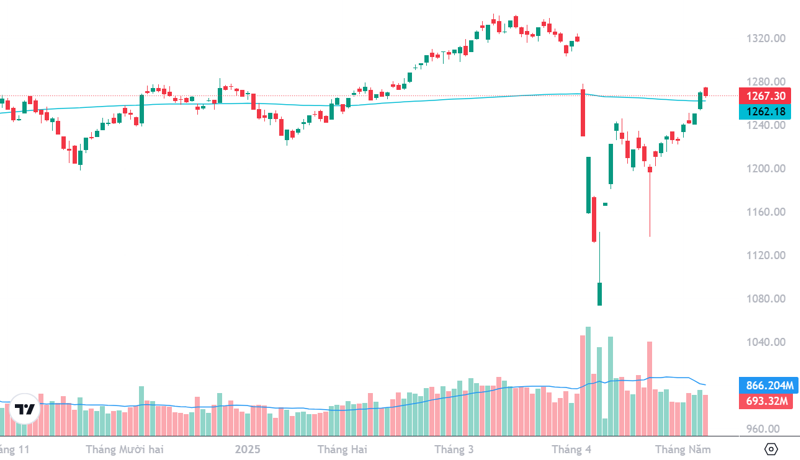

The VN-Index’s enthusiastic upward momentum in the first three sessions of the week helped it recover all the losses from the countervailing tax shock on April 3. However, strong profit-taking pressure in the last session of the week also signaled the market’s potential to end its short-term upward trend…

Commenting on the profit-taking and downward trend at the end of the week, experts believed it was a normal phenomenon, and they had also expected to take profits during the previous discussion and actually reduced their stock proportions during the week. The good increase in both stocks and indices will increase the demand for profit-taking, even without any unfavorable information. Currently, experts are prioritizing stock holdings ranging from 60-80% of their portfolios, with some as low as 30%.

Although they reduced their stock proportions, the experts did not think the market had turned unfavorable. If a correction scenario occurs, it will only be a technical stepping stone to continue climbing higher, with the goal of conquering the 1340-point peak of the VN-Index. Some positive opinions even suggested that this temporary retreat would only last a few sessions, and the market could still have another upward test of the peak by the end of May or early June.

Assessing the supportive information, the market currently lacks prominent events, but expectations remain. The time for Vietnam-US trade negotiations is running out, and the market is looking forward to a positive outcome. This expectation is confirmed as the cash flow in the market is getting stronger, and foreign investors also have notable net buying behavior.

Nguyen Hoang – VnEconomy

Although there were three good sessions last week, the VN-Index eventually failed to surpass the “gap” of the April 3 decline and adjusted in the remaining two days. In the previous week’s assessment, you mostly agreed to recommend profit-taking and reducing stock proportions. How do you evaluate the pressure in the last two sessions of the week? Is this just the usual T+ profit-taking shake, allowing the VN-Index to continue advancing to challenge the 1340-point peak, or will it turn around and adjust immediately?

In my opinion, the first-quarter business results of 2025 were the main reason for the VN-Index’s good growth in the past three weeks. Therefore, it will be challenging to maintain the upward momentum and surpass the peak of 1340 points with the information we currently have.

Nguyen Viet Quang

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

The profit-taking pressure in the last two sessions mainly came from the VN-Index approaching the strong resistance zone of 1320-1340 points – the “gap” area after the tariff information on April 3, where a large supply of investors who bought at the previous bottom was concentrated. This development reflects a cautious mentality when the index touches high-price zones, combined with the May futures expiration session causing significant fluctuations in the blue-chip stock group.

However, I believe the upward momentum is still maintained thanks to the positive cash flow movement and the shift to the banking and securities groups. Technically, the technical momentum indicators have not penetrated the overbought zone, which may imply that the correction pace could be just a “T+ normal” phenomenon to accumulate before challenging the 1340-point peak. However, the risk of a deeper adjustment (~1275-1290) remains open if negative macroeconomic signals emerge.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

The market has recovered well since the 1080-point bottom was tested, and stock performance has also improved. This easily encourages profit realization when the sudden drop before still leaves “injuries” for investors. The profit-taking response is technically appropriate; I think this is a short-term fluctuation to consolidate the trend and move towards higher targets.

