The pharmaceutical industry witnessed policy changes in 2024 with the introduction of new regulations, including the amended Pharmacy Law, which prioritized administrative procedures and expedited the process for new drug registrations, extensions, and imports. The amended Health Insurance Law also brought prospects for hospital channels, while the 2023 Bidding Law, effective from January 1, 2024, favored domestic pharmaceutical enterprises with EU-GMP-compliant production lines.

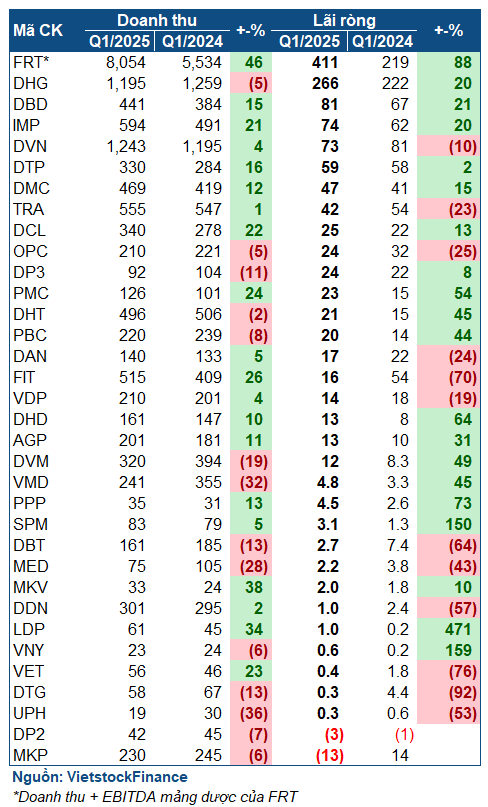

With these policy advantages, pharmaceutical enterprises made significant shifts in their business structures, prioritizing self-produced products, which gradually yielded positive results. According to VietstockFinance, out of 34 pharmaceutical companies that published their first-quarter financial statements for 2025, 20 companies reported increased profits. Only 11 units regressed, along with two loss-making entities.

|

Financial performance of pharmaceutical companies in the first quarter of 2025

|

The most notable profit increases were observed among major players in the industry, attributed to their product restructuring strategies.

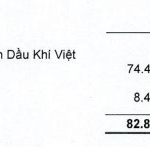

Although Dhg Pharmaceutical Joint Stock Company (HOSE: DHG) experienced a slight decline in revenue, it still achieved impressive growth in the first quarter, with a net profit of 266 billion VND, a 20% increase compared to the same period last year. The company attributed this success to their decision to reduce revenue from low-margin goods while increasing the sales of in-house produced products with higher profit margins by 8%.

| Financial performance of Dhg Pharmaceutical Joint Stock Company |

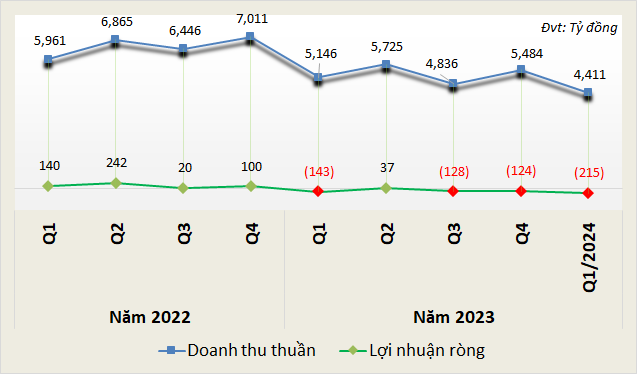

Similarly, Bidiphar Joint Stock Company (HOSE: DBD) recorded a net profit of 81 billion VND, a 21% increase, by restructuring their business portfolio and focusing on promoting self-produced pharmaceutical products, resulting in a significant boost in revenue. Additionally, their marketing expenses for the first quarter reached only 5.9% of the annual plan, and they intend to intensify marketing activities and invest in developing new products to support their long-term strategy and gain a competitive edge in the future.

| DBD increases profits through product portfolio restructuring |

Imexpharm Corporation (HOSE: IMP) maintained its growth trajectory after a successful 2024, marking the third consecutive year of record-breaking profits. In the first quarter of 2025, the company achieved a 20% increase in net profit, reaching 74 billion VND. This growth can be attributed to their strategic expansion into new markets, restructuring of their product portfolio, and effective cost management.

| Imexpharm Corporation continues its upward trajectory in the first quarter of 2025 |

Another notable mention is FRT (FPT Retail), whose pharmaceutical segment, driven by the expansion of the Long Chau chain, contributed nearly 8.1 trillion VND in net revenue, a 46% increase compared to the previous year, accounting for 69% of consolidated revenue. FRT also reported a remarkable 88% increase in EBITDA, reaching 411 billion VND. According to FRT, the company opened 435 new pharmacies and 93 new vaccination centers compared to the same period last year. Currently, FRT operates over 2,000 pharmacies, with an average revenue of approximately 1.3 billion VND per pharmacy per month.

