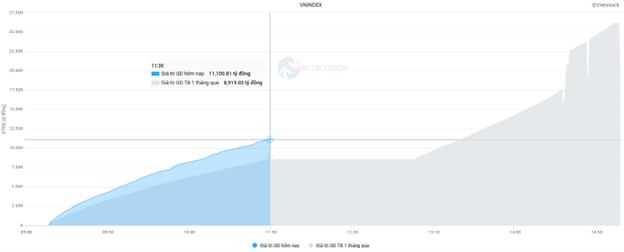

The VN-Index trading volume reached over 437 million units in the morning session, equivalent to a value of more than 11 trillion VND, 24% higher than the 1-month average. The HNX-Index recorded a volume of nearly 29 million units with a value of over 464 billion VND.

Source: VietstockFinance

|

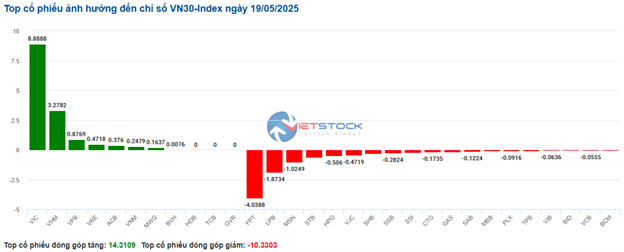

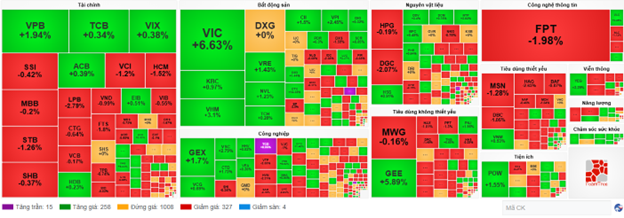

The duo of VIC and VHM are currently the two main pillars contributing the most positively, helping the VN-Index gain more than 7 points (with VIC alone contributing more than 5 points). On the other hand, VPL, FPT, and LPB had a notable negative impact, taking away about 2 points from the overall index.

Most sectors are currently dominated by red hues. The real estate sector, despite recording an outstanding 2.65% increase, saw this number contributed mainly by VIC‘s ceiling price, along with VHM (+3.28%), VRE (+0.61%), VPI (+2.45%), and KDH (+0.87%). The majority of the remaining stocks traded around the reference threshold or even fell sharply, such as BCM (-1.8%), SIP (-2.8%), IDC (-2.14%), SJS (-3.17%), SZC (-1.04%), and DXS (-2.17%).

The financial sector is also experiencing clear differentiation. Bank and insurance stocks rose and fell alternately, with a slight advantage for the buying side, while securities were dominated by red hues, with many stocks falling by more than 1%, including VCI, HCM, FTS, MBS, BSI, CTS, VDS, ORS, and BVS, among others.

Information technology and telecommunications are the two temporary “bottom” markets with significant pressure from FPT (-1.65%), VGI (-1.66%), CTR (-2.45%), FOX (-1.51%), SGT (-1.12%), and ELC (-1.12%).

Foreign investors continued to net sell slightly more than 87 billion VND on all three exchanges this morning. MSN, VHM, and GEX were the stocks that foreign investors sold the most, with a net value of around 65-80 billion VND. On the opposite side, VIC was the most prominent bright spot, attracting more than 161 billion VND in net buying from foreign investors, far surpassing the other stocks.

| Top 10 stocks net bought and sold by foreign investors in the morning session of May 19, 2025 (as of 11:30 am) |

10:35 am: Vingroup stocks support the index, narrowing the decline

The unexpected emergence of buying power helped pull the main indices back towards the reference mark. As of 10:30 am, the VN-Index gained 0.21 points, trading around 1,301 points. HNX-Index lost 0.77 points, trading around 217 points.

