A “Break-the-Mold” Proposal for National Infrastructure Investment

The high-speed rail project connecting Hanoi and Ho Chi Minh City has long been Vietnam’s century-old infrastructure dream. The vision of a vital transport link connecting the two metropolises in a matter of hours instead of the traditional near-30-hour journey has always been touted as a symbol of the country’s development and modernization. However, amidst budgetary constraints and complex public investment procedures, a private enterprise, VinSpeed High-Speed Railway Development and Investment Joint Stock Company (abbreviated as VinSpeed), boldly proposes to construct the entire 1,541-kilometer line within five years, with a timeline to commence construction by the end of 2025 and operate the full line by 2030.

Ms. Dao Thuy Van, Vice President of VinSpeed, acknowledged that the project is “extremely challenging.” However, she also believes that “this is a historic moment for Vietnamese private enterprises to step up, embracing Resolution 57-NQ/TW on breakthroughs in science and technology development, innovation, and national digital transformation, and especially Resolution 68-NQ/TW on private economic development. With this spirit, coupled with our aspiration to build a high-speed railway industry, contributing to economic growth and improving the lives of people in localities, we consider this a dedication project rather than a profit-oriented one.”

The most notable aspect of VinSpeed’s proposal is the public-private partnership (PPP) model with an ambitious capital mobilization ratio: 20% of self-funded capital from the enterprise (approximately $12 billion) and 80% of borrowed capital from the state (0% interest rate for 35 years). While this proposal sparks debates about its feasibility, it introduces a very novel approach in the context of Vietnam’s cautiousness towards large-scale PPP projects.

According to documents sent to the Prime Minister, VinSpeed commits not only to constructing but also to developing a domestic high-speed railway ecosystem, aiming for the production of trains, technical infrastructure, and management operations to international standards. The goal is not merely operating a railway line but initiating a localized industry with high added value.

VinSpeed’s Success Will Create a Remarkable Feat

In the field of transport infrastructure, especially high-speed rail (HSR), three factors always measure success: cost, quality, and time. Among these, progress is the most unpredictable variable, as it depends not only on the contractor’s capacity but also on the institutional framework, land clearance, terrain and geology, and the readiness of supporting industries.

When VinSpeed, a Vietnamese private enterprise, proposes to construct the entire 1,541-kilometer Hanoi-Ho Chi Minh City high-speed rail line within five years, the question arises: Is this feasible, and if accomplished, would it be a new milestone in the high-speed rail sector?

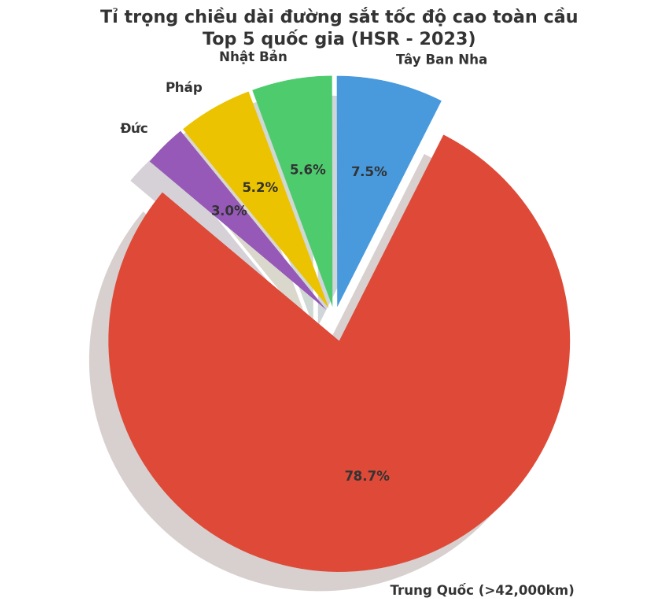

For a comprehensive perspective, let’s examine which country is the “top dog” in this industry and their current standing.

According to statistics, China currently boasts the largest high-speed rail (HSR) network in the world, spanning over 42,000 kilometers by the end of 2023 and accounting for more than 70% of the global HSR length. More importantly, China also holds most records for the speed of constructing long HSR lines.

This country is also “unbeatable” when it comes to infrastructure speed, holding the world’s most notable record to date: the Beijing-Shanghai line, stretching 1,318 kilometers with a designed speed of 350 km/h. The project commenced in April 2008 and was completed and operational by June 2011, taking a total construction time of 38 months (3 years and 2 months).

