VN-Index surpassed the psychological threshold of 1,300 points this week, returning to its March 2025 peak before the sharp decline triggered by news of US tariffs. The benchmark index recorded a gain of 34 points, equivalent to a 2.69% increase, reflecting the improving investor sentiment.

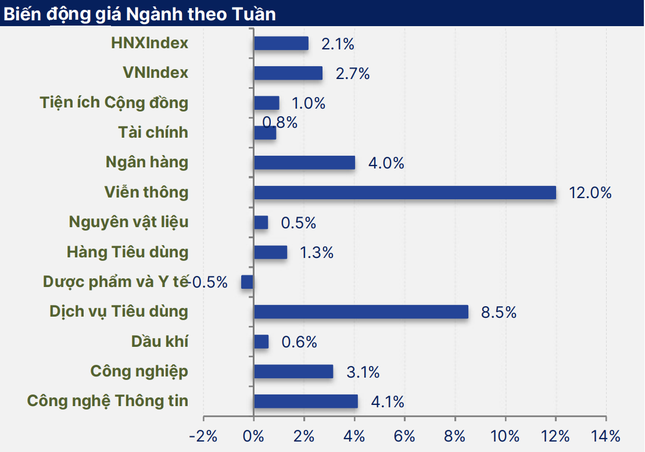

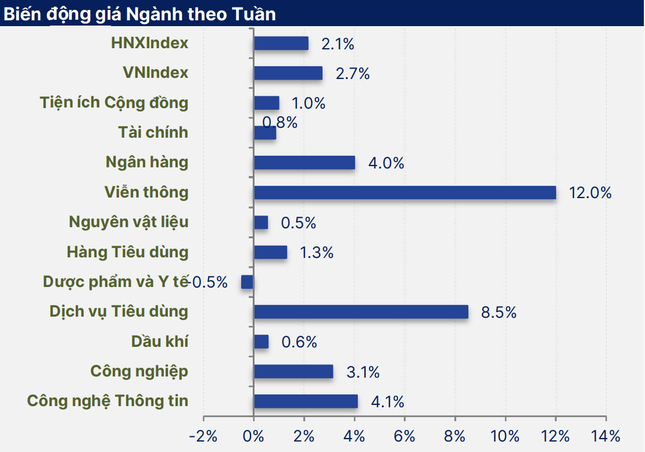

Most sectors witnessed a recovery, with banking, finance, retail, and technology standing out as the leading sectors. In contrast, industrial zones, retail, telecommunications, and textile industries faced corrective pressures and divergence. Short-term money flow picked up again, with foreign investors net buying strongly, valued at VND 2,920 billion on HoSE.

This week, most sectors recovered. Statistics: SHS.

Analysts from Asean Securities stated that the optimistic sentiment spread from the beginning of the week, following the strong rally in the US stock market. The US and China reached a temporary agreement on tariff reductions after negotiations in Switzerland, raising hopes for easing trade tensions and reducing the risk of a global economic downturn. The recovery momentum persisted throughout the subsequent sessions, with investors expanding their positions, reflecting their optimism about the improving international trade environment.

Mr. Nguyen The Minh, Director of Research and Analysis at Yuanta Securities, forecasted that in the next 1-2 weeks, the market will receive information related to the negotiation rounds between the US and other countries, which may cause fluctuations.

Investors generally avoid stocks that are significantly impacted by tariffs, making it challenging to find new buying opportunities in this environment.

Looking ahead, Yuanta Securities anticipated that the market might experience further adjustments in the coming week, with the VN-Index retesting the 1,250 – 1,280 range. The market is likely to return to a short-term accumulation phase, with divergence and low liquidity.

Additionally, the continued rise in sentiment indicators into overly optimistic territory suggests increasing risks of a correction and narrowing opportunities for short-term profit-taking.

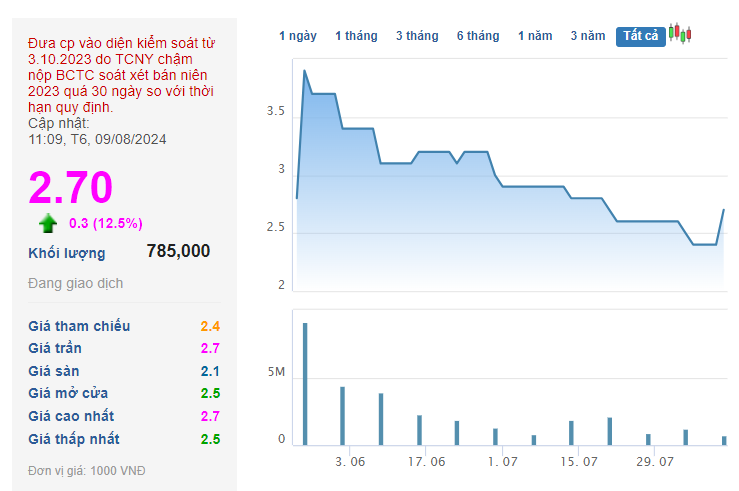

Phu Hung Securities (PHS) opined that after a shocking decline, the market has entered a positive recovery phase. Attractive valuations and a stable macroeconomic foundation are driving the VN-Index’s recovery trend. Moreover, the introduction of the KRX system marks a turning point for Vietnam’s market, aiming for an upgrade. Foreign investors have resumed net buying.

According to PHS experts, investors should pay attention to external uncertainties. The outcome of tariff negotiations with the US will significantly impact Vietnam’s economic growth prospects this year. Therefore, investors are advised to maintain a long-term perspective and refrain from excessive leverage during this period.

The Flow of Funds: A Shake-Up to Re-test Old Peaks?

The exhilarating surge across the first three trading sessions of the week helped the VN-Index recoup all losses incurred from the April 3rd tax countermeasure shock. However, intense profit-taking pressure on the last trading day also signaled the market’s potential to conclude its short-term upward trend.

The Big Buy: Foreign Investors Go on a Shopping Spree, Splurging on Vietnamese Bank Stocks

Foreign transactions continue to be a bright spot, with net buys of 891 billion VND in today’s session.