A trove of precious metals has been discovered by miners along the border between Argentina and Chile, touted as “one of the world’s largest sources of copper, gold, and silver.”

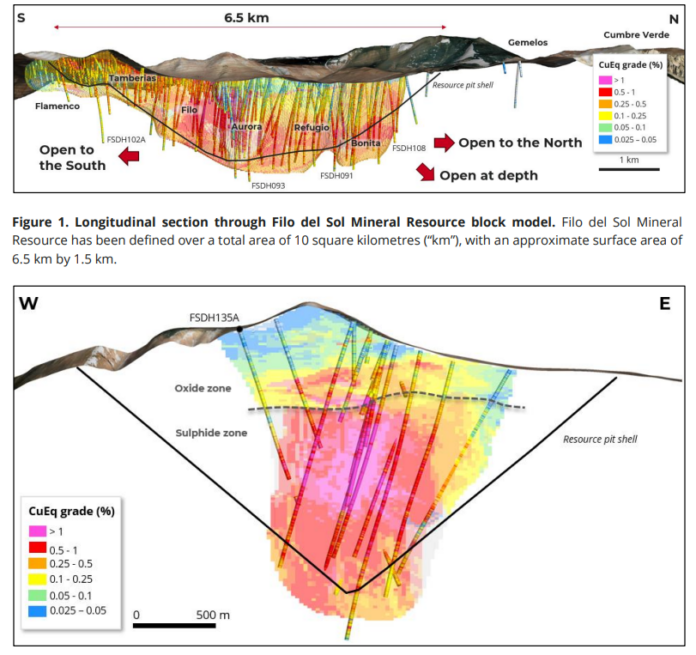

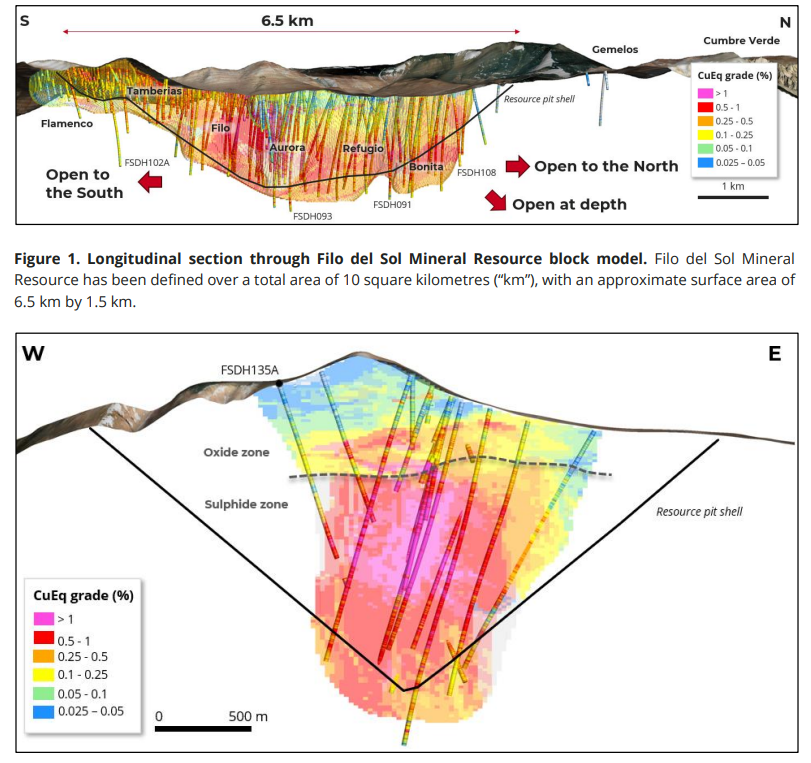

According to the latest surveys, the Vicuña Mineral Resource area—spanning from San Juan Province in Argentina to the Atacama region in Chile—is estimated to contain up to 13 million tons of copper, 32 million ounces of gold (approximately 907 tons), and 659 million ounces of silver (about 18.6 thousand tons).

The Vicuña resource is currently managed by two prominent mining corporations, Lundin Mining and BHP, with a focus on two primary mines: Filo del Sol and Josemaria. Both mines are ranked among the top 10 global producers of copper and boast gold and silver reserves that are among the largest in the world.

“Filo del Sol and the Vicuña district are on track to become a world-class, global-scale mining complex,” said Jack Lundin, President and CEO of Lundin Mining.

He further emphasized, “This discovery not only confirms the scale of Vicuña but also unveils the high-quality ore body of the mines. Large deposits tend to get bigger over time, and we clearly see the growth potential of this region.”

The Filo del Sol mine reveals a high-grade oxide zone.

While Lundin Mining has not disclosed specific values, the impressive reserves mentioned earlier undoubtedly translate to a project value in the billions of dollars.

Gold, silver, and copper are not just rare precious metals used in jewelry or value storage but also essential materials in high-tech industries such as microcircuit manufacturing, communications equipment, spacecraft, jet engines, and various other electronic devices.

Mineral deposits like Vicuña are the result of geological processes spanning millions of years. When tectonic plates collide, molten lava and superheated fluids seep through cracks in the Earth’s crust, carrying dissolved minerals from deep within the planet. As these flows cool, they leave behind veins of precious metals.

Over time, these deposits are further displaced by erosion and water, settling at the bottom of ancient seas or floodplains to form today’s valuable placer deposits.

However, extracting these vast resources requires the construction of large-scale infrastructure, road networks, and the deployment of heavy machinery. The presence of mining activities will undoubtedly alter the pristine natural landscape and presents significant environmental protection challenges.

In the race to extract the values forged by nature over millions of years, humanity faces the risk of damaging the very environment that birthed this wealth.

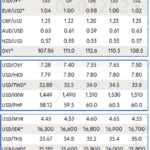

The Greenback’s Future: Forecasting USD’s Fate

The Market and Global Economics Research team at UOB Bank (Singapore) has released its May strategy report on exchange rates and interest rates. The bank’s forecast for the upcoming quarters is as follows: 26,100 VND/USD for Q2, 26,300 VND/USD for Q3, 26,000 VND/USD for Q4, and 25,800 VND/USD for Q1 2026.

Gold Prices Dip While Rubber Rallies: A Contrasting Commodities Market on May 9th

The global commodities market is experiencing a period of heightened volatility. Oil prices have staged a robust recovery following a previous downturn. Rubber prices continued to climb, reaching their highest level in nearly a month. In contrast, gold prices declined, alongside iron ore, wheat, and cocoa.

The VN-Index Surges by 41 Points Post-Holiday Week

“For the week of May 5th to May 9th, the VN-Index witnessed a robust upward trend, with four out of five trading sessions ending in the green. On May 9th, the index witnessed a slight dip, closing at 1,267.3 points, which still marked a notable 41-point increase compared to the closing value on April 29th.”

“Global Markets Rally Ahead of Crucial US-China Trade Talks”

The global markets are abuzz with activity as oil, gold, rubber, and coffee prices, along with US agricultural products, surge ahead of the highly anticipated US-China tariff talks scheduled for later this week.