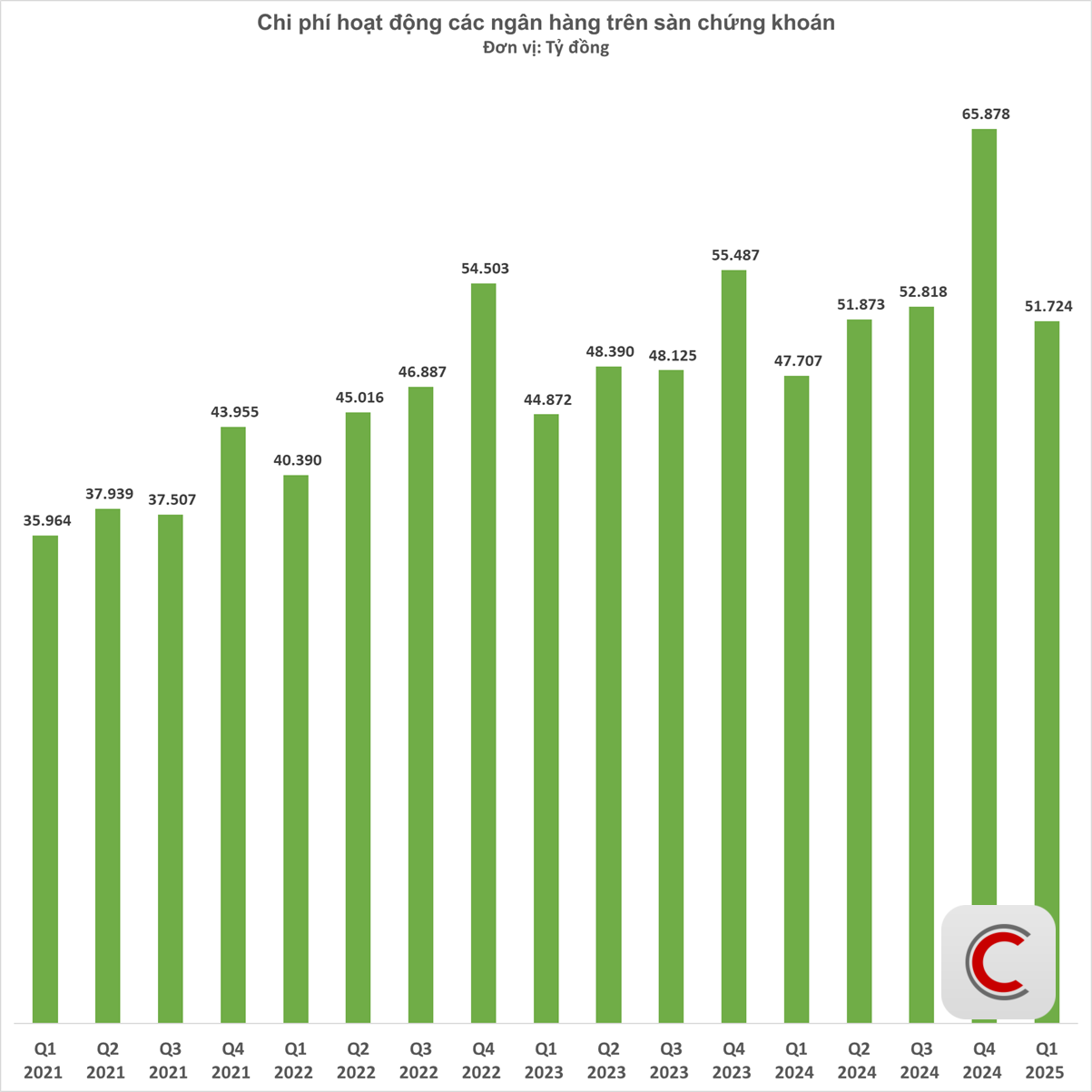

In Q1 of 2025, the total operating expenses of 27 commercial banks listed on the stock exchange witnessed a significant 21.49% decrease compared to Q4 of 2024, falling from VND 65,878 billion to VND 51,724 billion.

Quarterly data reveals that banks’ operating expenses tend to surge in Q4 and then drop notably in the first quarter of the following year. This pattern, recurring over the years, reflects year-end accounting and operational peculiarities such as bonus payments, heightened marketing expenditures, internal debt management, provision of contingency expenses, or investments in technology and infrastructure upgrades.

Hence, the over VND 14,000 billion reduction in total operating expenses during Q1 of 2025 aligns with the cyclical adjustment trend within the financial year.

