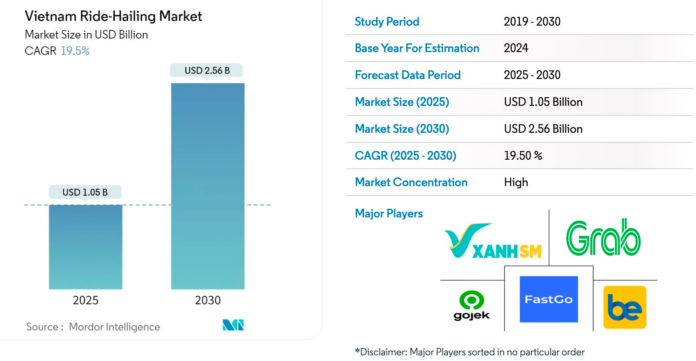

The latest report from Mordor Intelligence noted that the ride-hailing market in Vietnam is estimated to reach US$1.05 billion by 2025 and is expected to further increase to US$2.56 billion by 2030, with a CAGR of 19.5% in the forecast period of 2025-2030.

According to Mordor Intelligence, the market size has increased significantly as Vietnam undergoes a rapid digital transformation, driven by urbanization and the growing adoption of technology.

As of 2023, Vietnam had 77.93 million internet users, accounting for 79.1% of the population, and over 70 million social media users. The digital infrastructure has also seen robust development, with 162 million active mobile connections, equivalent to 164% of the population (data from GSMA Intelligence), an increase of 4.7 million (~3%) since 2022.

Xanh SM’s Rising Presence

This digital transformation has created a fertile “playing field” for ride-hailing services. In fact, Vietnam’s ride-hailing market is dynamic, with significant changes occurring each year. Notably, 2024 was a year of strong restructuring following the departure of Gojek (Indonesia) in September, leaving behind approximately 17% market share at that time (according to the report “The Connected Customer,” Q3/2024).

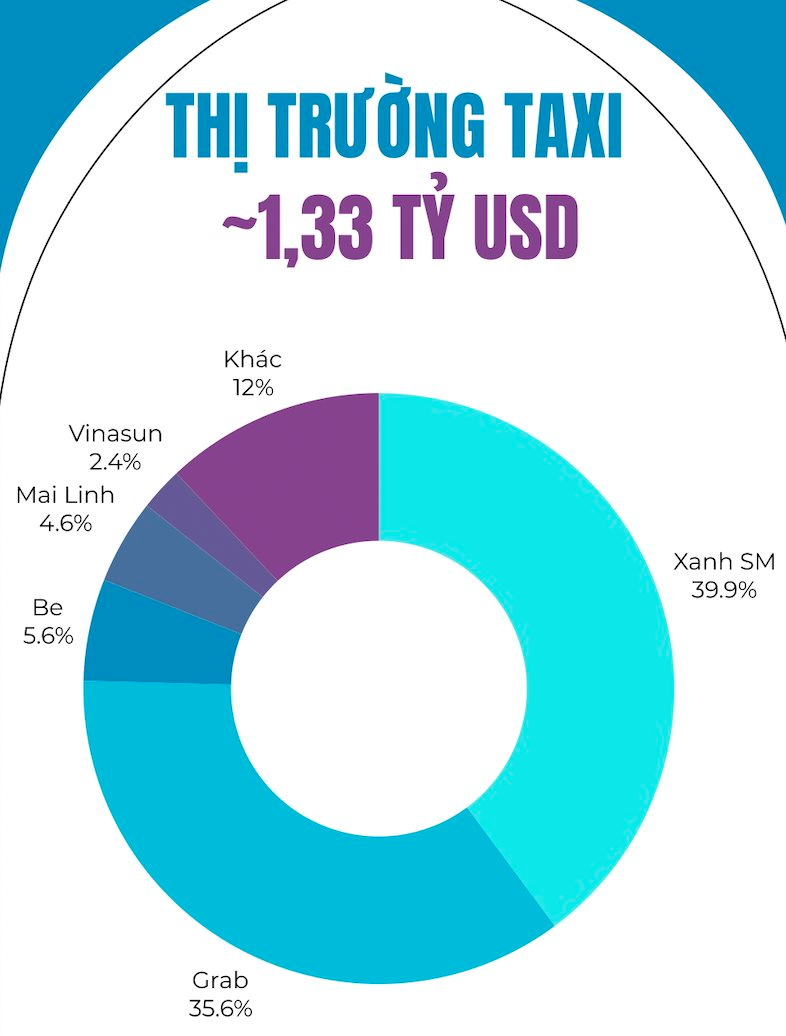

2024 also witnessed the strong rise of local applications, including Xanh SM and Be. Xanh SM, in particular, has raised its capital to VND 18,000 billion and started to expand its presence. The company has also partnered with a series of local partners such as Be, Taxi G7, and Mai Linh, quickly rising to become one of the top two most favored ride-hailing apps in Vietnam, capturing more than 32% market share (according to Decision Lab’s “The Connected Consumer” report for Q1/2024).