Meanwhile, Hanoi Pharmaceutical Joint Stock Company (HNX: DHT) experienced a slight decline in revenue but witnessed a significant 15% increase in gross profit due to a more substantial decrease in cost of goods sold. This indicates the company’s successful restructuring of its product portfolio towards higher-margin offerings. Additionally, their first-quarter profit surge of 45%, resulting in a net profit of 21 billion VND, was partly attributed to additional income from the transfer of capital in an associated company.

However, several large enterprises reported decreased profits. Traphaco Joint Stock Company (HOSE: TRA) announced a 23% decline in profit, amounting to 42 billion VND, due to higher cost of goods sold compared to revenue. Vietnam Pharmaceutical Corporation (UPCoM: DVN) also experienced a 10% drop in profit, totaling 73 billion VND, as a result of increased production costs. OPC faced a 25% decline in profit, amounting to 24 billion VND, as their high-profit products witnessed a downturn, while production costs continued to rise.

F.I.T Group Joint Stock Company (HOSE: FIT) saw a 70% drop in profit, reaching only 16 billion VND, mainly due to a significant decrease in financial revenue. Conversely, their revenue increased considerably by 26%, totaling 515 billion VND, with pharmaceuticals and medical equipment accounting for over 340 billion VND, a nearly 22% increase. Their gross profit also rose by 35%, reaching nearly 127 billion VND.

The first quarter witnessed losses for MKP and DP2. MKP shifted from a profit of 14 billion VND to a net loss of 13 billion VND due to decreased revenue and higher selling and management expenses. DP2 incurred a loss of 3.4 billion VND, a more substantial loss compared to the previous year’s loss of 1.4 billion VND, as a result of challenging market conditions leading to reduced revenue and the absence of other income as seen in the previous year.

Looking ahead, the pharmaceutical companies anticipate continued growth, as reflected in their ambitious plans for 2025, aiming to sustain their upward trajectory and even break profit records, as envisioned by IMP and DBD. These plans are underpinned by market assessments and the promising outlook for Vietnam’s pharmaceutical industry in the upcoming period.

According to ABS Securities, the pharmaceutical industry is expected to experience stable growth. The market value, which stood at 3.4 billion USD in 2015, has nearly doubled to reach 7 billion USD in 2023. With a targeted GDP growth rate of 8% for 2025, healthcare spending is projected to increase. Moreover, there is a growing awareness among the populace regarding health issues. A 2023 study by Roland Berger revealed that 78% of respondents were willing to spend more on healthcare products and services, reflecting a rising consumption trend in the industry.

Additionally, Vietnam is one of the fastest-aging countries globally, with a population of over 100 million people. The proportion of individuals aged 60 and above stood at 13.9% in 2023 and is expected to surpass 25% by 2050. By 2036, Vietnam will enter an era of an aging population, transitioning from an “aging” to an “aged” society. Older adults tend to have higher pharmaceutical and healthcare needs due to the aging process and associated health concerns.

Lastly, supportive government policies, such as the amended Pharmacy Law, the 2023 Bidding Law, and the Health Insurance Law, promote the development of domestic pharmaceutical production, reduce reliance on imported medicines, and encourage investment in research and development.

The Three Top Executives of Viettel Global Step Down

“Three individuals, united by a serendipitous twist of fate, found themselves entrusted with a new mission from the conglomerate. Their paths converged as they embarked on a journey to uncover the mysteries of their shared assignment. As they delved deeper, they discovered a web of intrigue, where their unique skills and perspectives became their greatest assets. With a collective determination, they set out to leave an indelible mark, driven by a passion to excel and a desire to unravel the unknown.”

“DIC Corp Announces Plans to Release Nearly 36.6 Million Shares as 2024 Dividend”

“DIC Corp is set to release almost 36.6 million shares as a dividend for its shareholders for the year 2024, with a distribution ratio of 100:6. The record date for the allocation of rights is May 30, 2025. This move by DIC Corp showcases their commitment to rewarding their shareholders and fostering a culture of long-term investment.”