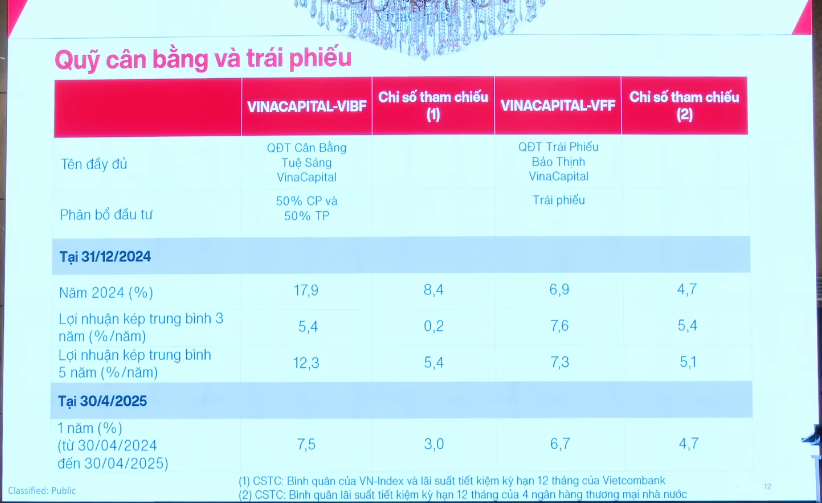

Regarding the balanced fund VIBF (allocating 50% to equities and 50% to bonds), the 2024 results also showed an impressive figure of 17.9%. Over the past year, the profit reached 7.5%. For the specialized bond fund VFF, 2024 brought a profit of 6.9%, and over the past year, it achieved 6.7%.

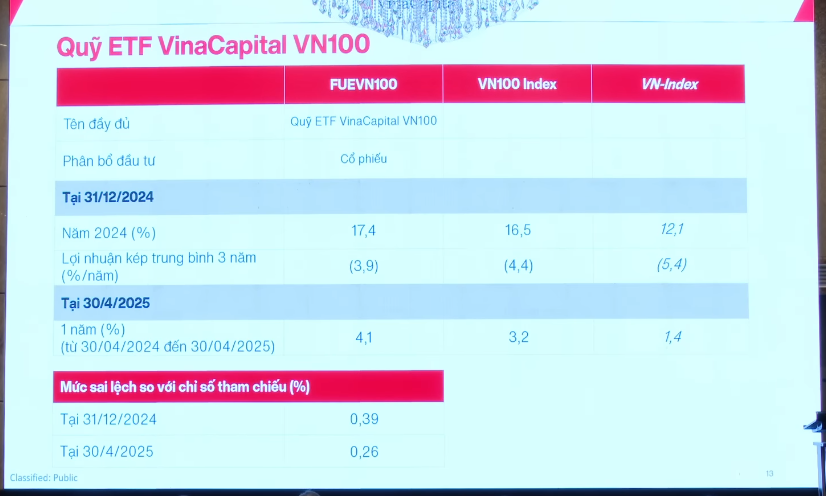

Finally, the VinaCapital VN100 ETF (modeling the VN100 index) yielded a profit of 17.4% in 2024, while the VN100 grew by 16.5%. Over the past year, the fund gained 4.1% while the VN100 rose by 3.2%.

|

|

Performance of funds managed by VinaCapital

|

Cash Ratio Stands at Around 7-10%, Ready to Deploy on Attractive Valuations

During the Q&A session, in response to an investor’s question about strategies to ensure effectiveness amid tense trade relations, Deputy General Director Nguyen Hoai Thu shared that VinaCapital promptly implemented countermeasures, including reviewing all monitored companies, assessing their prospects, growth potential, and valuations, and subsequently adjusting the portfolio.

For all equity funds, the weightage of stocks in sectors directly impacted by trade policies has decreased, including exports, industrial parks, and seaports, while increasing the allocation to sectors less affected, such as domestic consumption, retail, and finance.

Deputy General Director Nguyen Hoai Thu answers investors’ questions at the conference

|

Addressing another question about risk management strategies and the optimal cash position for defence or seizing opportunities, Ms. Thu shared that VinaCapital maintains a specific cash strategy for its funds, particularly equity funds. Accordingly, if the market outlook is concerning, the cash ratio will exceed 12%. Currently, all funds hold a cash position of around 7-10%, reflecting a cautious optimism and readiness to deploy cash to purchase securities at attractive valuations during market downturns.