In Q1/2025, Xanh SM topped the ride-hailing market share in Vietnam with a rate of 39.85%, as per Mordor Intelligence. User surveys showed that Xanh SM was highly rated for its clean cars, polite drivers, easy booking process, and user-friendly app.

Additionally, features aimed at ensuring safety and protecting customers’ rights, such as the proactive safety monitoring system (S2S) implemented across all vehicles, have contributed to enhancing trust in the user experience.

Be’s Commitment to the Super App Strategy

Another local application, Be, also made strides in January 2024 by securing $30 million in new funding. Unlike Xanh SM, Be attracts customers through a traditional strategy of developing a Super App, offering a range of 12 consumer services, while well-known enterprises have, for years, focused primarily on core services such as ride-hailing, delivery, and food ordering. Be also targets Gen Z customers with a series of Marketing content following the latest “trends.”

As a result, in 2024, Be’s data showed a 60% increase in GMV (Gross Merchandise Value), a 50% rise in app users, including individual and business customers, serving 30% of the urban population.

Be also noted that its digital services (DG) showed signs of growth, indicating that users are developing a habit of purchasing travel tickets, recharging phones, and making other transactions through the app instead of traditional offline channels or hotlines. On average, regular Be users utilize five out of the 12 services available on the Super App.

Regarding partners, Be recorded a 30% increase in the number of drivers in 2024 compared to 2023, reaching the milestone of 50,000 active drivers. Over 95% of Be drivers consider it their main job and primary source of family income. Additionally, Be Food also surpassed 80,000 restaurants in the past year, with a monthly sales growth of 15-20% for these establishments.

For 2025, Be aims to continue applying AI to its Super App to enhance customer experiences, in line with Resolution 57 on the breakthrough development of science and technology. Simultaneously, Be will introduce additional services such as beValet – a car rental service with drivers, and the expansion of beGiúpviệc in Hanoi from April 2025.

Image: Be positioned itself as a SuperApp from October 2024.

Grab Vietnam Appoints a New Leader After Being Overtaken by Xanh SM

Meanwhile, Grab, the largest ride-hailing company in Southeast Asia, continues to attract customers through its affordable pricing segment. Aggregated reports and assessments indicate that Grab has maintained its leading position in Vietnam’s ride-hailing market. Still, the giant now faces competitive pressure from key Vietnamese players like Be and Xanh SM.

Specifically, in the taxi segment, after years of dominance, Grab was unexpectedly overtaken by the electric taxi company of billionaire Pham Nhat Vuong in Q4/2024.

In response to the rising competition, Grab has recently appointed Ma Tuan Trong, the company’s current Commercial Director, as the new leader for Grab Vietnam.

For 2025, the new CEO stated that Grab and its merchant partners would leverage technology solutions to achieve sustainable growth.

The “Unique” TADA App is Gradually Gaining Traction

Image: TADA drivers are increasingly visible on the streets of Ho Chi Minh City.

Additionally, there are many discreet players in the ride-hailing market, such as TADA, a Singapore-based app owned by MVL Foundation. TADA entered the Vietnamese market in 2019 with a unique model – not charging any commission from drivers. Instead, the company utilizes user data to develop new services and sells this data to partner enterprises, generating revenue.

Globally, TADA is known as the first ride-hailing app not to charge a discount from drivers, and the company is confident that this “non-profit” policy will help it thrive and attract a significant number of drivers, especially when competitors impose high discounts.

In Vietnam, while not prominent, TADA’s success lies in its ability to survive in the fiercely competitive market for over five years. Along with customer incentives, TADA is gradually making its presence felt on the streets of Ho Chi Minh City.

Apart from traditional ride-hailing services, TADA has also experimented with expanding into the delivery segment with TADA Delivery in Ho Chi Minh City since May 2020, offering competitive pricing with a flat rate of VND 15,000 for intra-city orders under 3 kg.

Another potential entrant is Bọlt, which has shown signs of preparing to enter Vietnam. Bọlt is actively recruiting personnel in major cities (Hanoi and Ho Chi Minh City) and seeking cooperation from drivers. Bọlt is a tech “unicorn” valued at up to $8 billion, already present in over 50 countries. It has established a presence in several large Southeast Asian markets, including Thailand (2020) and Malaysia (November 2024).

“Major Shake-up at PJICO Insurance: Sudden Departure of CEO and Deputy CEO”

“PJICO shakes things up with a bold move, announcing the simultaneous departure of both its CEO and Vice CEO effective May 15, 2025. This unexpected development marks a turning point for the company, leaving many questions unanswered and a path forward that is yet to be paved.”

“Overcoming Challenges: Unleashing the Potential of Vietnam’s Private Sector”

“During the National Conference on May 18, Prime Minister Pham Minh Chinh pointed out a slew of shortcomings hindering the development of the private sector, ranging from institutional and cognitive aspects to implementation. Despite accounting for 50% of GDP, this sector still faces a “double bind” in terms of legal framework, credit, and connectivity.”

![[Photo Essay]: National Conference on the Propagation and Implementation of the 11th Plenum Resolutions](https://xe.today/wp-content/uploads/2025/05/img2050-17447720177111743218177-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)