Latest Updates

CEO Nguyen Quoc Cuong introduces the Phuoc Kien project. Photo: Tu Kinh

|

Kicking off the meeting, CEO Nguyen Quoc Cuong shared that from a small enterprise, QCG has today risen to contribute thousands of billion VND to the state budget and created thousands of jobs over three decades of operation.

“What we have achieved today is the result of countless efforts, sweat, and tears, and even at times, sacrificing personal freedom to protect and preserve the company,” said an emotional Mr. Cuong.

Mr. Cuong repeatedly emphasized the sacrifices and dedication of the company’s founder, Ms. Nguyen Thi Nhu Loan. “Even when flying, she only chooses economy class instead of business class. All her life, Ms. Loan has dedicated to Quoc Cuong, sacrificing personal time and freedom,” Mr. Cuong expressed to his mother at the AGM.

Discussion

Why does the company have low debt, is it because it cannot borrow, or because we don’t want to borrow?

CEO Nguyen Quoc Cuong: This is also something that many shareholders are concerned about. There are two parts to this: first, the reason why the company doesn’t borrow, and second, the ability to raise capital in the future.

The company is not unable to borrow, but chooses not to, especially in the context of a volatile market and unclear legal framework for large projects.

In the period of 2016-2017, the company had a very large deal with Sunny Island regarding the Phuoc Kien project, with an advance transfer amount of up to 2,882 billion VND. At that time, we were very hopeful about the long-term cooperation and believed that everything would go as per the contract. However, after a few initial payments, the partner failed to continue its financial obligations, and this deal became a major obstacle that lasted for years. This experience made the Management Board, especially Ms. Nguyen Thi Nhu Loan – the founder of the company – more cautious.

While the market situation has not shown positive signs, we are even more reluctant to borrow to avoid being dependent on a financial institution. Therefore, the option of using borrowed funds is excluded by QCG.

Regarding the second point about whether QCG can borrow or raise capital, the answer is absolutely yes. With our current total assets, large land fund, and gradually improving legal framework, we are eligible to borrow from banks, issue bonds, or call for additional investment. However, we will only borrow when it is really necessary and have a clear plan for cash flow, project feasibility, legal completion, sales and collection plan. At that time, not only banks but also institutional investors at home and abroad will be ready to accompany us. We are not afraid to borrow or raise capital, but only when the risk is acceptable and the financial efficiency is clear.

What is the revenue structure of the 2,000 billion VND revenue plan for 2025?

Mr. Nguyen Quoc Cuong: We plan to structure our 2,000 billion VND revenue plan for this year from three main sources: 900 billion VND from handling and divesting hydropower projects; 700 billion VND from phase 1 of the Marina Danang project, with 37 units under construction and permission to sell; and the remaining 400 billion VND from handling inventory of apartment products.

What is QCG‘s strategy in the rubber sector?

Mr. Nguyen Quoc Cuong: Currently, the company owns about 2,000 hectares of rubber plantations in operation. In previous years, due to low rubber prices, the business efficiency was not very promising. At present, although rubber prices are showing positive signs, it is not yet known how long this trend will last. We still need more time to observe and evaluate the long-term trend. With our current agricultural land area, we do not rule out the possibility of converting part of the rubber plantation model to other cropping models to increase the value of the Group’s agriculture segment.

The name “Quoc Cuong Gia Lai” is not easy for foreigners to remember

Why is it necessary to change the company’s name?

Mr. Nguyen Quoc Cuong: After 30 years of operation, we are considering changing the company’s name. When established, the company had a certain form, aspiration, and dream. Now, as the country enters a new era with many cooperation opportunities at home and abroad, we want to change to a shorter, more concise, and more spreadable name to domestic and foreign partners. The name “Quoc Cuong Gia Lai” is not easy for foreign partners to remember and pronounce, so a change is necessary in the context of new integration.

What is QCG‘s ownership ratio in the projects?

Mr. Nguyen Quoc Cuong: QCG currently owns nearly 65% of the Marina Danang project, 100% of the 6B Pham Hung project (Binh Chanh), 100% of the Lavida Plus project, 43.8% of the Da Phuoc Residential Area project (Pham Gia project), 34% of the Song Da Riverside project (National Highway 13), and 100% of the Phuoc Kien project.

Which projects is QCG implementing?

The Marina Danang project had revenue from phase 1 in 2017-2018, and the remaining phase 1 is under construction and will generate revenue this year. That is certain.

The Lavida Plus project is generating revenue from inventory sales. If we receive the remaining land to implement the next block, revenue will come in the next 12 months (Q2 of next year).

For the 6B Pham Hung project, the company has been pursuing it for a long time, and many customers have bought land and are waiting. The latest document sent to the HCMC Department of Natural Resources and Environment on May 15, 2025, was to determine the financial obligations. The project still has 200 social housing units waiting for approval from the Department of Construction.

The Pham Gia, Song Da Riverside, and Phuoc Kien projects are expected to generate revenue in the next 2-3 years.

It is difficult to implement the Phuoc Kien project independently

What is the capacity to implement the Phuoc Kien project?

Mr. Nguyen Quoc Cuong: Phuoc Kien is an extremely large-scale project. Indeed, it is a bit large for QCG to implement on its own in terms of the company’s current capacity. This is one of the few remaining projects in the southern area of Saigon, connecting to all directions: to Can Gio, to the Mekong Delta, and to Long Thanh airport on the highway axis. With an area of nearly 100 hectares, the project has about 1.5 million m2 of floor area (including both low-rise and high-rise). This scale is equivalent to 50% of the Phu My Hung project, which took more than 30 years to fill.

