The Vietnamese market experienced a relatively positive trading week with improved market sentiment. The main index, VN-Index, gained for four consecutive sessions with increasing liquidity before facing corrective pressure towards the week’s end as it encountered a strong resistance zone. Overall, the VN-Index rose by 2.69% to close at 1,301.39 points.

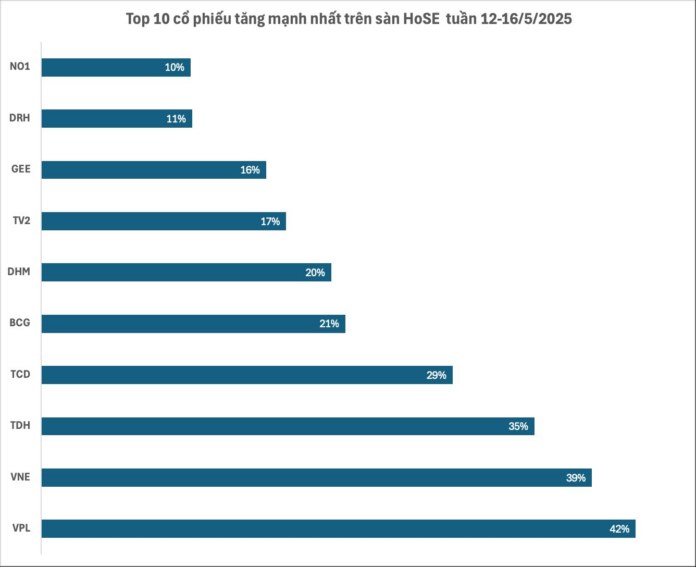

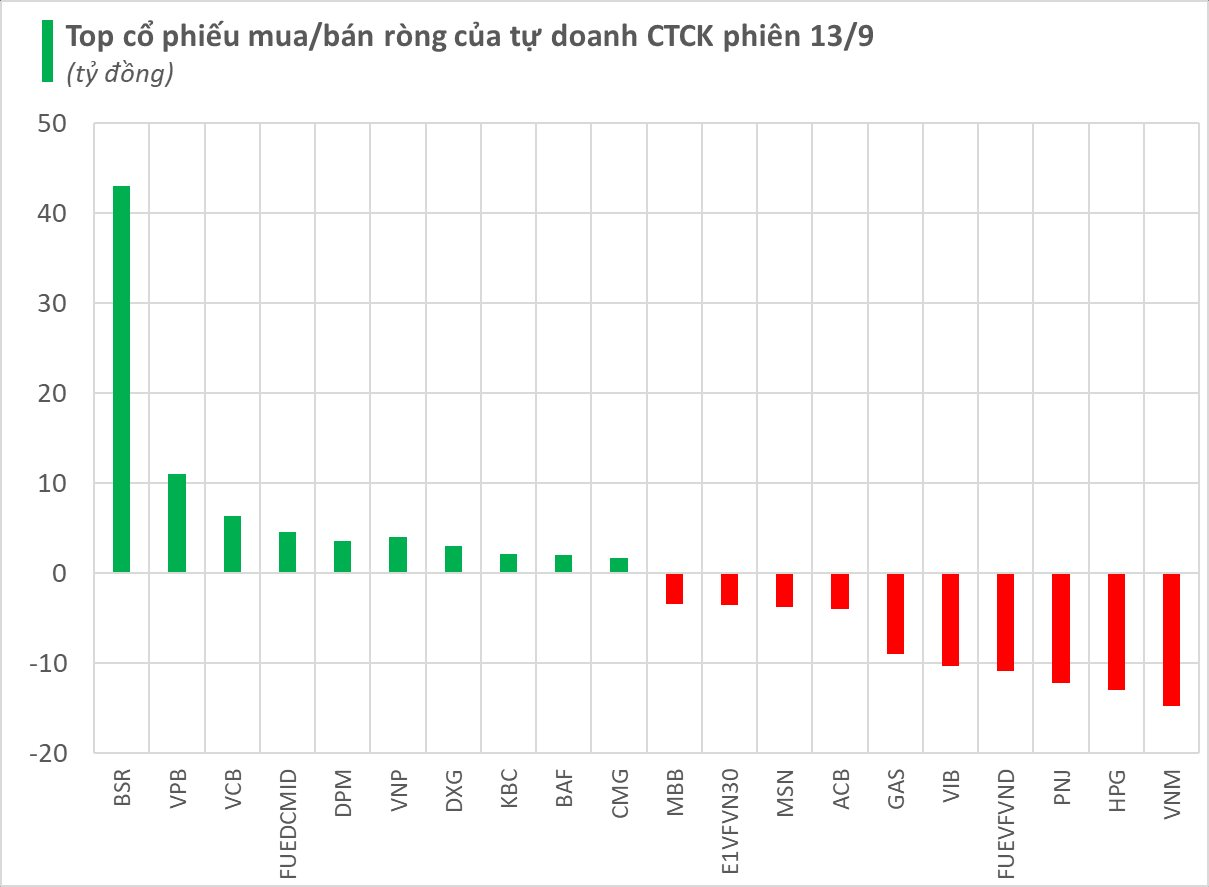

On the HOSE, newcomer VPL – Vinpearl topped the list of strongest gainers with a robust four-day rally, including three ceiling-hitting sessions. Currently, VPL stands at 101,000 VND per share, reflecting a remarkable over-46% weekly gain.

Following closely, VNE surged by 38.59% to 4,920 VND, TDH climbed by 34.56% to 5,490 VND, and TCD rose by 28.82% to 2,190 VND. Other stocks such as BCG, DHM, TV2, GEE, DRH, and NO1 also witnessed gains ranging from over 10% to more than 21%, indicating a positive market breadth.

