FPT Group’s Impressive Performance in the First Four Months of 2025

FPT Group

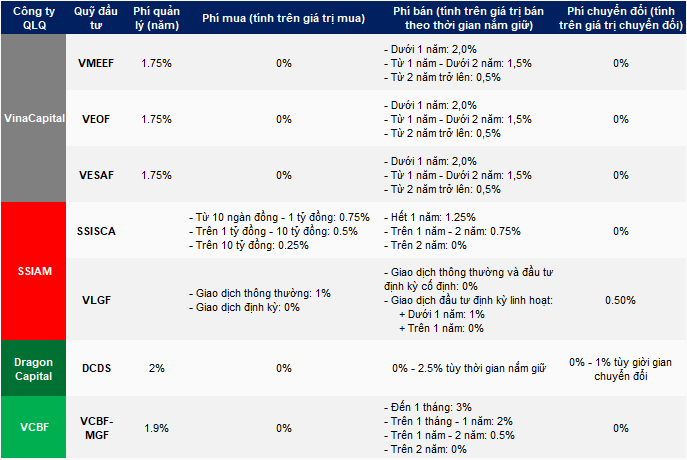

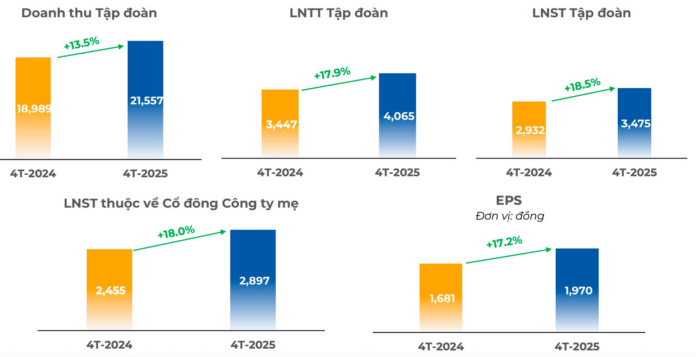

has announced impressive financial results for the first four months of 2025, with revenue reaching VND 21,557 billion and pre-tax profit of VND 4,065 billion, up 13.5% and 17.9% year-on-year, respectively. Net profit attributable to parent company shareholders (net profit) increased by 18% to VND 2,897 billion, corresponding to an EPS of VND 1,970 per share.

In April 2025 alone, FPT’s revenue reached VND 5,499 billion, up 12.3% year-on-year. Net profit for April increased by 10% year-on-year to VND 723 billion.

FPT is known for its disciplined approach to growth, consistently maintaining a growth rate of around 20%. This technology enterprise has steadily grown month after month, quarter after quarter, and year after year. The 10% profit growth in April is a relatively rare occurrence.

According to FPT, the current context has not shown significant improvement due to ongoing economic and geopolitical uncertainties, causing global businesses to become more cautious in their technology spending decisions.

