Dragon Capital, a prominent foreign investment fund, has recently sold 250,000 DGC shares of Duc Giang Chemical Group JSC. On May 13th, Amersham Industries Limited and Norges Bank, both part of Dragon Capital, sold 125,000 shares each, reducing their collective ownership from 7.028% to 6.96% of the charter capital.

In recent times, DGC shares have witnessed a notable recovery, surging by 25.7% from VND 73,100 to VND 91,900 per share between April 9th and May 16th.

In other news, Duc Giang Chemical Group approved a plan on May 10th to inject an additional VND 500 billion into Duc Giang Real Estate One Member Co., Ltd., raising its charter capital to VND 1,000 billion. The contribution is expected to be made in the form of cash in the second quarter of 2025.

Prior to this, the 2025 Annual General Meeting of DGC shareholders gave their approval for the “Complex of Public Works, Schools, and Duc Giang Residence” project, located at 18/44 Duc Giang Street, Thuong Thanh Ward, Long Bien District. The project encompasses plans for 1,000 apartments and 60 adjacent houses.

Regarding business operations, Duc Giang Chemical Group recorded impressive results in the first quarter of 2025, with consolidated revenue reaching VND 2,810.3 billion, marking an 18% increase year-over-year. Consolidated after-tax profit also rose by 19% to VND 837 billion over the same period.

For the second quarter of 2025, the Group has set consolidated revenue and after-tax profit targets of VND 2,841.7 billion and VND 800 billion, respectively. Additionally, they have allocated VND 500 billion for the Nghi Son project and VND 40 billion for the Alcohol Plant in their second-quarter capital construction plan.

Looking at the full year of 2025, Duc Giang Chemical Group aims for consolidated revenue of VND 10,385 billion, a 5% increase compared to 2024. However, they anticipate a 3.4% decrease in consolidated after-tax profit, targeting VND 3,000 billion.

The Power of Selling: Dominating the Investment Fund Game

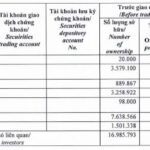

“During the week of May 12-16, 2025, investment funds predominantly sold off as the market rebounded to pre-tariff announcement levels. “

The Penultimate Word-Smith: Crafting Captivating Copy

“A Member of the Board of Directors of Dat Xanh Group Accumulated 5 Million Shares”

Mr. Ha Duc Hieu, a prominent member of the Board of Directors at Dat Xanh Group, has demonstrated his confidence in the company’s prospects by significantly increasing his stake. Between May 7 and May 15, Mr. Hieu acquired an impressive 5 million DXG shares, elevating his ownership to 0.66% of the group’s capital. This substantial purchase underscores Mr. Hieu’s faith in the company’s future trajectory and potential for growth.