Viettel Global (VTG), a leading international investment corporation, was established in 2007 with a focus on telecommunications investments in foreign markets. The company aims to expand its operations, enhance its competitiveness, and prepare for research and production activities.

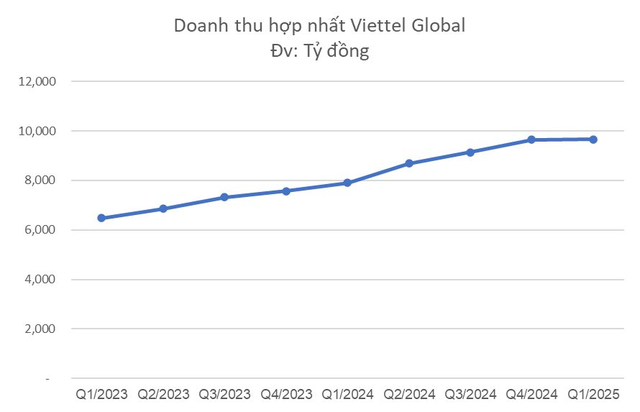

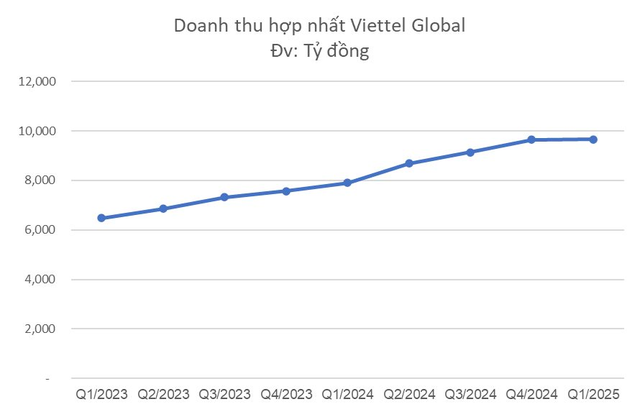

As per the recently published Q1 2025 consolidated financial report, VTG witnessed a remarkable 22% revenue growth. The company’s sales and service revenue reached VND 9,657 billion, a 22% increase compared to Q1 2024. The consolidated pre-tax profit stood at VND 1,310 billion.

VTG assessed that amidst a nearly saturated global telecommunications market, this marks the sixth consecutive quarter of over 20% revenue growth, showcasing the company’s sustainable development.

In Q1, VTG experienced significant growth in sales and service revenue across all its markets, with standout performances in Viettel Burundi (38% increase), Viettel Tanzania (29% increase), Viettel Haiti (28% increase), and Viettel Mozambique (23% increase).

Alongside strong results in traditional telecommunications, VTG’s e-wallet companies also demonstrated impressive growth. Lumicash in Burundi grew by 59%, Halopesa in Tanzania by 47%, Emoney in Cambodia by 42%, and M-Mola in Mozambique by 27%.

VTG’s stock closed at VND 72,600 per share on May 16, with a market capitalization of over VND 220 trillion (approximately $8.5 billion), making it the fifth-largest capitalized company in the market.

VTG stock price movement over the past year. Source: Cafef.

According to documents for the upcoming 2025 Annual General Meeting of Shareholders, VTG sets ambitious targets for 2025, aiming for a consolidated total revenue of VND 38,649 billion and a consolidated pre-tax profit of VND 7,599 billion.

To achieve these goals, VTG will employ a dual-pronged strategy: fortifying traditional telecommunications services as the bedrock of profitability and aggressively promoting digital services as a new growth engine.

This strategy entails maintaining exceptional growth rates, solidifying leadership in key markets, and constructing a comprehensive service ecosystem to meet competitive challenges and shape the future of the telecommunications and technology industries in its operating markets.

For traditional telecommunications services, the company reinforces its core role in generating revenue and profits while adapting technology to sustain its competitive edge.

Regarding non-traditional telecommunications services, VTG is creating a holistic digital service ecosystem, branching out into new fields beyond telecommunications to catalyze breakthrough growth and align with global digitalization trends.

In vital markets, the company solidifies its dominance in strategic markets, optimizes profits, and tailors comprehensive service ecosystems to cater to its customers’ diverse needs.

On May 14, 2025, VTG received resignation requests from two Board of Directors members and the Chief Controller. Mr. Phung Van Cuong and Mr. Le Xuan Hung, Board members, and Mr. Le Quang Tiep, Chief Controller, will step down from their positions effective June 5, 2025, due to new assignments within the Group.

“Major Shake-up at PJICO Insurance: Sudden Departure of CEO and Deputy CEO”

“PJICO shakes things up with a bold move, announcing the simultaneous departure of both its CEO and Vice CEO effective May 15, 2025. This unexpected development marks a turning point for the company, leaving many questions unanswered and a path forward that is yet to be paved.”

The Three Top Executives of Viettel Global Step Down

“Three individuals, united by a serendipitous twist of fate, found themselves entrusted with a new mission from the conglomerate. Their paths converged as they embarked on a journey to uncover the mysteries of their shared assignment. As they delved deeper, they discovered a web of intrigue, where their unique skills and perspectives became their greatest assets. With a collective determination, they set out to leave an indelible mark, driven by a passion to excel and a desire to unravel the unknown.”

“Dragon Capital is No Longer a Major Shareholder in PNJ”

Dragon Capital, a prominent foreign investment fund, has recently sold 100,000 PNJ shares, reducing their ownership stake to 4.9972%. This move signifies their exit from the position of a major shareholder in PNJ, marking a notable shift in the company’s investment landscape.

“State-Owned Enterprise Partners with Vingroup: Encourages 40,000 Employees to Go Electric with VinFast”

“VNPT is encouraging its employees to prioritize the use of Vingroup’s products and services, with a special focus on VinFast electric vehicles. This initiative is part of the company’s commitment to promoting green transformation in transportation. By embracing sustainable mobility, VNPT aims to lead by example and inspire a wider shift towards environmentally conscious choices.”