However, a notable deviation from previous years is the 21.49% decline, the steepest drop to date (Q1 of 2024: 14%, Q1 of 2023: 17.7%, Q1 of 2022: 8.1%). This indicates the banks’ heightened determination to curtail expenses.

Large Banks Tighten Their Belts

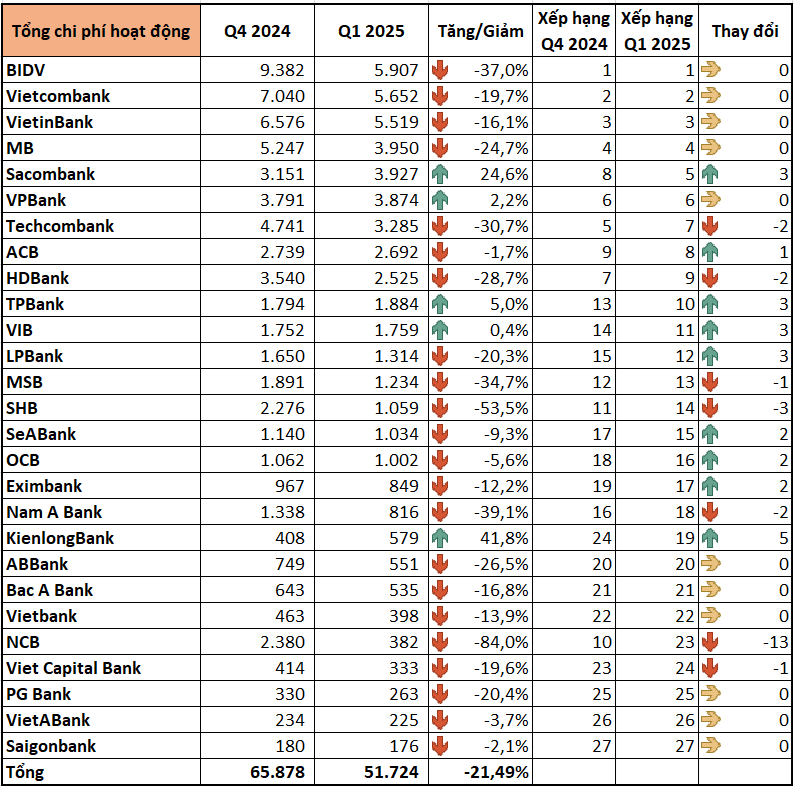

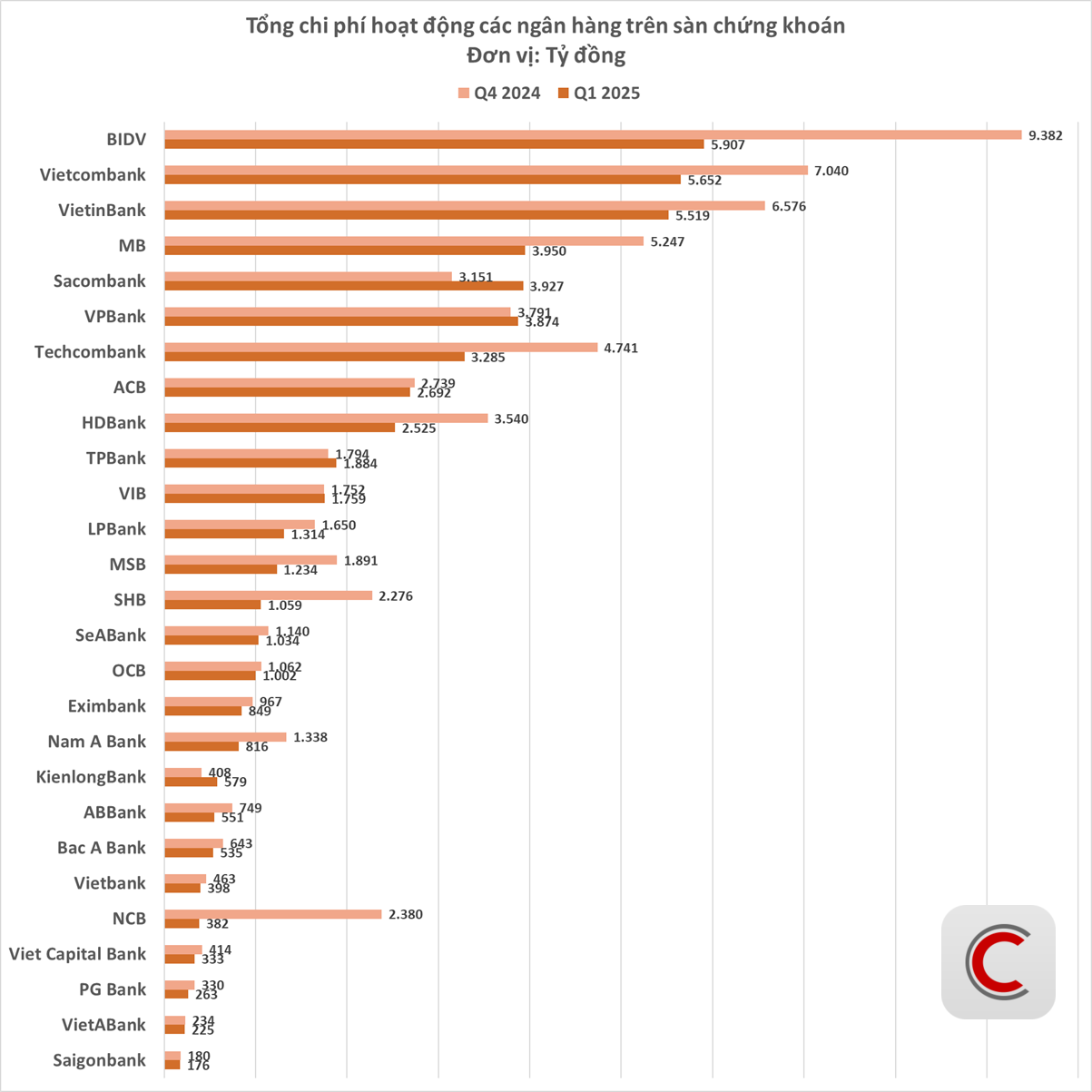

Banks with larger scales, particularly those with state capital, registered significant decreases in operating expenses. BIDV, the country’s largest lender by assets, achieved the most considerable reduction, slashing expenses by 37%. This brought their Q1 2025 total operating costs to VND 5,907 billion, a savings of over VND 3,400 billion compared to the previous quarter. Despite this, BIDV still holds the highest operating expenses in the industry, and this reduction reflects their commitment to expense management.

Vietcombank and VietinBank, two leading banks with extensive networks and high transaction volumes, also reduced their operating expenses by 19.7% and 16.1%, respectively, bringing their totals to VND 5,652 billion and VND 5,519 billion.

In line with the State Bank of Vietnam’s directives, enhancing operational efficiency and streamlining operating costs are among the key policy priorities for 2025.

Private Banks Join the Cost-Cutting Effort

Following the lead of state-owned banks, most private banks also significantly reduced their spending. Techcombank stands out with a 30% decrease in expenses, amounting to nearly VND 1,500 billion in savings compared to the previous quarter, the second-highest in the industry after BIDV.

HDBank also trimmed over VND 1,000 billion from its Q1 expenses. Other private banks with notable cost reductions include SHB, Nam A Bank, and NCB.

