This was the plan approved by the 2025 Annual General Meeting of Agriseco on March 28, 2025. With over 244 billion VND in undistributed post-tax profits as of December 31, 2024, in addition to paying over 129 billion VND in dividends, the company also allocated over 13 billion VND to employee bonus and welfare funds and nearly 439 million VND to the management bonus fund.

Agriseco plans to implement a dividend payout in 2025. Upon completion, the company’s charter capital will increase from nearly VND 2,154 billion to over VND 2,283 billion to meet business development needs.

Source: VietstockFinance

|

At the 2025 Annual General Meeting, Chairman Phan Van Tuan stated that the company needed to strengthen its financial capacity after a prolonged restructuring phase that weakened its position. The leader emphasized that the company could afford to pay up to a 10% dividend ratio but needed to maintain a balance to avoid impacting business performance and stock value, especially amid the volatile nature of the securities industry.

Previously, after eliminating accumulated losses in 2021, the securities company began paying dividends to shareholders at rates of 6% (for 2022) and 7% (for 2023), both in cash. The last time the company raised capital through equity issuance was in 2023 at a ratio of 100,000:1,602, with nearly 3.4 million shares, using the reserve fund to supplement charter capital as of December 31, 2021.

Chairman Phan Van Tuan speaking at the 2025 Annual General Meeting of Agriseco – Photo: Agriseco

|

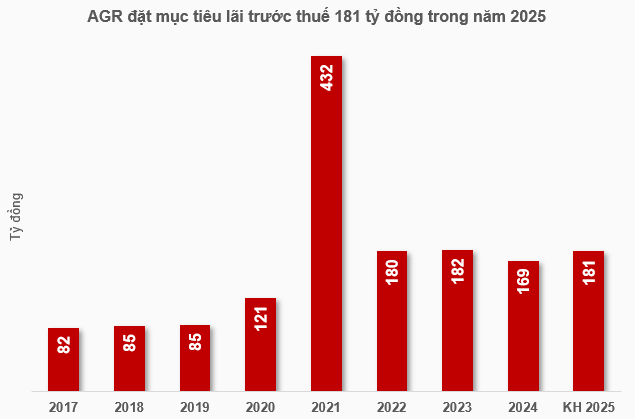

In addition to the dividend plan, the meeting also approved the 2025 business plan with a total revenue of 450 billion VND and total expenses of 269 billion VND, resulting in a pre-tax profit of 181 billion VND. The pre-tax profit target indicates an expected growth of over 7% compared to the 2024 performance and is in line with the trend since 2023.

Source: VietstockFinance

|

According to the company, the securities market in 2025 is expected to face more risks than opportunities. Uncertainties are on the rise, including trade wars, the Russia-Ukraine conflict, a global economic downturn, the Fed’s high-interest rate stance, exchange rate pressures, and capital outflows from stocks.

Domestically, the economy is affected by significant trade activities and limited resilience. There is also mounting pressure from corporate bond maturities, with many organizations defaulting on their payment obligations, creating bottlenecks for economic growth.

However, the market still has bright spots, thanks to controlled inflation, government stimulus policies, and expectations of an upgraded market status attracting foreign capital back into the country.

In the first quarter of 2025, the company’s pre-tax profit exceeded 40 billion VND, an 8% decrease compared to the same period last year, achieving 22% of the yearly plan. Finally, the company posted a net profit of over 32 billion VND, an 8% decrease.

– 09:43 19/05/2025

A Brokerage Firm is About to Pay a 43% Dividend Yield

The anticipated launch timeline is set for Q2 and Q3 of 2025, pending approval from the State Securities Commission.

State Subsidies: A Profitable Venture for Rail Operators in Hanoi

Let me know if you would like me to incorporate any keywords or if there are any other specifications you would like me to follow.

The subsidy surged by almost VND 100 billion in 2024 as the Nhon – Hanoi Railway Station route commenced operations on the elevated section.