Spotting Opportunities in Real Estate and Public Investment

In response to an investor’s inquiry about VinaCapital’s plan to increase the allocation to real estate bonds, Head of Investment Pham Minh Thang acknowledged that VinaCapital has observed signs of recovery in the real estate sector in 2025, and indeed, there are opportunities to boost the allocation to real estate bonds. However, thorough due diligence is conducted, investing only in bonds of companies with solid projects, comprehensive legal frameworks, healthy cash flow from the project itself, and sufficient collateral.

Head of Investment Pham Minh Thang responds to investors’ inquiries at the conference

|

According to Senior Investment Director Dinh Duc Minh, the average investment ratio in the real estate sector across VinaCapital’s funds stands at approximately 5-7%, slightly higher than the sector’s weightage in the VN-Index. Excluding the Vingroup conglomerate, the real estate sector accounts for about 4% of the VN-Index.

Addressing the allocation to Vingroup’s stocks, Mr. Minh opined that while Vingroup carries a grand mission and vision, it can be challenging to align with their responsibilities and burdens. Instead, VinaCapital seeks alternative stocks that offer a more favourable balance between profits and risks, aligning with the funds’ investment objectives.

Similarly, stocks that may not be selected today could become investment choices in the future if their profit-and-risk profile becomes more attractive, Mr. Minh added.

Senior Investment Director Dinh Duc Minh shares insights at the conference

|

Further contributing to the discussion, Deputy General Director Nguyen Hoai Thu emphasized that beyond a company’s high growth potential and strong fundamentals, a crucial factor is its valuation. “We consider multiple factors simultaneously, not just the company’s brand name or the number of projects they undertake. Even with strong growth potential, if the risks are high or the valuation is excessive, we will not proceed with the investment”, asserted the Deputy General Director of VinaCapital.

Regarding the opportunity presented by the surge in public investment to $36 billion in 2025, Investment Director Thai Quang Trung affirmed a “definite yes”. He elaborated that this could include stocks of construction companies executing public investment projects or businesses supplying construction materials for such projects. However, VinaCapital adopts a selective approach, investing only in carefully vetted stocks.

“We do not equate policy support with creating value for shareholders and investors”, Mr. Trung emphasized.

Investment Director Thai Quang Trung shares insights at the conference

|

Timing the Entry into the Crypto Market

Discussing the crypto market, Strategy Director Vuong Van Anh shared that VinaCapital closely monitors the legal and technical landscape in Vietnam to develop related products. However, the company will exercise caution, thoroughly studying both the benefits and risks before deciding on the appropriate time to launch crypto-related products.

Ms. Van Anh noted that even major international financial centres like Hong Kong are investing in crypto assets in a sandbox environment. In Vietnam, the legal and technical framework is still lacking in several aspects, such as the absence of designated banks for digital asset custody and relaxed regulations for foreign exchange management.

Strategy Director Vuong Van Anh addresses investors’ inquiries at the conference

|

– 19:06 17/05/2025

Unleashing Vietnam’s Private Sector: Vinacapital Expert Weighs in on Resolution 68

“The core vision of Resolution 68, according to the director of VinaCapital, is to foster a dynamic, robust, high-quality private economic sector with a global competitive edge. This resolution aims to empower private enterprises to become key drivers of Vietnam’s economic growth and transformation.”

Unlocking Vietnam’s Economic Potential: Resolution 68 and the Rise of the Private Sector

The Politburo has issued Resolution 68 – a significant directive that is expected to bring about a major shift in the orientation of private sector development in Vietnam. Marked as a historic turning point, this Resolution elevates the private sector’s status, clearly recognizing it as the “most important driving force of the national economy.”

The Crypto Exchange That Rejected Pi Network Listing Hacked for $150 Million

“In the wake of the recent hack on Bybit, Ethereum suffered a significant blow, with its value plunging by almost $100 per ETH. The cryptocurrency is currently trading in the range of $2,720 to $2,730, reflecting a volatile market sentiment.”