Sacombank Swims Against the Tide

Interestingly, while most listed banks trimmed their operating expenses in Q1 of 2025, a few institutions, notably Sacombank, registered an increase, deviating from the industry trend. Sacombank’s operating expenses rose by 24.6%, from VND 3,151 billion to VND 3,927 billion, making it the costliest private bank after the Big 4 state-owned banks.

KienlongBank reported a 41.8% surge in expenses compared to the previous quarter, the most significant increase across all banks.

VPBank, VIB, and TPBank also experienced minor increases in expenses, all below 5%.

In 2025, the State Bank of Vietnam continues to instruct credit institutions to minimize operating expenses to facilitate lower lending rates, supporting businesses and individuals in their recovery efforts. In meetings with the banking system in February 2025, the State Bank of Vietnam urged commercial banks to actively reduce costs, optimize internal processes, and eliminate unnecessary spending to create room for lower lending rates, thus contributing to macroeconomic stability and inflation control.

Additionally, the State Bank of Vietnam has launched initiatives and plans to reduce red tape and compliance costs for businesses in the banking sector, aiming to cut compliance costs by at least 20% by 2025.

Enhancing NIM: Tackling the Ongoing Challenge

Speaking to the Bank Times journalist, Dr. Le Duy Binh, Executive Director of Economica Vietnam asserted that restoring the net interest margin (NIM) to a higher level is a challenging task for the banking system. The immediate solution lies in focusing on optimizing operating costs, enhancing governance capabilities, accelerating digital transformation, and increasing the CASA ratio to improve NIM.