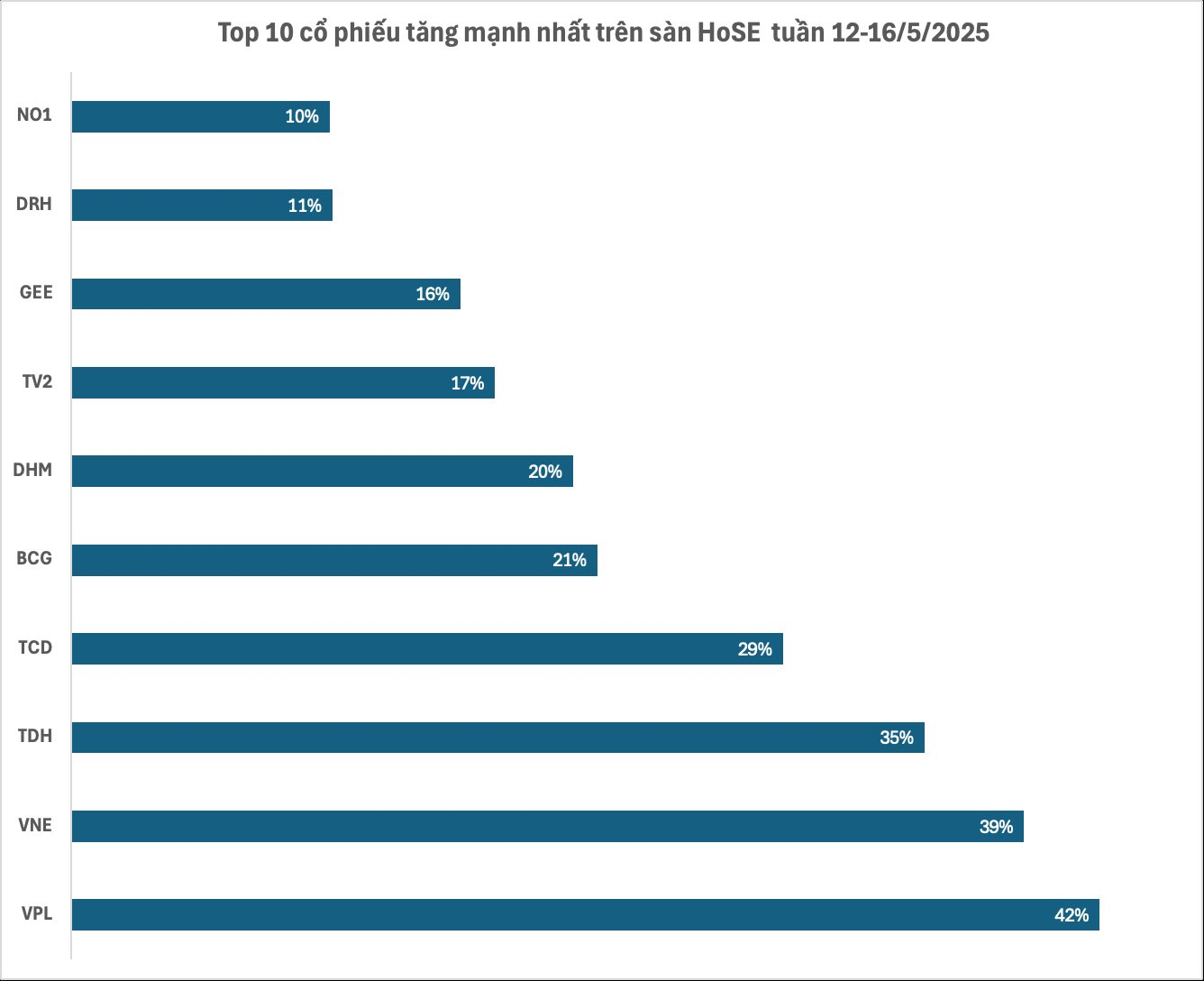

On the HNX, API took the lead with an outstanding over-43% gain over five sessions, reaching 7,900 VND per share. PRC and UNI followed suit, rising by 25.34% and 24.14%, respectively. Midcap and penny stocks witnessed broad-based gains, indicating that speculative money continues to flow into HNX, targeting stocks with mid-term recovery potential.