This is the longest high-speed rail line in the world completed in the shortest time as of now.

| Country | Line | Length (km) | Construction Time | Average Monthly Construction (km/month) |

|---|---|---|---|---|

| Vietnam (VinSpeed Proposal) | North-South | 1,541 | 2025 – 2030 (60 months) | 25.68 km/month |

| China | Beijing – Shanghai | 1,318 | 2008 – 2011 (38 months) | 34.68 km/month |

| Japan | Tokaido Shinkansen | 515 | 1959 – 1964 (60 months) | 8.58 km/month |

| Spain | Madrid – Barcelona | 621 | 1996 – 2005 (108 months) | 5.75 km/month |

| South Korea | Seoul – Busan (Phase 1) | 412 | 1992 – 2000 (96 months) | 4.29 km/month |

| India | Mumbai – Ahmedabad | 508 | 2017 – 2027 (120 months)* | 4.23 km/month |

When comparing Vietnam’s North-South high-speed rail line, which is about 17% longer than the Beijing-Shanghai line, the construction time is longer, but objectively, Vietnam faces more disadvantages than China, such as weaker supporting industrial infrastructure, no practical HSR project experience, and no precedent for large-scale PPP coordination.

Based on the statistics, if VinSpeed achieves its proposed timeline, with an average monthly construction speed of approximately 25.7 km, it will rank second globally in construction speed, only after China, but under much more challenging conditions.

Compared to developed countries like Japan and Spain and a developing country like India, Vietnam (if completed on time) will have three to six times higher efficiency.

While VinSpeed may not achieve an absolute speed record compared to Beijing-Shanghai, considering the context and starting point, completing 1,541 kilometers in five years would be a symbolic feat for Vietnam.

“In five years, China even completed 29,000 kilometers of high-speed rail. So why doubt VinSpeed’s capabilities and commitment? Moreover, completing the project five years ahead of schedule will save significant resources for the nation,” said Dr. Le Xuan Nghia, former Vice Chairman of the National Financial Supervisory Commission, in Thanh Nien newspaper.

Dr. Nghia further expressed his confidence in VinSpeed carrying the “gene of achievement” from Vingroup, proven by numerous infrastructure projects that set records in construction speed while ensuring quality.

Illustration: VinSpeed high-speed train in the future created by AI Beta

As evident, VinSpeed’s project, if completed as proposed, will not only “break the record” in construction time but also affirm the capabilities of Vietnamese private enterprises in an area traditionally considered a “state-dominated arena.” Additionally, it elevates Vietnam’s regional standing in infrastructure, attracts investment, promotes high technology, and facilitates technology transfer. It sets a successful model for PPP in strategic infrastructure, an area where even many developed countries face challenges.

On May 16, in Tien Phong newspaper, Associate Professor Dr. Bui Quang Tuan, Vice President of the Vietnam Economic Science Association and former Director of the Vietnam Economics Institute, also asserted that if this project could be expedited within five years, it would not only save national resources but also seize the opportunity for early and rapid development. Large-scale projects, when put into operation ahead of schedule, create a strong and immediate boost, meeting the urgent demands of progress.

Thus, it is evident that VinSpeed’s dream of traveling from Hanoi to Ho Chi Minh City for breakfast and lunch within five years is entirely plausible and worthy of our trust.

Content and statistics supported by AI

The Pharma Chairman’s Dark Secrets: How a Daughter-in-Law’s Bribe Exposed a Web of Corruption.

“In order to secure lucrative contracts to supply medicines to hospitals and medical centers in Hung Yen, the former chairman of Duoc Son Lam Company had to grease palms, paying bribes of between 10% and 15% on every invoice. This practice was seemingly commonplace, and the chairman was all too willing to play the game, ensuring his company’s success in the region.”

The New Game in the $1.05 Billion Tech Vehicle Market: Xanh SM Overtakes Grab, Be Remains Loyal to Super App, and the Entry of a Special Player

“2024 witnessed a significant restructuring phase following the exit of Gojek from the Vietnamese market in September, leaving a substantial 17% market share up for grabs (as indicated in the Q3 2024 report, ‘The Connected Customer’). This presented a unique opportunity for existing and new players to strategize and capture this newly available market share.”

“Major Shake-up at PJICO Insurance: Sudden Departure of CEO and Deputy CEO”

“PJICO shakes things up with a bold move, announcing the simultaneous departure of both its CEO and Vice CEO effective May 15, 2025. This unexpected development marks a turning point for the company, leaving many questions unanswered and a path forward that is yet to be paved.”

![[Photo Essay]: National Conference on the Propagation and Implementation of the 11th Plenum Resolutions](https://xe.today/wp-content/uploads/2025/05/img2050-17447720177111743218177-150x150.jpg)