“Value Investing: Navigating Through the Storm”

While the outlook for value investors has always been brightest when the rest of the world loses faith, buying cheap stocks has proven effective over the long term.

Economists Eugene Fama and Ken French define a value stock as one with a low price-to-book ratio. By this measure, US value stocks have outperformed growth stocks with high price-to-book ratios by 2.5% annually since 1926. Value stocks have also outperformed in most other foreign markets, according to the UBS Global Investment Returns Yearbook.

However, this trend came to an end on the eve of the global financial crisis. From 2007 to 2020, growth stocks outperformed value stocks. While value stocks made a partial recovery in 2020, they fell back again as tech stocks soared in late 2022.

Importantly, book value is not a measure that contemporary value investors rely on.

Warren Buffett’s partner, Charlie Munger, taught him to consider a company’s competitive position. If a business consistently achieves above-average returns on capital, investors can safely buy its stock even at a premium to the market. Moreover, a company’s balance sheet value is an unreliable gauge of worth as it excludes intangible assets like research and development. Stock buybacks and mergers further distort book value accounting.

However, there are other factors to consider. Small-cap stocks, which have historically outperformed their larger peers and are favored by value investors, have also had a dismal run.

Global stock markets, both developed and emerging, have been outperformed by the extraordinary performance of US stocks. According to UBS, from 2010 to early this year, US stocks delivered annual inflation-adjusted returns of 10%. During the same period, other stock markets delivered a total inflation-adjusted return of 2.6% per year. Emerging markets delivered only half that figure.

Veteran value investor and co-chairman of Oaktree Capital Management, Howard Marks, laments, “All norms have been upended.”

The challenging period for value investing strategies can be explained by various factors.

Firstly, ultra-low interest rates after the global financial crisis boosted the appeal of growth stocks, while value stocks became relatively disadvantaged.

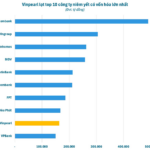

Secondly, value investors have been impacted by the rapid expansion of index funds. Nearly 60% of the US stock market is held by passive tracking funds. Goldman Sachs predicts that from 2014 to 2026, a total of $3 trillion will be withdrawn from active funds in the US and invested in passive funds. As passive funds grow, investors sell value and small-cap stocks to switch to S&P 500 trackers.

Warren Buffett, who stayed out of this market frenzy, is said to be baffled by what happened. But when this bubble bursts and market concentration decreases, as it did in 1975 and 2000, value stocks are expected to outperform in the following years.

So, are value investors about to embark on another winning streak?

The chaos in the early days of Donald Trump’s second term may be a harbinger of such a shift. At the London Value Investor Conference on May 14, Richard Oldfield of Oldfield Partners stated that the Trump administration, with its tariff threats, is creating risks for the US. If inflows into the US start to reverse, other developed and emerging stock markets will benefit. While value stocks’ outperformance has been declining in recent years, Oldfield believes this time will be different.

The obstacles that have hindered value investors in the past decade may soon disappear. In the last three years, interest rates have returned to more normal levels. The seven biggest tech companies in the US market are racing to invest in artificial intelligence. Time will tell if their massive capital expenditures will yield satisfactory returns. These large-cap growth stocks have actually underperformed this year. In contrast, value and small-cap stocks in the US and elsewhere offer potential investment opportunities.

Kim Dung (According to Reuters)

The Flow of Funds: A Shake-Up to Re-test Old Peaks?

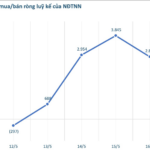

The exhilarating surge across the first three trading sessions of the week helped the VN-Index recoup all losses incurred from the April 3rd tax countermeasure shock. However, intense profit-taking pressure on the last trading day also signaled the market’s potential to conclude its short-term upward trend.

“ABS Research: Mid-Term Outlook Remains Somewhat Opaque”

“May’s strategic report from An Binh Securities Company’s (ABS) research arm indicates that we are in a phase of market recovery with a positive short-term outlook, despite a lack of overwhelmingly positive economic indicators. “