The factors supporting this scenario include: First, large cash flows participate again, reflected in the large-cap group performing better, typically VN30, which has moved towards the old peak area. Second, the diffusion level has improved significantly, with most sectors receiving buying pressure to push prices up, even in the most negatively affected groups recently. Third, the trade tension has eased, although there are still many unknowns, but in the short term, many moves to de-escalate tensions from major economic powers will support the trend.

Nguyen Viet Quang – Business Director, Yuanta Securities

Although the market continued to maintain its upward momentum in the first three sessions of the week, there was immediate profit-taking pressure when it encountered resistance at 1320 points in the next two sessions. In my opinion, this is short-term profit-taking pressure from bottom-fishing investors with sufficient profit margins. With the current information trough in the market and the KRX system unable to be a stepping stone for the market to break through and challenge the 1340-point peak, I think we still need to wait for more positive information from the countervailing tax negotiations.

Money Flow Trend: Stocks Profiting Well After 10 Climbing Sessions, Profit-Taking or Holding?

Le Duc Khanh – Analysis Director, VPS Securities

After a series of price increases to break through the important points of 1260 – 1280 – 1300 and 1310 points, the VN-Index needs technical adjustments at these resistance levels, and 2 – 3 or 5 sessions of adjustments with alternating increases and decreases can be expected from the end of last week to the beginning of this week. Portfolio restructuring, especially in the last sessions of the week, is also reasonable and necessary for investors holding many stocks. In my opinion, the 1340-point mark can still be reached, maybe not next week but at the end of May or even early June. It’s just a matter of time.

Nguyen Hoang – VnEconomy

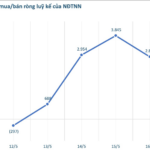

The most surprising change last week was probably the large-scale net buying again by foreign investors in the middle three sessions of the week, with a net purchase of over VND 4,100 billion. However, this block sold a net amount on the last day of the week. Do you think this is a signal for a trend reversal in the withdrawal of this capital flow, or is it just short-term wave surfing transactions?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

Foreign investors showed signs of net selling towards the end of the week, but overall, they still net bought a large amount during the week, with a value of nearly VND 2,923 billion on HoSE. In the previous week, foreign investors also net bought a large amount of nearly VND 1,250 billion. I expect the net buying trend to continue in the context of escalating trade tensions before, causing stock prices in emerging markets to plummet, thereby discounting attractive valuations for the long term and attracting attention from large funds. This buying movement is not only happening in Vietnam but also in emerging Asian stock markets (excluding China) since the end of April, reversing the previous net selling trend.

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

I think the large net buying of VND 4,100 billion in the middle of the week, followed by net selling on the last day, reflects a flexible strategy rather than a long-term trend reversal signal. The main reason is to take advantage of attractive valuations after the previous sharp adjustment and expectations of positive macroeconomic changes. However, the profit-taking pressure at the end of the week from global ETF funds (due to portfolio rebalancing) and concerns about the Fed delaying interest rate cuts have made this cash flow cautious. In essence, this movement is short-term wave surfing, focusing more on the blue-chip group.

Surpassing the high of 1340 – 1350 points could be a surprise in the last week of May or the beginning of June. The medium-term “uptrend” of the market has become clearer, even though the overall economic context still faces many difficulties.

Le Duc Khanh

Nguyen Viet Quang – Business Director, Yuanta Securities

Foreign investors have been net selling continuously for more than a year, and although there have been many trading sessions of net buying with large volumes, the cash flow is not sustainable, and net selling immediately returns if the upward momentum is not maintained. This also reflects the pressure that foreign investors are facing when the information on the market upgrade of our country does not progress, and trade negotiations have not yielded clear results, causing potential FDI capital to be affected, and exchange rate pressure has not subsided.

Le Duc Khanh – Analysis Director, VPS Securities

I think the midweek net buying of VND 4,100 billion or net selling at the end of the week is generally still a small amount that is not worth noting – we need data over a longer period. Of course, this is a more positive signal through the net buying signal of foreign investors. This is just the normal short-term trading activity of this block.

