Vietnam Container Shipping Joint Stock Company (Viconship, HOSE: VSC) has reported on its recent purchase of HAH shares of Hai An Transport and Stevedoring Joint Stock Company (HOSE: HAH).

On May 13 and 14, Green Logistics Center Co., Ltd. (a subsidiary of Viconship) acquired a total of 254,000 HAH shares, increasing its ownership from 0.62% to 0.82% of the charter capital.

Viconship itself purchased over 1 million HAH shares, raising its ownership from 9.31% to 10.08%.

Meanwhile, another Viconship subsidiary, Green Port Service Co., Ltd., maintained its ownership stake at 0.719%.

As a result, the group of shareholders related to Viconship now holds 11.61% of the charter capital in Hai An Transport and Stevedoring.

Prior to this, Viconship successfully acquired more than 2.4 million HAH shares through four separate transactions from May 7 to 9, increasing its ownership from 7.451% to 9.31%.

In another development, Hai An Stevedoring announced the record date for shareholders to attend the upcoming Annual General Meeting (AGM) for the fiscal year 2025.

The deadline for shareholder registration for the AGM is set as May 29, 2025.

The AGM is expected to take place in late June 2025, at the Hai An Building, 7th Floor, Dinh Vu Road, Dong Hai II Ward, Hai An District, Hai Phong City.

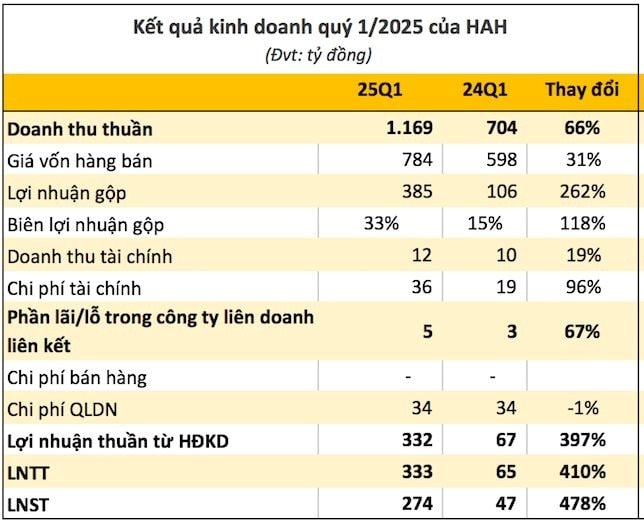

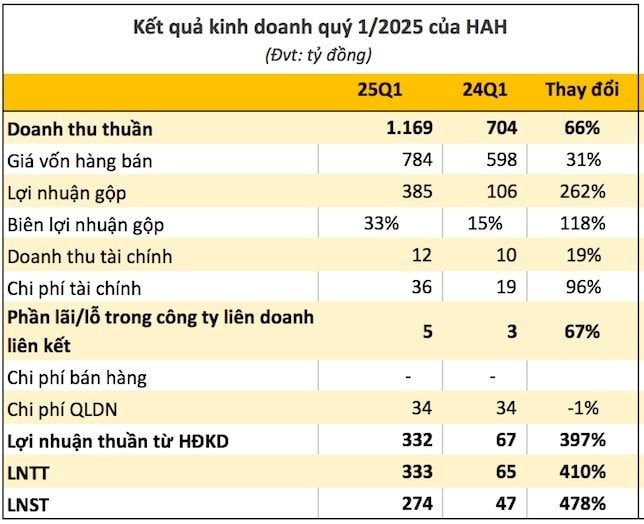

For the first quarter of 2025, Hai An Stevedoring reported impressive financial results with a 66% surge in net revenue year-over-year. The cost of goods sold increased by 31%, lower than the revenue growth rate, leading to a gross profit of nearly VND 385 billion, almost four times higher than the same period last year. The gross profit margin also improved from 15% to 33% in Q1 2025.

Hai An Transport and Stevedoring Joint Stock Company

The company announced a substantial after-tax profit of nearly VND 274 billion, reflecting a remarkable 478% increase compared to the previous year. The after-tax profit attributable to the parent company stood at VND 233 billion, almost four times higher than the same period in 2024. With these results, the company has accomplished 28% of its annual revenue target and 39% of its annual profit plan for the year.

“Shareholder Meeting: Considering Multiple Payment Installments to Regain the Phuoc Kien Project”

At the 2025 Annual General Meeting held on the afternoon of May 17th, JSC Quoc Cuong Gia Lai (HOSE: QCG) will propose to its shareholders a target of VND 300 billion in pre-tax profit, a figure that is second only to the years 2010 and 2017, along with a record-breaking revenue. Most surprisingly, the company is proposing to change its name after more than 30 years of operation.

“Shareholder Meeting: Considering Multiple Payment Installments to Reclaim the Bac Phuoc Kien Project”

At the 2025 Annual General Meeting held on May 17, JSC Quoc Cuong Gia Lai (HOSE: QCG) will propose to its shareholders a target of VND 300 billion in pre-tax profit, a figure surpassed only in 2010 and 2017, alongside record-breaking revenue. The most surprising item on the agenda is the proposal to change the company’s name after over three decades of operation.

Dragon Capital, a Leading Foreign Ownership Fund, Steps Down as Major Shareholder of PVS

Dragon Capital, a prominent foreign investment fund, has recently sold 650,000 PVS shares, reducing their ownership stake to 4.8906%. This move signifies a notable shift as Dragon Capital is no longer a major shareholder in PVS.