During the implementation process, we want to ensure a high occupancy rate for our products instead of implementing and selling at all costs, and then the project becomes a waste of society like many large urban areas today.

Is QCG or Chairman Lai The Ha related to the Hodeco deal to sell the Dai Duong tourist project in Vung Tau or not?

Mr. Nguyen Quoc Cuong: QCG is not related to this project at all. If there is any related information, it is only related to individuals on the Board of Directors, not the official activities of QCG.

The capacity of the transferee of more than 37% of the shares of Dai Duong tourist project from HDC

What is the plan to pay 2,882 billion VND to get back the Phuoc Kien project?

Regarding the payment of 2,882 billion VND for enforcement, the company is currently working with the enforcement agency and has proposed a number of plans. One of them is to pay in installments over two years, with the first installment starting in Q3/2025 and ending in Q1 or Q2/2027. With the 2025 business plan revenue of 2,000 billion VND, the company has to divest from the hydropower segment to have the financial resources to pay for the above enforcement.

In addition to the long-term payment plan until 2027, the company is considering many other plans, including the possibility of early payment if conditions permit.

How is the North Phuoc Kien project going?

Compared to the past, the planning has been updated with changes in the transportation system. There is a main traffic route running from the beginning to the end of the project, connecting to Dao Su Tich Street. In parallel, there is an additional transverse road, dividing the project into four parts. As of now, compensation work has reached about 85% of the total project area. With the project divided into four phases, the company can implement each small phase. Although the compensation agreement with the people always presents challenges, with ready financial resources, this is not an impossible task for the company.

Regarding the application of decrees and mechanisms to remove obstacles for real estate projects until 2031, for the Phuoc Kien project and other projects, the company has listed them in the list of projects that need to be removed according to Resolution 171. We expect that in the coming time, these mechanisms will help remove difficulties and obstacles for the project, enabling the company to implement the project as soon as possible.

At the end of the meeting, all proposals were passed.

Quoc Cuong Gia Lai held the 2025 AGM in the afternoon of May 17 – Photo: Tu Kinh

|

Targets profit of 300 billion VND, wants to change the company name after 3 decades

2024 marked a positive turning point for QCG with revenue reaching 729 billion VND, up 75% over the same period last year, of which the real estate segment contributed 510 billion VND, 2.5 times higher than the same period, becoming the main pillar. Net profit increased sharply to 83 billion VND, more than 11 times higher, and was the highest since 2018.

Stepping into 2025, QCG sets a target of 2,000 billion VND in net revenue and 300 billion VND in pre-tax profit, up 274% and 306% respectively over the same period last year. This is the highest revenue milestone so far, and the pre-tax profit is only lower than in 2010 and 2017.

One notable content at the 2025 AGM was the proposal to change the company’s name. The Management Board stated that this is to align with the new administrative context as localities are merging, and at the same time, to facilitate transactions with partners and expand the market. The Board of Directors is authorized to decide on the new name and the time of business registration, but no later than 12 months from the date of approval.

As of 14:30, the total number of shareholders and authorized representatives eligible to participate was 63, holding 66% of the total voting shares. Thus, the 2025 AGM of QCG was eligible to be held.

| QCG sets very high revenue and profit targets for 2025 |

– 16:45 17/05/2025

“Shareholder Meeting: Considering Multiple Payment Installments to Reclaim the Bac Phuoc Kien Project”

At the 2025 Annual General Meeting held on May 17, JSC Quoc Cuong Gia Lai (HOSE: QCG) will propose to its shareholders a target of VND 300 billion in pre-tax profit, a figure surpassed only in 2010 and 2017, alongside record-breaking revenue. The most surprising item on the agenda is the proposal to change the company’s name after over three decades of operation.

Sowatco’s Astonishing Move: A 35% Cash Dividend Surprise!

The Southern Waterway Joint Stock Company (Sowatco), trading on the UPCoM exchange under the ticker SWC, has announced a substantial dividend payout for 2024. The company’s Annual General Meeting approved a cash dividend of up to 35% of charter capital, equivalent to VND 3,500 per share. This significant payout marks a notable increase from the previously intended plan of not distributing dividends.

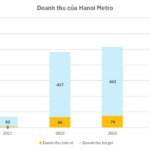

State Subsidies: A Profitable Venture for Rail Operators in Hanoi

Let me know if you would like me to incorporate any keywords or if there are any other specifications you would like me to follow.

The subsidy surged by almost VND 100 billion in 2024 as the Nhon – Hanoi Railway Station route commenced operations on the elevated section.

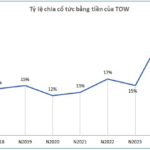

Unveiling the Ultimate Guide to Captivating Copy: “TOW Unveils Record-Breaking Dividends: A Historic Payout after Landmark Profits”

“In a move that will surely delight investors, the Tra Noc – O Mon Water Supply Joint Stock Company (TOW) has announced an extraordinarily generous cash dividend for 2024. Shareholders have every reason to rejoice as the company has declared a record-high dividend ratio. Mark your calendars, as May 29, 2025, is the crucial date for trading without entitlement to this dividend.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)