Nguyen Hoang – VnEconomy

Currently, the results of Vietnam-US trade negotiations have not shown clear progress. Meanwhile, the 90-day temporary suspension of countervailing tax is only a little over a month left. Will the VN-Index still have the opportunity to surpass the 1340-point peak in this period? What supportive factors create strong enough expectations for this scenario?

Nguyen Viet Quang – Business Director, Yuanta Securities

In my opinion, the scenario of the VN-Index surpassing the 1340-point peak is very unlikely as the market almost lacks supportive information. Recently, the KRX system has been officially put into operation, but it has not brought positive reflections to the market, as VCI and SSI have not broken through to return to the price before the countervailing tax information was released. In my opinion, the first-quarter business results of 2025 were the main reason for the VN-Index’s good growth in the past three weeks, so it will be challenging to maintain the upward momentum and surpass the 1340-point peak with the information we currently have.

Le Duc Khanh – Analysis Director, VPS Securities

After the adjustment in April, May is still a month of stock price increases in Vietnam this year, and the rise from the 1250 – 1300 – 1350-point area, in my opinion, will likely happen in May and June. The ability to rise to the 1260 – 1280 – 1300-point area will be the milestone that the VN-Index will achieve in May as the main direction of the trend, and surpassing the high of 1340 – 1350 points could be a surprise in the last week of May or the beginning of June. The medium-term “uptrend” of the market has become clearer, even though the overall economic context still faces many difficulties.

Technically, the technical momentum indicators have not penetrated the overbought zone, which may imply that the correction pace could be just a “T+ normal” phenomenon to accumulate before challenging the 1340-point peak.

Nghiem Sy Tien

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

The movement of the VN-Index can currently be considered from a technical and fundamental perspective. Technically, the trend has been continuously improving. Although the index has touched the strong resistance zone in the upward movement, the supply pressure has not shown a significant impact that could cause a reversal in the movement. In addition, the percentage of stocks regaining the upward trend has improved significantly, and some high-performance stock groups have even surpassed historical peaks. I think the short-term adjustment pace is technical, and there is still room for the index to conquer the old peak of 1340 points, provided there are no more unexpected shocks from the macro perspective.

In terms of fundamentals, the most positive catalyst is probably the expectation that Vietnam will reach a favorable trade agreement with the US. In addition, the government continues to promote economic support policies, and recently, Resolution 68 is expected to create momentum for the private economy.

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

Currently, the results of Vietnam-US trade negotiations are still unclear, while the 90-day temporary suspension of countervailing tax is only a little over a month away. I think this puts psychological pressure on the market, making it difficult for the VN-Index to surpass the 1340-point peak in the short term. However, if the negotiations have positive breakthroughs or the government promotes supportive policies, the index still has the opportunity to break through. The supporting factors could be: the domestic cash flow still shows abundant momentum, the macro economy is stable, and the second-quarter business profits of 2025 are expected to be positive.

Nguyen Hoang – VnEconomy

Did you take profits last week? When do you plan to reinvest? What is the current stock proportion?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Company

Last week, some stocks in my portfolio achieved good short-term performance targets, so I took profits on a small portion. I still hold the rest, with an investment portfolio allocation of about 80% in stocks.

The necessary support levels I will particularly pay attention to in the VN-Index’s cooling pace are the 1285-point and 1245-point thresholds. If there are signs of violation, the action of reducing stock proportions will be considered. If the market stabilizes around the 1300-point mark and continues to confirm the upward momentum, I will increase my position again to target testing the old peak of 1340 points and, more optimistically, surpassing it.

I think the short-term adjustment pace is technical, and there is still room for the index to conquer the old peak of 1340 points, provided there are no more unexpected shocks from the macro perspective.

Nguyen Thi My Lien

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

Last week, I took profits on a small portion of my portfolio at the beginning of the week when the market rose strongly but had not yet surpassed the adjustment pressure. I plan to reinvest when the index adjusts to the support

The Big Buy: Foreign Investors Go on a Shopping Spree, Splurging on Vietnamese Bank Stocks

Foreign transactions continue to be a bright spot, with net buys of 891 billion VND in today’s session.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)