The VN-Index closed the 20th trading week of 2025 at 1,301.39 points, a gain of 34.09 points or +2.69% from the previous week, with liquidity continuing to improve as the average trading value of matched orders rose by 37.2%.

After more than 6 weeks of recovery since the sharp correction due to concerns about retaliatory tariffs, the VN-Index has returned to the 1,300-point level. However, the momentum started to slow down on Friday as market drivers weakened, especially with foreign investors turning from strong net buyers to net sellers.

The average matched trading value on the HOSE reached VND 21,620 billion, up +17.8% compared to the 5-week average.

In terms of capitalization, liquidity improved significantly in the large-cap VN30 group thanks to more active trading in many bank stocks. As a result, the majority of the money flow was allocated to the VN30 group (56.4%) and, conversely, slightly decreased in the mid-cap VNMID and small-cap VNSML groups.

By industry, liquidity improved broadly, with strong increases in Banking and Securities – the two industries with outstanding price gains compared to the overall market, up +3.9% and +3.5%, respectively. In contrast, money flow slowed in Real Estate and decreased sharply in Oil & Gas and Airlines.

Across the 3 exchanges, the total average trading value for the 20th week of 2025 reached VND 26,523 billion, of which the average matched trading value was VND 23,459 billion, up +36.8% from the previous week and +17.1% from the 5-week average.