The VN30 basket is currently dominated by red hues. Notably, FPT took away 4.04 points, LPB took away 1.87 points, MSN took away 1.02 points, and STB took away 0.63 points. Conversely, only a few stocks, such as VIC, VHM, VPB, and VRE, remained in the green and contributed more than 13.5 points to the overall index.

Source: VietstockFinance

|

The real estate sector witnessed the strongest recovery with a 2.95% increase despite the ongoing differentiation. Specifically, the sector’s large-cap stocks, such as VIC, which hit the ceiling price, VHM rising 4.32%, VRE up 2.24%, SSH gaining 0.57%, etc., contributed to the overall index’s rebound. On the selling side, stocks like BCM falling 1.48%, NLG down 0.59%, SJS losing 3.17%, KSF decreasing 0.62%, and SIP dropping 1.91%… are hindering the overall upward momentum.

Next, the healthcare sector also supported the market’s recovery, with the green hue mainly present in large-cap pharmaceutical manufacturing companies such as DHG rising 0.47%, IMP up 1.65%, DVN gaining 0.84%, and TRA increasing 2.61%…

In another development, the information technology sector was not very positive as strong selling pressure focused on the industry’s two giants, FPT, which fell 1.9%, and CMG, which declined 1.28%. However, the green hue was observed in stocks like ITD rising 1.81%, CMT up 0.71%, POT gaining 4.61%, and PIA increasing 1.72%, but their impact was not significant.

Compared to the opening, sellers still hold the upper hand. There were 327 declining stocks and 258 advancing stocks.

Source: VietstockFinance

|

Opening: Declines across the board, VN-Index submerged in red

The market opened on a negative note, with most sectors shrouded in red. Notably, the VN30 index had the most negative impact as most of the stocks in this group declined.

The red hue temporarily prevailed in the VN30 basket, with 25 decreasing stocks, 4 increasing stocks, and 1 stock unchanged. Among them, LPB, FPT, GAS, and VJC were the most negatively impacted. Conversely, VIC, VHM, GVR, and ACB were the stocks that increased the most.

The telecommunications services sector was the most negatively affected at the opening, falling 1.82%. Specifically, stocks like VGI dropping 1.93%, FOX down 1.51%, CTR losing 1.63%, and ELC falling 0.67%, among others.

Following closely was the information technology sector, as the large-cap stocks in this group also exhibited a similar pessimistic sentiment, with FPT declining 1.74% and CMG falling 1%.

– 11:55, May 19, 2025

The IPO Tsunami: VN-Index Surges Past 1,300

The two market indices continued their upward trajectory during the trading week of May 12-16. The VN-Index climbed a total of 2.69%, reaching 1,301.39 points, despite a minor dip in the final trading session. Similarly, the HNX-Index mirrored this positive performance, gaining 2.13% to close at 218.69 points.

“Vietstock Weekly: Uptrend Persists, Setting the Tone for a Bullish Week Ahead”

The VN-Index continued its upward trajectory, maintaining its positive momentum since crossing above the 200-week SMA. Accompanied by strong trading volumes above the 20-week average, this indicates robust participation from investors. This momentum was pivotal in propelling the index beyond the 1,300-point mark. Should the VN-Index sustain levels above this threshold in the coming weeks, it could potentially pave the way for a revisit to the March 2025 highs of 1,320-1,340 points. This zone also coincides with the highest peak since May 2022.

The VN-Index Surges: Will Investors Keep the Faith?

The VN-Index surges past the 1,300-point milestone, marking a robust week of recovery following the US tariff shock. However, the week’s end saw a corrective session, leaving investors questioning whether to continue investing or temporarily stay on the sidelines, securing their profits.

The Flow of Funds: A Shake-Up to Re-test Old Peaks?

The exhilarating surge across the first three trading sessions of the week helped the VN-Index recoup all losses incurred from the April 3rd tax countermeasure shock. However, intense profit-taking pressure on the last trading day also signaled the market’s potential to conclude its short-term upward trend.