|

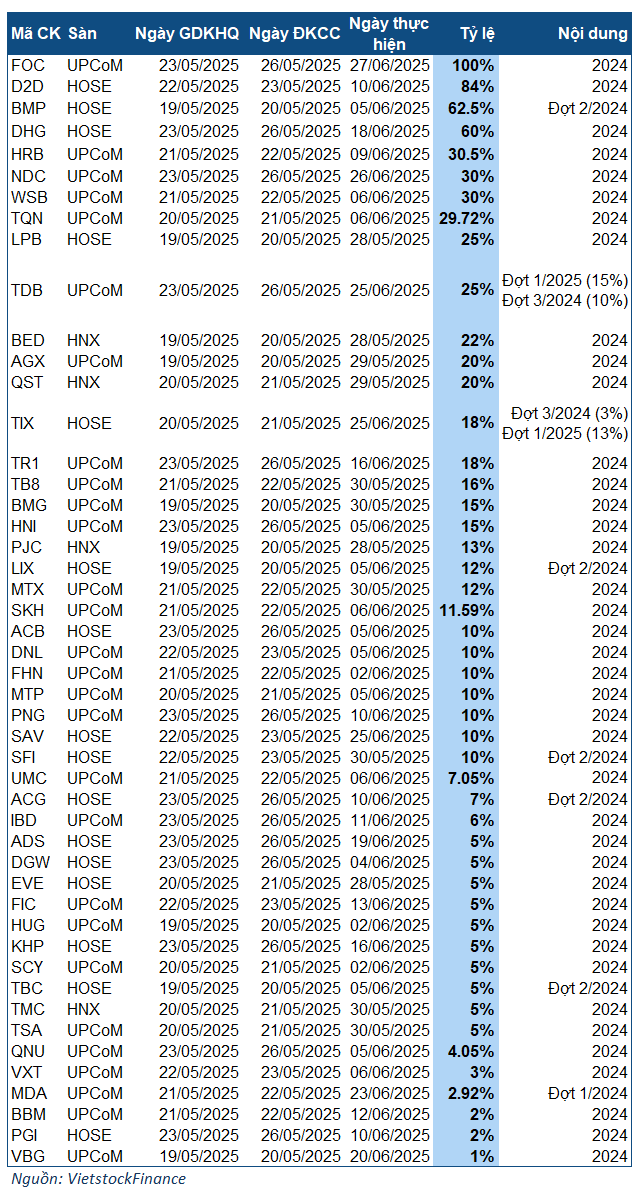

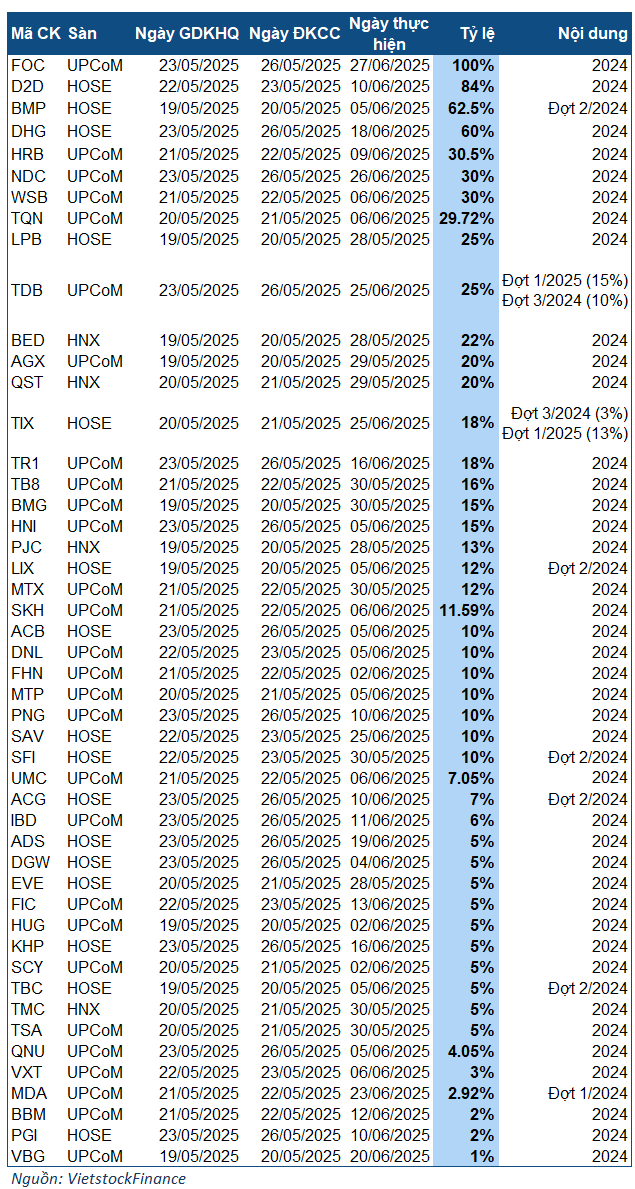

Companies finalising dividend payments for the week of 19-23/05

|

The most notable name for next week is FPT Online (UPCoM: FOC), with a dividend payout ratio of up to 100%, equivalent to nearly VND 185 billion. The ex-dividend date is 23/05, and payment is expected on 27/06.

