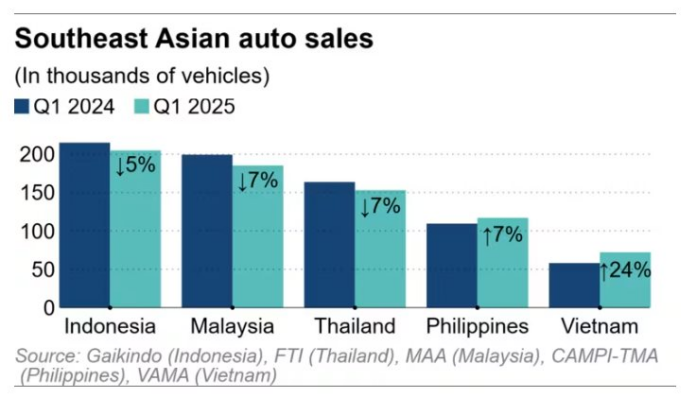

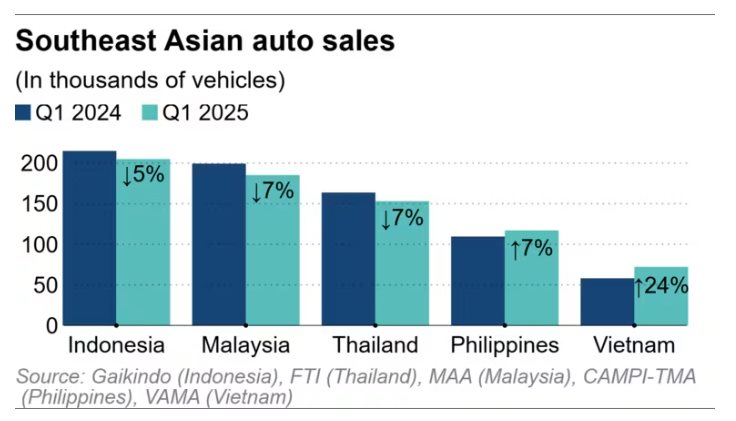

According to Nikkei Asian Review, Vietnam’s car sales in Q1 2025 witnessed a robust 24% year-on-year growth, outpacing other major Southeast Asian markets, thanks to favorable economic trends and improved domestic consumption.

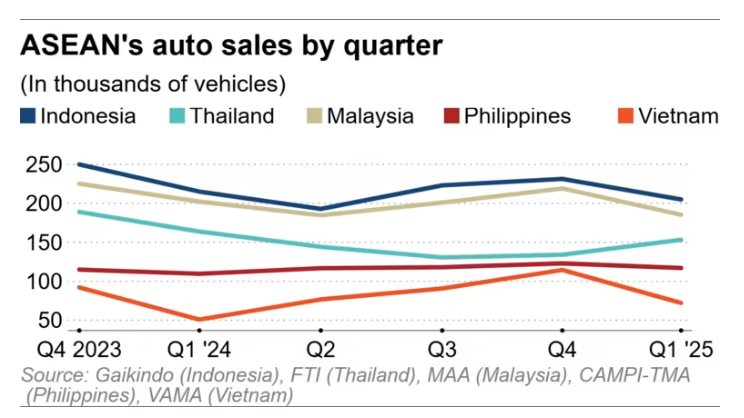

Nikkei compiled sales data from January to March across the top five Southeast Asian markets: Indonesia, Malaysia, Thailand, the Philippines, and Vietnam.

Total car sales in these five countries amounted to approximately 732,898 units, a 1.7% decline year-on-year. Vietnam emerged as a rare bright spot in the region.

Leading the Region

In Vietnam, hybrid vehicles recorded the highest growth rate among all types, surging by 80% to 2,562 units year-on-year.

Toyota Motor, one of the most popular brands in the country with a market share of around 14%, launched the hybrid Camry model last year. Another Japanese brand, Suzuki Motor, introduced the hybrid version of its large-sized XL7 SUV in September, contributing to the growth of this vehicle segment.

Q1 2025 Car Sales Performance Compared to the Previous Year (in thousands)

Commercial vehicles and trucks were the biggest growth drivers in Vietnam, with sales increasing by 22% and 21% to 15,445 and 13,400 units, respectively. Nikkei attributed this surge to higher public investment, which boosted demand.

Vietnam has ramped up public investment to stimulate the economy, with total public investment reaching US$4.67 billion in Q1 2025, up 19.8% year-on-year.

“We expect Vietnam’s passenger car sales, excluding VinFast and some luxury brands, to grow by 15% year-on-year in 2025, thanks to further improvements in consumer spending, continuous attractive promotions from automakers, and the launch of affordable models,” said Thuc Than, an industry analyst at Viet Capital Securities, to Nikkei.

It’s important to note that the statistics from the Vietnam Automobile Manufacturers Association (VAMA) do not include the Vietnamese electric car manufacturer VinFast (Vingroup) or Hyundai Motor of South Korea, whose cars are produced and sold in Vietnam by the Thanh Cong Group.

VinFast sold 35,100 vehicles in the first quarter, while Hyundai sold 11,464 units.

When combining the industry’s figures, Vietnam’s total car sales of 118,813 units surpassed the Philippines, which sold 117,074 vehicles in the first three months of 2025.

Among the top five Southeast Asian car markets, the Philippines also recorded a solid year-on-year growth of 7% in the first quarter, selling 117,074 vehicles.

However, passenger car sales in the Philippines declined by 13.7%, while commercial vehicle sales increased by 13.9%. Electric and hybrid vehicle sales reached 4,544 units, accounting for 5.73% of total car sales in the country.

In other markets, such as Thailand, car sales in the first three months of the year decreased by 7% year-on-year to 153,193 units.

Pickup truck sales in Thailand dropped by 13% to 40,475 units, and internal combustion engine (ICE) passenger car sales declined by 14% to 37,555 units. In contrast, electric vehicle sales surged by 19% to 22,737 units, led by Chinese brands like BYD, which saw its March sales soar by 2.8 times year-on-year to 3,204 units.

On a quarterly basis, Thailand’s Q1 2025 car sales increased by 14% compared to Q4 2024 and surpassed 150,000 units for the first time in four quarters.

Car Sales by Quarter (in thousands)

This quarterly increase was partly due to promotional programs and discounts offered by automakers, as the market had previously been weighed down by high household debt, leading to tighter auto loan screening by banks.

Another major car market, Malaysia, which experienced sales growth last year, saw a slowdown in early 2025. Car sales in Q1 2025 declined by 7.4% year-on-year to 188,100 units.

Malaysia’s car sales were sluggish in the first two months but picked up in March, with 72,700 cars sold, equivalent to a 2.2% increase compared to March 2024.

According to Hong Leong Investment Bank’s report, the March increase was mainly driven by aggressive sales campaigns from automakers following two sluggish months.

Industry executives anticipate electric vehicle sales in Malaysia to rise in the remaining months of the year.

Periasamy Arumugam, sales director at China’s Great Wall Motors, shared that around 13 to 14 Chinese automotive companies would enter the Malaysian market by the end of this year.

“Chinese brands are offering very competitive and affordable pricing,” he told Nikkei Asia.

*Source: Nikkei