Positive outlook for the Vietnamese Dong despite lingering pressures. Photo: LE VU |

Has the pressure on exchange rates eased?

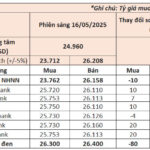

The US dollar exchange rate has remained relatively stable in Vietnam during May, with little fluctuation after a significant increase in April. At Vietcombank, one of the largest state-owned commercial banks in Vietnam, the buying rate was hovering around 23,200 VND per USD, while the free market rate was about 23,500 VND per USD.

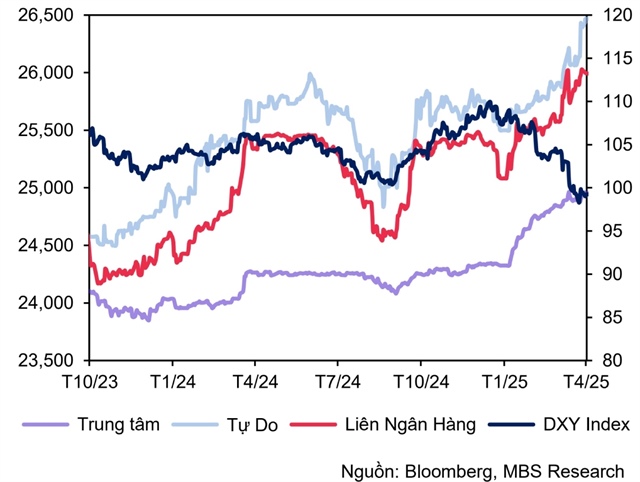

This stability is noteworthy given the broader context of a strong recovery in Asian currencies and a significant weakening of the US dollar. The DXY index, which tracks the value of the US dollar against a basket of foreign currencies, fell by as much as 9.7% from its 2025 peak.

The Vietnamese Dong was an outlier during the sharp rebound of regional currencies in April, according to the May 2025 Currency and Interest Rate Strategy Report by UOB (Singapore) Global Economics and Market Research.

The 1.6% monthly depreciation may reflect the market’s anticipation of negative economic impacts on Vietnam following the tariff announcements. Additionally, a decline in the manufacturing index indicated producers’ cautious sentiment amid concerns about Vietnamese goods losing their price competitiveness in the US market, the largest export market for Vietnam, as per UOB.

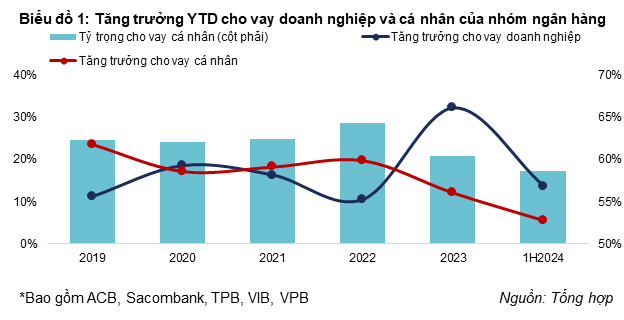

One reason for the persistent high exchange rate, despite the sharp drop in the DXY index, is the tightening foreign currency supply. This is due to the State Bank of Vietnam’s continued dollar purchases from commercial banks, according to MBS. Meanwhile, businesses’ demand for foreign currency tends to increase amid tariff concerns.

Moreover, the sharp decline in interbank interest rates to a 13-month low at the end of the month widened the interest rate differential between the Dong and the US dollar, exerting pressure on the exchange rate, according to MBS experts. In April, the exchange rate surged, with the interbank rate increasing by 1.4% compared to the end of March and 2.1% compared to the beginning of the year.

As the Vietnamese Dong has yet to recover, the strengthening US dollar raises concerns about the future trajectory of exchange rates.

In a related development, the US Federal Reserve (Fed) decided to keep interest rates unchanged at its May meeting, marking the third consecutive meeting with no change. “With risks increasingly tilted towards both persistently high inflation above the 2% target and weakening employment growth, the Fed will find it challenging to accelerate the pace of interest rate cuts as previously expected this year,” said Maybank Securities analysts.

Tran Hoang Son, Director of Market Strategy at VPBank Securities (VPBankS), noted that based on the Fed’s March meeting minutes, there will be two rate cuts later this year. Market futures predict a higher probability of rate cuts in July, October, and December. “After the Fed meeting, the stock market grew positively. The inflow of funds into risky assets like bitcoin also affirmed the robustness of the US economy,” Mr. Son added.

Exchange rate movement runs counter to the DXY index movement |

What policy room is available?

While the foreign exchange market continues to face pressure, the outlook for the Vietnamese Dong remains positive, according to assessments by organizations and experts, particularly in terms of the policy management capabilities of the State Bank of Vietnam.

Firstly, there is the potential for a weaker US dollar towards the end of the year. The US dollar is expected to continue weakening against other major currencies. UOB predicts that the DXY index will fall further to around 96.9 points in Q1-2026. Currencies of economically strong countries, such as the euro, British pound, and Japanese yen, are expected to strengthen.

However, it is important to note that Asian currencies still face risks that could hinder their recovery, even though the volatile period at the beginning of April has passed. “These factors include the uncertainty surrounding the outcome of trade negotiations between the US and China, as well as the rapid appreciation of Asian currencies while the region’s economic and trade outlook weakens,” the UOB report stated.

In its exchange rate forecast, UOB expressed increased optimism by lowering the expected rates for the last three quarters of this year and the first quarter of the next. Specifically, the rate for Q3-2025 is projected at 23,300, and it is expected to drop to 23,000 in Q4-2025. These figures are significantly lower than the previous estimates made at the beginning of the year.

Another factor influencing the Vietnamese Dong is the tariff negotiation outlook. According to Mr. Thanh, Nguyen Xuan Thanh, a senior lecturer at the Fulbright School of Public Policy and Management, a positive sign is that the US side did not mention currency policy in their negotiation demands.

This suggests that the US may request a flexible management approach that prevents the Vietnamese Dong from depreciating too rapidly against the US dollar. This presents a significant challenge for Vietnam, a country that has previously been sensitive to allegations of currency manipulation, Mr. Thanh shared at the Saigon Economic Times’ Finance and Real Estate Forum 2025.

On the macroeconomic policy front, Mr. Thanh also assessed that the positive aspect is that policy management will not be “jittery” as it was before. “Vietnam will not experience a significant shock in either exchange rates or interest rates as we feared a month ago,” he said.

Another positive factor is the inflation situation. April data showed that the average CPI for the first four months of the year increased by 3.2% year-on-year, still well below the 5.0% target. “This provides ample room for the State Bank of Vietnam to maintain its expansionary monetary policies to boost economic development,” Maybank Securities analysts commented.

However, with tariff policies still unclear, the foreign exchange market will remain susceptible to unpredictable impacts. Currently, exports to the US are accelerating in April as importers rush to beat the tariffs. Export growth is expected to continue in May and June. Conversely, FDI faces concerns about attracting new investment, and the global supply chain disruption makes foreign investors cautious and await negotiation outcomes.

The significant challenge for policymakers is to prevent a sharp depreciation of the currency while supporting economic growth. With high growth targets and increasing credit supply, there is also upward pressure on exchange rates. “The big challenge now is to maintain stable interest rates,” Mr. Thanh concluded.

Dung Nguyen

– 07:00 19/05/2025

The Greenback Slides in Vietnam

The US dollar witnessed a surprising decline at commercial banks, hovering just above the 26,000 VND mark.