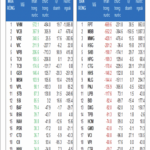

VPL was the standout performer this week, contributing over 13.8 points to the VN-Index – the highest on the exchange. This stock has only been listed on the HOSE since May 13, but it has already seen three consecutive sessions of upward trading and added 3.38% in the final session of the week, closing at 101,000 VND per share. Since its initial reference price of 71,300 VND on its debut, VPL has surged 42% in just four sessions, with an average daily trading volume of 1.27 million shares. With a market capitalization of over 181 trillion VND, VPL has surpassed established companies such as HPG, FPT, VPB, GAS, VNM, and ACB.

Source: VietstockFinance

|

The point contribution from VPL far outpaced other positive performers. The banking sector dominated with seven tickers, including TCB, VPB, BID, CTG, VCB, MBB, and LPB, collectively adding 15.8 points to the VN-Index. Notably, TCB, VPB, and BID each contributed between 2.6 and 3.3 points.

VIC, another member of the Vingroup conglomerate, was the third-best performer on the HOSE, contributing 3.2 points. FPT also made a significant contribution with a 1.9-point increase.

On the other hand, VHM was the most negative influence on the index this week, erasing more than 3.8 points. This was a significant contrast to other declining stocks like HVN, VRE, and VPI, which lost less than 0.3 points each.

| Stocks Impacting the VN-Index from May 12-16 (in points) |

The VN30 basket continued its upward trajectory, with 27 out of 30 stocks posting gains. FPT, VIC, MWG, and TCB were the top performers in this group, contributing between 5.5 and 6 points each. Conversely, VHM witnessed the steepest decline, causing the index to lose nearly 5.8 points. The remaining two decliners were VRE (-0.6 points) and MSN (-0.3 points).

| Stocks Boosting the VN30-Index from May 12-16 (in points) |

| Stocks Dragging the VN30-Index from May 12-16 (in points) |

On the HNX exchange, the index continued its upward trend, led by IDC (+0.7 points), NVB (+0.5 points), and MBS, PVS, and SHS, each contributing 0.3 points. On the downside, KSV exerted the most significant downward pressure, erasing 2.3 points. However, the declines in other stocks like HGM (-0.2 points) and SCG (-0.15 points) were relatively minor, and most tickers experienced slight adjustments of less than 0.1 points, which did not alter the index’s overall upward trajectory.

| Stocks Impacting the HNX-Index from May 12-16 (in points) |

– 19:28 05/18/2025

“Vietstock Weekly: Uptrend Persists, Setting the Tone for a Bullish Week Ahead”

The VN-Index continued its upward trajectory, maintaining its positive momentum since crossing above the 200-week SMA. Accompanied by strong trading volumes above the 20-week average, this indicates robust participation from investors. This momentum was pivotal in propelling the index beyond the 1,300-point mark. Should the VN-Index sustain levels above this threshold in the coming weeks, it could potentially pave the way for a revisit to the March 2025 highs of 1,320-1,340 points. This zone also coincides with the highest peak since May 2022.

The VN-Index Surges: Will Investors Keep the Faith?

The VN-Index surges past the 1,300-point milestone, marking a robust week of recovery following the US tariff shock. However, the week’s end saw a corrective session, leaving investors questioning whether to continue investing or temporarily stay on the sidelines, securing their profits.

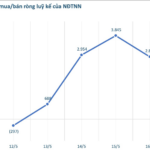

The Flow of Funds: A Shake-Up to Re-test Old Peaks?

The exhilarating surge across the first three trading sessions of the week helped the VN-Index recoup all losses incurred from the April 3rd tax countermeasure shock. However, intense profit-taking pressure on the last trading day also signaled the market’s potential to conclude its short-term upward trend.