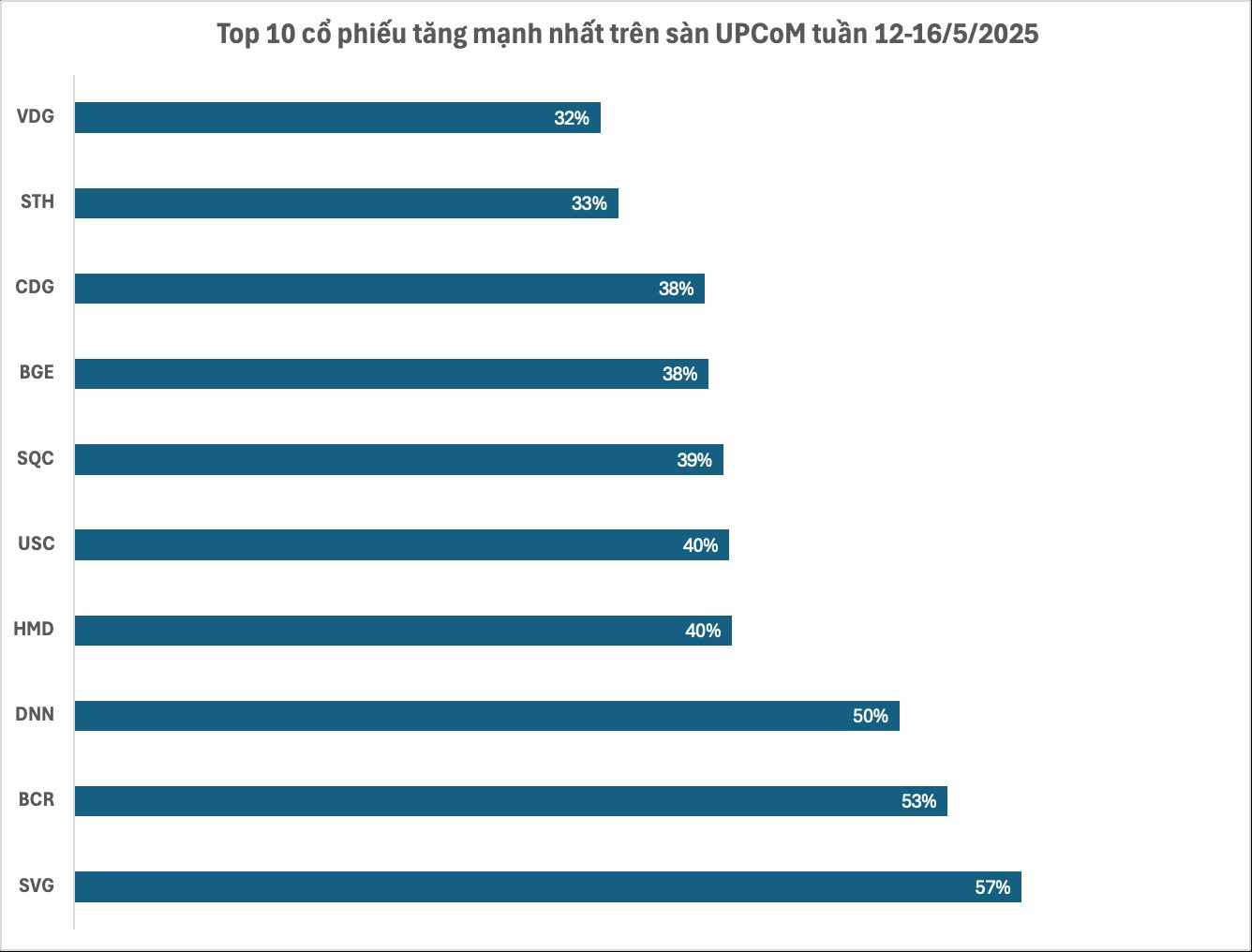

On the UPCOM, SVG of Hơi Kỹ Nghệ Que Hàn Joint Stock Company led the pack with a stunning 57.41% weekly gain, pushing its share price to 8,500 VND. SVG, formerly known as SOVIGAZ Industrial Gas Company, was established through the merger of the Vietnam division of S.O.A.E.O and Vietnam Industrial Gas Company in 1974. Currently, the Vietnam National Chemical Group (Vinachem) holds a controlling stake of 98.16% in SVG.

Notably, the duo of BCR and BGE from the Bamboo Capital ecosystem witnessed significant breakouts, surging by nearly 53% and 38%, respectively, over the week’s five sessions. Several other stocks, including HMD, USC, SQC, and VDG, also recorded gains of over 30%.

The IPO Tsunami: VN-Index Surges Past 1,300

The two market indices continued their upward trajectory during the trading week of May 12-16. The VN-Index climbed a total of 2.69%, reaching 1,301.39 points, despite a minor dip in the final trading session. Similarly, the HNX-Index mirrored this positive performance, gaining 2.13% to close at 218.69 points.

“Vietstock Weekly: Uptrend Persists, Setting the Tone for a Bullish Week Ahead”

The VN-Index continued its upward trajectory, maintaining its positive momentum since crossing above the 200-week SMA. Accompanied by strong trading volumes above the 20-week average, this indicates robust participation from investors. This momentum was pivotal in propelling the index beyond the 1,300-point mark. Should the VN-Index sustain levels above this threshold in the coming weeks, it could potentially pave the way for a revisit to the March 2025 highs of 1,320-1,340 points. This zone also coincides with the highest peak since May 2022.

