Based on political, legal, and practical grounds, as well as in line with the direction to remove institutional bottlenecks and promptly address difficulties faced by the people and businesses.

Reporter: The draft Law amending and supplementing a number of articles of the Law on Credit Institutions 2024 is expected to be considered for approval at the 9th session of the 15th National Assembly. From the perspective of the management agency, what are your expectations for this amendment and supplement?

Acting Director Tran Van Phuoc: In the context of Vietnam setting a target of 8% economic growth in 2025, the amendment of this law plays a pivotal role in creating a new impetus, supporting businesses and people to access credit at reasonable costs, while consolidating macroeconomic stability.

I expect that this amendment and supplement will enhance the effectiveness of bad debt handling, contributing to unblocking capital sources and improving the safety and health of the credit institution system. Along with this, the adjustment of regulations on the authority to provide special loans with an interest rate of 0% per annum and without collateral is necessary to meet practical demands.

Currently, the rising trend of bad debts is putting pressure on the banking industry, especially in the current context when 2025 is identified as a year of acceleration and breakthrough to complete the targets of the 2021-2025 term. The government sets a target of achieving at least 8% growth, aiming to create momentum and momentum to bring the country’s growth to a two-digit number in the following years.

MA. Tran Van Phuoc, Acting Director of the State Bank Branch in Region 15

The State Bank also pointed out the following reasons for the increase in bad debts:

First, the global economy continues to pose risks and challenges; the domestic economy still faces difficulties and is affected by unpredictable world situations and complex natural disasters;

Second, the stock, bond, and real estate markets are recovering slowly.

Third, the debt trading market has not developed as expected; some important contents of Resolution 42 have not been legalized, affecting the process of handling and recovering debts by credit institutions and debt trading and handling organizations;

Fourth, the governance capacity of some credit institutions has not yet met the requirements in terms of scale, growth rate, and risk level.

Reporter: In your opinion, what are the policies that need to be legalized, with clear content and specific impact assessment, while ensuring consistency and uniformity in the legal system?

Acting Director Tran Van Phuoc: It is expected that on May 20, the National Assembly will hear the Governor of the State Bank of Vietnam, on behalf of the Prime Minister, present the proposal for the draft Law amending and supplementing a number of articles of the Law on Credit Institutions. On May 29, the National Assembly will discuss this bill in the hall, and on June 17, the National Assembly will vote for its approval.

The amendments in the bill have positive impacts on the management and investment of state capital. The legalization of bad debt handling regulations enables credit institutions and debt trading organizations to quickly handle stagnant debts and unlock capital for reinvestment in key economic projects.

The regulation on the right to seize and distrain collateral enhances debt recovery efficiency, reduces financial risks, and strengthens investors’ confidence in the banking system.

The delegation of authority to provide special loans to the State Bank improves capital management efficiency, reduces administrative costs and processing time. This ensures that capital is allocated in a timely manner, especially in emergency situations, while enhancing the responsibility of the State Bank in risk control and loss prevention. The new regulations are also in line with the goals of administrative reform, decentralization, and international integration, creating a transparent and competitive legal environment for state capital investment.

Reporter: Another important amendment is to delegate the authority to decide on providing special loans with an interest rate of 0% per annum and without collateral from the Prime Minister to the State Bank. What is the significance of this change, sir?

Acting Director Tran Van Phuoc: This regulation aims to thoroughly decentralize and empower the State Bank of Vietnam, in line with Resolution No. 27-NQ/TW dated November 9, 2022, on building a rule-of-law Socialist State. The transfer of authority helps reduce intermediaries, shorten processing time, ensure timely, safe, and effective implementation, and prevent negativities, losses, and legal violations.

The new regulation meets practical demands, especially in the context of rising bad debts and the pressure to achieve high economic growth targets. By vesting the decision-making power in the SBV, the bill ensures flexibility and rigor in managing special credit, in line with international treaties and Vietnam’s integration commitments.

The amendment and supplementation of the new provision on the authority to decide on providing special loans with an interest rate of 0% per annum and without collateral should ensure timely, strict, effective, feasible, and safe implementation, while protecting the credit institution system and preventing negativities, losses, waste, or legal violations.

The amendments and supplements must ensure compliance with international treaties to which Vietnam is a member, as well as other international agreements and commitments, to guarantee the goal of international integration and alignment with global development trends.

Reporter: Thank you very much!

Legalization of three key regulations from Resolution 42

The State Bank of Vietnam believes that it is necessary to continue legalizing the regulations in Resolution 42 that have proven effective, including: regulations on the right to seize collateral; regulations on the distrain of collateral of the party obliged to execute the judgment; regulations on the return of collateral that is an exhibit in a criminal case; and supplementing regulations on the return of collateral that is a means of violation administrative.

Unleashing Vietnam’s Private Sector: Vinacapital Expert Weighs in on Resolution 68

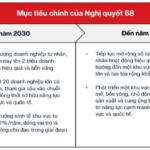

“The core vision of Resolution 68, according to the director of VinaCapital, is to foster a dynamic, robust, high-quality private economic sector with a global competitive edge. This resolution aims to empower private enterprises to become key drivers of Vietnam’s economic growth and transformation.”

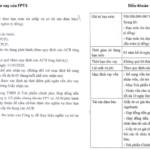

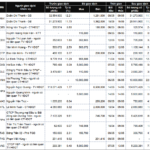

Two Securities Firms Receive a Combined Limit of VND 2,500 Billion from ACB

On May 15, the Board of Directors of FPT Securities (FPTS, HOSE: FTS) approved a short-term borrowing limit of VND 2,000 billion at Asia Commercial Joint Stock Bank (ACB). On the same day, the Board of Directors of Agribank Securities (Agriseco, HOSE: AGR) also approved a limit of VND 500 billion at ACB, with similar terms and conditions regarding purpose and collateral.

Nurturing Vietnam’s Future: Vice Prime Minister Ho Duc Phoc on the Path to Samsung, Lotte, and Posco

I hope this revised title suits your needs and captures the essence of the text while showcasing a high level of English proficiency.

“The idea of fostering private sector growth to create large conglomerates like Samsung, Lotte, and Posco is a prudent and necessary step for Vietnam, as emphasized by Deputy Prime Minister Ho Duc Phoc. This approach has the potential to propel the country’s economy forward and establish Vietnam as a prominent player in the global business arena.”

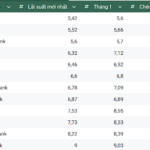

What’s the Average Lending Interest Rate at Banks Nowadays?

The banking landscape has witnessed a shift with major banks updating their average lending rates, marking a significant deviation from the figures recorded at the beginning of the year.