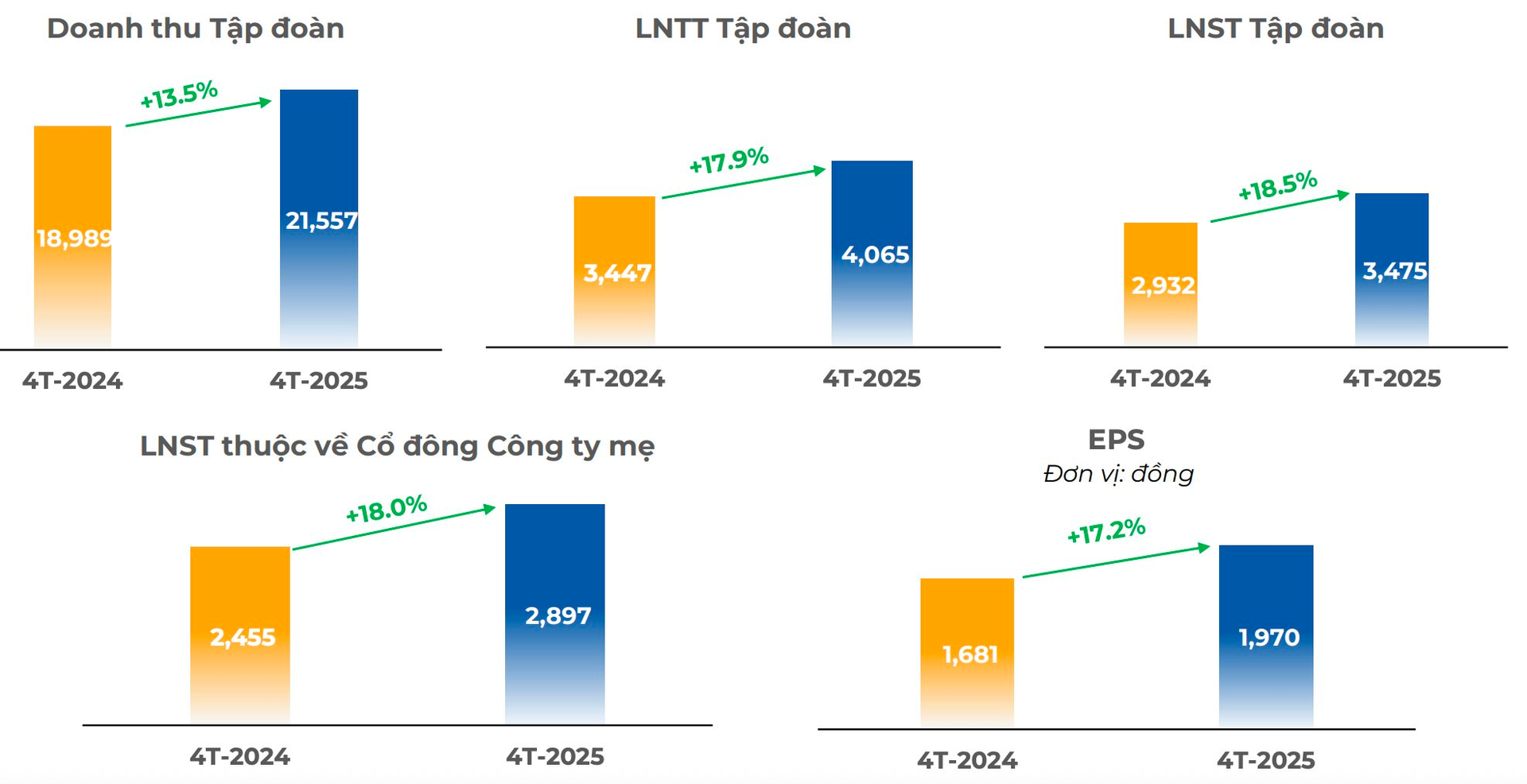

For 2025, FPT has set ambitious business plans, targeting a revenue of VND 75,400 billion and a pre-tax profit of VND 13,395 billion, representing increases of 20% and 21%, respectively, compared to 2024. If achieved, these will be new record-high revenue and profit levels and the fifth consecutive year of over 20% annual growth.

At the annual general meeting of shareholders held in mid-April, Mr. Truong Gia Binh, Chairman of FPT’s Board of Directors, acknowledged the extremely challenging context. He noted that businesses usually plan for multiple years, but when policies change overnight, it becomes difficult to respond promptly. However, he also emphasized that there are opportunities within these challenges, and FPT remains committed to its disciplined approach with a growth target of around 20%.

Mr. Nguyen Van Khoa, CEO of FPT, shared that the company’s business plans for the year were made in January, before the US announced its new tax policies.

“We believe we were courageous in setting such ambitious plans, but we will not be complacent. FPT will closely monitor the actual situation and be ready to adjust our plans if needed,”

said the CEO of FPT.

With the results achieved in the first four months, the group has accomplished approximately 30% of its annual plans.