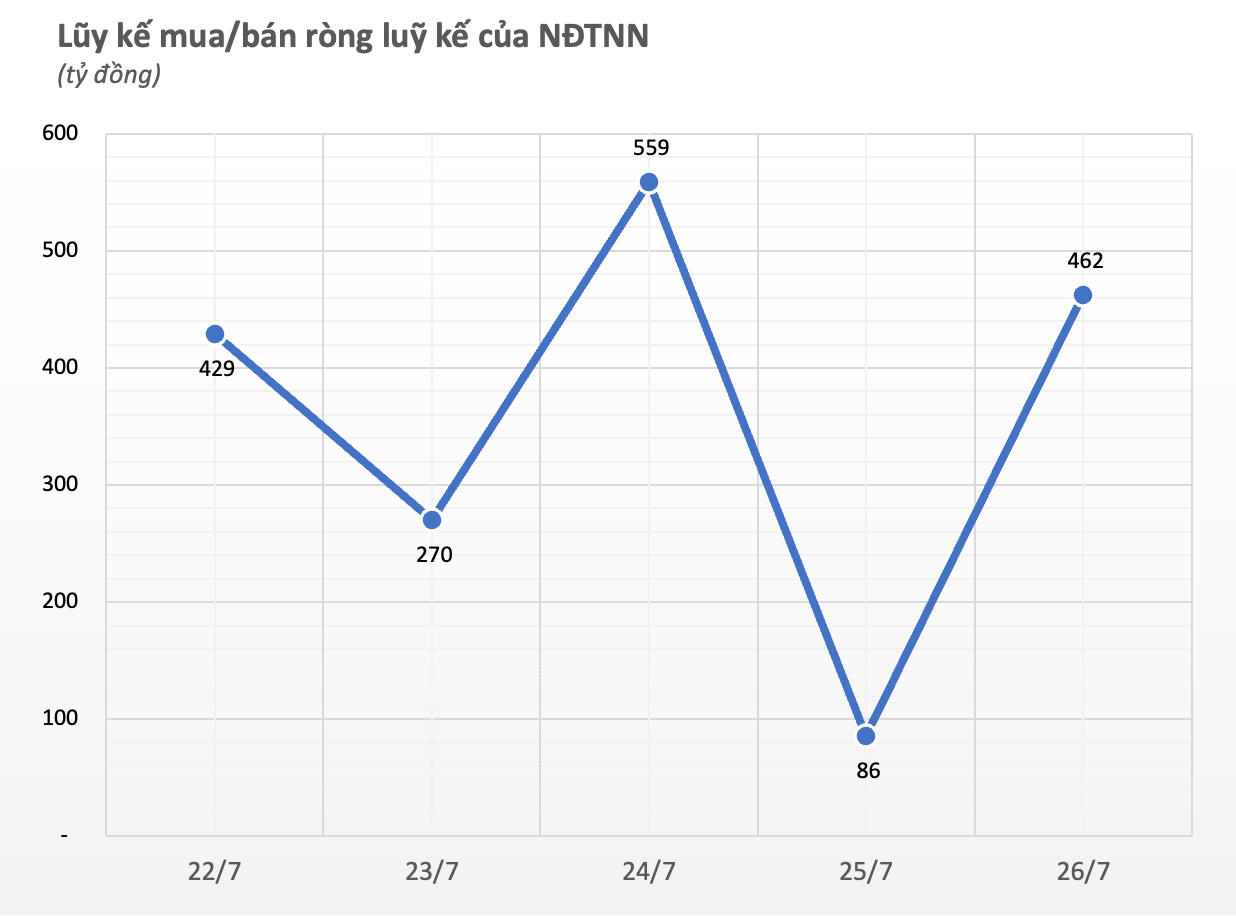

The Flow of Funds: A Shake-Up to Re-test Old Peaks?

The exhilarating surge across the first three trading sessions of the week helped the VN-Index recoup all losses incurred from the April 3rd tax countermeasure shock. However, intense profit-taking pressure on the last trading day also signaled the market’s potential to conclude its short-term upward trend.