This dividend will mainly go to FPT and its member companies. Specifically, FPT directly holds 23.86% of FOC‘s capital, while FPT Telecom (FOX) owns 56.51%. Currently, FPT also holds 45.66% of FOX‘s capital.

Ranking second is D2D with a payout ratio of 84% (VND 8,400/share), equal to the ratio approved at the 2025 AGM. With over 30.2 million shares in circulation, D2D will need to spend more than VND 254 billion. The ex-dividend date is 22/05, and payment is expected on 10/06/2025.

Next is Binh Minh Plastic Joint Stock Company (HOSE: BMP) with a ratio of 62.5%, which is the second dividend payment for 2024, costing approximately VND 511 billion. The ex-dividend date is 19/05, and payment is expected on 05/06/2025. Previously, BMP paid an interim dividend for 2024 of nearly VND 470 billion (a ratio of 57.4%, equivalent to VND 5,740/share) in December 2024. Thus, the total dividend ratio that BMP shareholders received for 2024 reached 119.9%. This plan was also approved at the 2025 Annual General Meeting of Shareholders.

Dược Hậu Giang (HOSE: DHG) also made a strong impression by spending more than VND 784 billion on dividends for 2024 (a ratio of 60%, or VND 6,000/share). The ex-dividend date is 23/05, and payment is expected on 18/06. Previously, in December 2024, the Company had once paid an interim dividend to shareholders with a ratio of 40%, spending nearly VND 523 billion. Thus, the total dividend ratio of DHG in 2024 reached 100%, with a total cost of over VND 1,300 billion, completing the target approved at the 2025 Annual General Meeting of Shareholders.

In fact, this is the highest dividend ratio that DHG has ever paid. Since 2019, the Company has often paid dividends with a ratio of 40%, except for 2023, which was 75%. The reason behind this high dividend is partly due to relatively stable business results, with net profits always exceeding VND 700 billion since 2020 and even reaching over VND 1,000 billion in 2023. Moreover, the 2025 Annual General Meeting of Shareholders approved the reversal of investment fund development into undistributed post-tax profits, with a total amount of up to VND 1,100 billion, providing the Company with a source of dividend payment.

In addition, there are several companies that will finalise dividend payments with relatively high ratios next week, including HRB (30.5%); NDC and WSB (30% each); TQN (29.72%); LPB and TDB (25% each); BED (22%); and AGX and QST (20% each).

Regarding stock dividends, two units will finalise the right to receive stock dividends next week, namely ACB and HVH. ACB will distribute dividends at a ratio of 15% (100 shares receive 15 new shares), equivalent to issuing nearly 670 million new shares. HVH will distribute dividends at a ratio of 7% (100 shares receive 7 new shares), issuing approximately 2.85 million new shares. The corresponding ex-dividend dates are 23 and 20/05/2025, respectively.

– 13:58 18/05/2025

“An Exciting Dividend Announcement: A 100% Cash Payout and a 50% Stock Surge”

“The company is expected to dish out a substantial sum of 184 billion VND to shareholders come June. This upcoming payout is certainly a notable event for investors to keep an eye on.”

I hope that captures the essence of your request, showcasing a fluent and engaging writing style.

“ACB Approved to Raise Capital to Nearly VND 51,400 Billion”

“ACB has received the green light from the State Bank of Vietnam to boost its charter capital by issuing bonus shares, taking its total capital to an impressive VND 51.4 trillion. This move underscores ACB’s strong position and ambitious growth strategy, rewarding shareholders with increased value and setting a new precedent for Vietnam’s dynamic banking sector.”

“Cut Red Tape and Go Digital: Businesses Yearn for Streamlined, Efficient Administrative Procedures”

“On behalf of the business community, Mr. Tu Tien Phat, CEO of ACB, expressed at the seminar for contributing to Resolution 68, the strongest desire to vigorously promote administrative procedure reform towards simplicity, transparency, and comprehensive digitalization. This would provide a strong impetus for a robust recovery in production and business activities.”