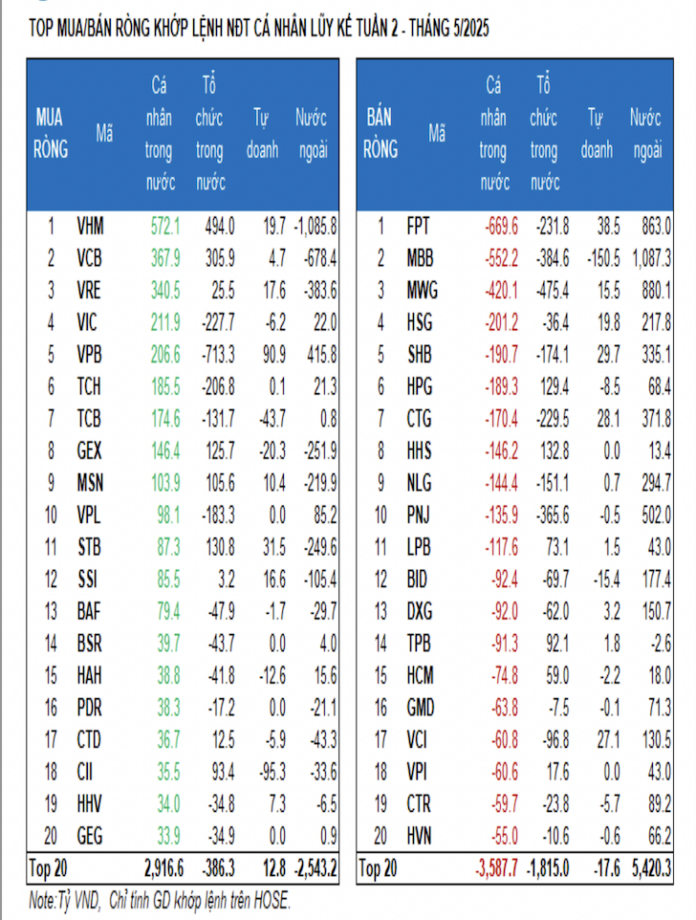

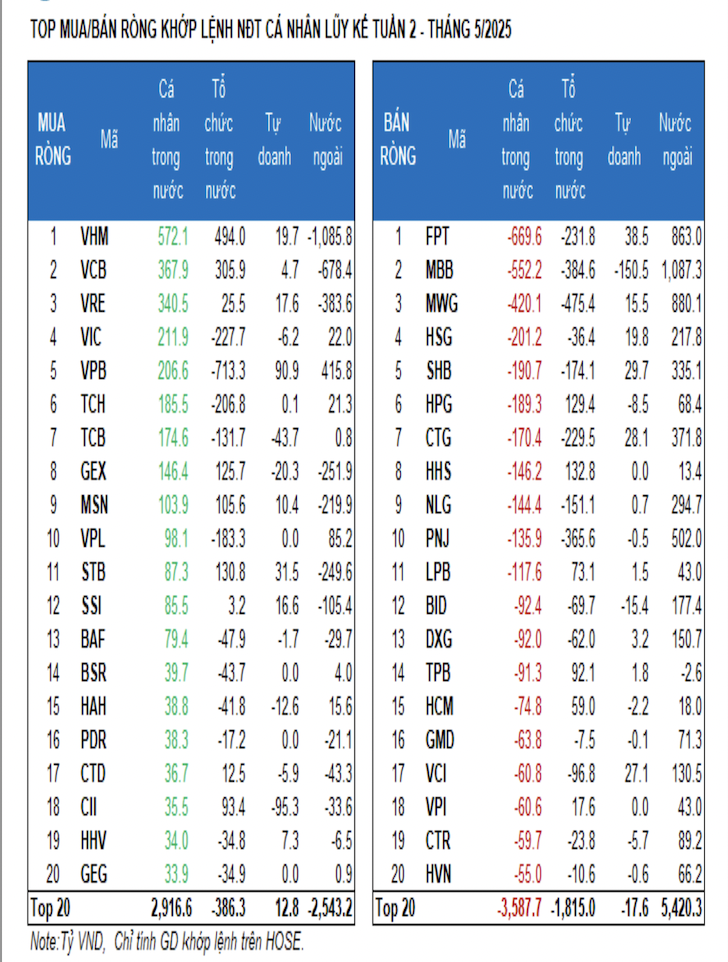

In terms of investor categories, foreign investors recorded net buying in 3/5 sessions, with a total net buy value of over VND 2,900 billion, marking the second consecutive week of net buying and the strongest week since mid-September 2022. This was the main driver of the Vn-Index’s gains last week. About half of the foreign net buy value belonged to the Banking sector. This was followed by Retail, Information Technology, Personal Goods, Steel, and Securities.

Foreign investors net bought VND 2,920.7 billion and, in terms of matched orders, they net bought VND 3,195.1 billion. The main sectors that foreign investors net bought were Banking and Retail. The top stocks that foreign investors net bought were MBB, MWG, FPT, PNJ, VPB, CTG, SHB, NLG, HSG, and BID.

On the net selling side, foreign investors focused on the Real Estate sector. The top stocks that foreign investors net sold were VHM, VCB, VRE, GEX, STB, VNM, SSI, HDB, and DGC.

Individual investors net sold VND 1,184.2 billion, of which VND 1,274.6 billion was from matched orders. In terms of matched orders, they net bought 5/18 industries, mainly in Real Estate. The top stocks bought by individual investors included VHM, VCB, VRE, VIC, VPB, TCH, TCB, GEX, MSN, and VPL.

On the net selling side, they net sold 13/18 industries, mainly in Information Technology and Banking. The top stocks that they net sold were FPT, MBB, MWG, HSG, SHB, HPG, HHS, NLG, and PNJ.

Proprietary trading arms of securities companies net bought VND 176.7 billion and, in terms of matched orders, they net bought VND 99.2 billion. In terms of matched orders, they net bought 10/18 industries, with the strongest net buying in Banking and Financial Services. The top stocks that proprietary trading arms net bought this week included ACB, VPB, FPT, E1VFVN30, STB, SHB, CTG, VCI, FUEVFVND, and HSG.

The top net sell sectors were Construction and Materials. The top stocks that were net sold included MBB, CII, TCB, REE, EVF, PLX, DGW, CMG, VSC, and GEX.

Domestic institutional investors net sold VND 1,913.1 billion and, in terms of matched orders, they net sold VND 2,019.7 billion. In terms of matched orders, domestic institutions net sold 10/18 industries, with the largest value in Banking. The top net sell stocks included VPB, MWG, MBB, PNJ, FPT, CTG, VIC, TCH, VPL, and SHB.

In terms of net buying, the largest sector was Food & Beverage. The top net buy stocks included VHM, VCB, VNM, HHS, STB, HPG, GEX, MSN, CII, and TPB.

The money flow allocation increased into Banking, Securities, Steel, and Retail, while it decreased in Real Estate, Information Technology, Construction, Food & Beverage, Chemicals, Electricity, Oil & Gas, Airlines, and Building Materials.

By trading size, liquidity improved broadly, with strong increases in Banking and Securities – the two industries with outstanding price gains compared to the overall market, up +3.9% and +3.5%, respectively. In contrast, money flow slowed in Real Estate and decreased sharply in Oil & Gas and Airlines.

Money Flow Strength: The large-cap VN30 group attracted money flow in the 20th week of 2025, with a dominant allocation of 56.4%, while this ratio slightly decreased in the mid-cap VNMID and small-cap VNSML groups.

On a weekly basis, the money flow allocation to the large-cap VN30 group was 56.4% – the highest level in 5 weeks. Conversely, the allocation ratio decreased to 33.3% in the mid-cap VNMID group and 6.9% in the small-cap VNSML group.

By trading size, liquidity improved significantly in the large-cap group in the 20th week, with the average trading value per session (matched orders only) reaching nearly VND 12,200 billion, an increase of VND 4,597 billion/+60.5% from the previous week. This group also had the highest efficiency last week, with the VN30 index gaining +2.4%, although it was still lower than the Vn-Index’s gain of 2.7%.

The Flow of Funds: A Shake-Up to Re-test Old Peaks?

The exhilarating surge across the first three trading sessions of the week helped the VN-Index recoup all losses incurred from the April 3rd tax countermeasure shock. However, intense profit-taking pressure on the last trading day also signaled the market’s potential to conclude its short-term upward trend.

The Evolution of a ‘Strange’ Stock: An In-Depth Analysis

Today’s session (May 16) saw profit-taking on many large-cap stocks. Meanwhile, speculative money flowed more briskly, especially on the UPCoM, as BCR surged for the fourth straight session, defying the BCG Land leadership’s massive sell-off of their shares.