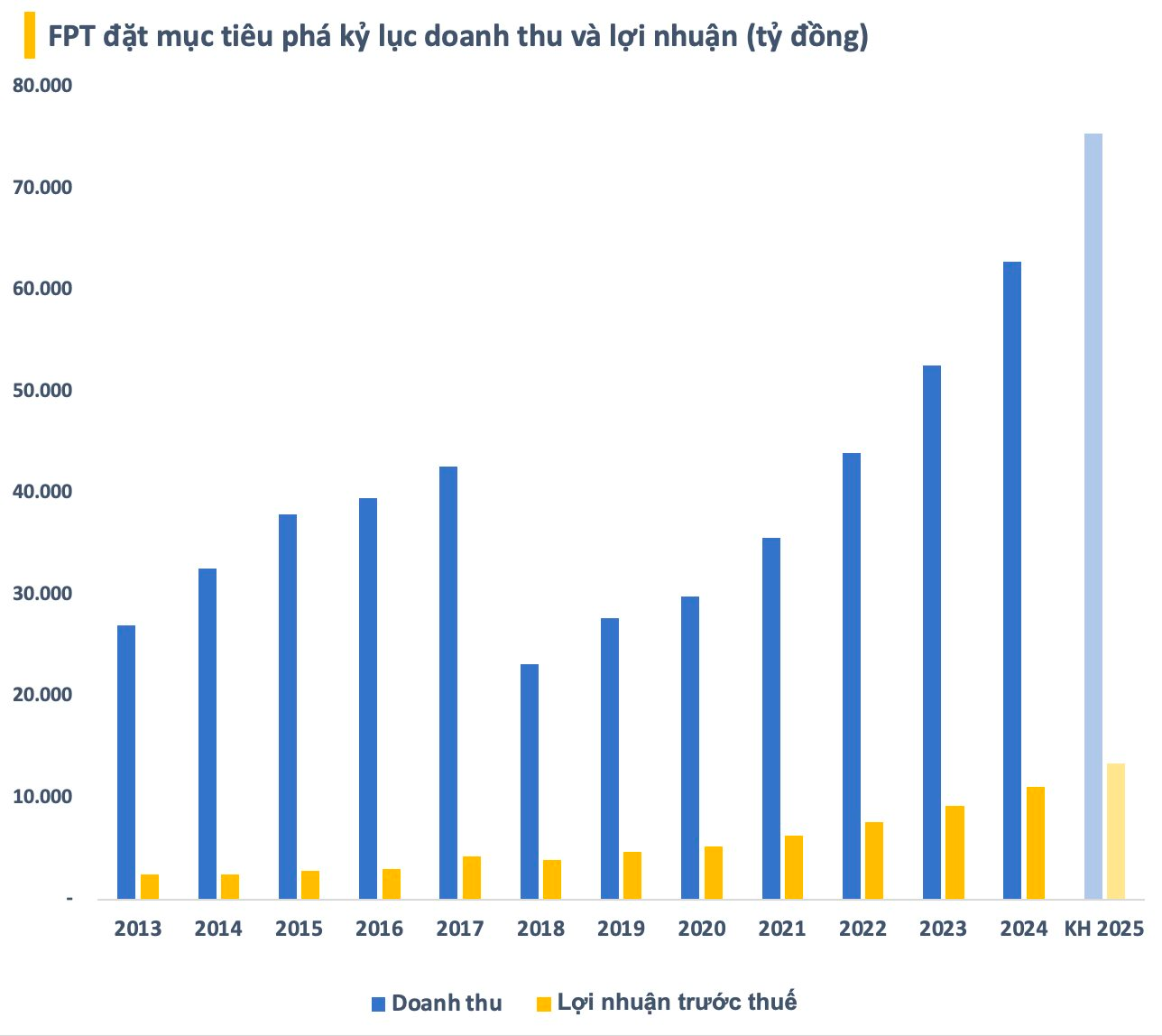

A closer look at the performance reveals that:

The IT Services segment in overseas markets

achieved a revenue of VND 11,001 billion in the first four months, equivalent to a 16.4% increase. Japan, the main market, maintained a growth rate of 30%, with a revenue of VND 4,780 billion. New order volume in overseas markets reached VND 15,384 billion, up 10.4%.

Additionally, the

Telecommunications Services segment

recorded positive growth, with revenue and pre-tax profit increasing by 14.6% and 19.2%, respectively, thanks to enhanced sales activities and optimized internet service packages.

In the market, FPT’s share price closed at VND 121,000 per share on May 16.

“PJICO Insurance: Leadership Transition – New Opportunities”

Let me know if you would like me to continue with a full article or provide any additional headlines for this imaginary piece.

The Chairman of the Board of Directors has taken on the additional role of legal representative, while the President and Vice President of PJICO have both stepped down from their respective positions simultaneously.

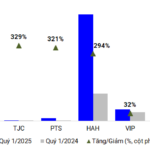

The Ocean Freight Industry: A Slow Start to Q1

The maritime transport industry witnessed a mixed performance in 2025, following two positive quarters in the latter half of 2024. While total revenues experienced a slight uptick, profits for many businesses took a hit due to extended Lunar New Year holidays, a weakened international market, and elevated repair and depreciation costs.

Captivating Cash Flows of Vinamilk, BAF

Vinamilk’s domestic sales for April witnessed a remarkable surge, surpassing the corresponding period of the previous year by over 10% and exhibiting an impressive 40% increase compared to the monthly average of the first quarter. Meanwhile, BAF boasted record-breaking performance in April, with a staggering turnover of VND 450 billion, marking the highest monthly revenue.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)

![[IR Awards] September 2024 Disclosure Calendar: Mark Your Dates!](https://xe.today/wp-content/uploads/2024/09/LCBTT_Screenshot_1.png)