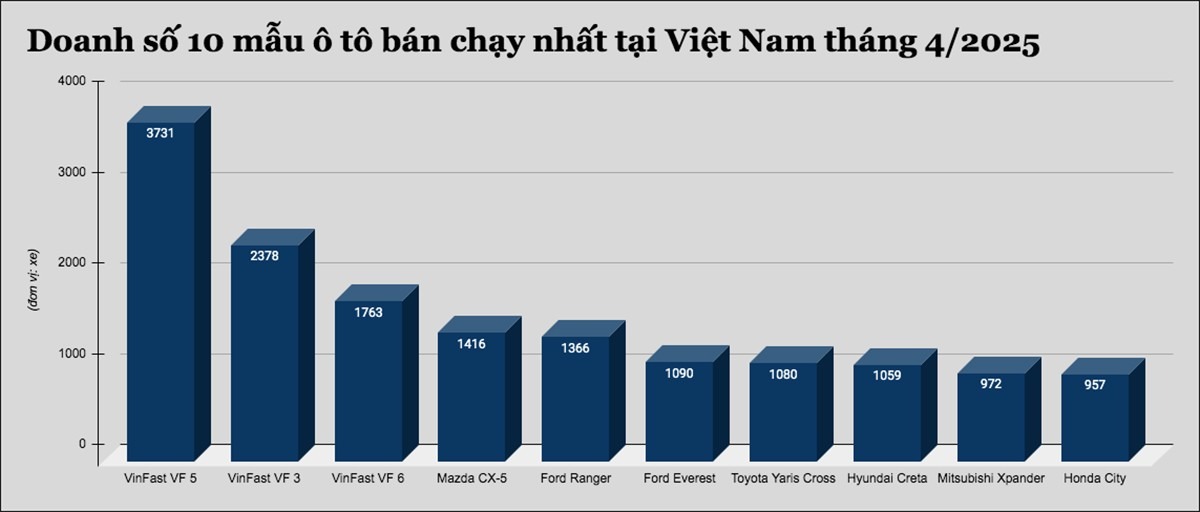

The Top 10 Best-Selling Cars in Vietnam: An Unexpected Turn of Events

April 2025 marked an unusual turn of events in the Vietnamese automotive market. For many, it was surprising to see Hyundai selling only 129 units of their Santa Fe model or Toyota’s absence from the top 10 best-sellers list. Meanwhile, VinFast dominated the charts with their VF 5 (3,731 units), VF 3 (2,378 units), and VF 6 (1,763 units).

These figures not only confirm the rapid rise in popularity of domestic electric vehicles but also paint a contrasting picture: former market leaders like the Toyota Vios, Hyundai Accent, and Mitsubishi Xpander are either absent from the top 10 or struggling to maintain their positions.

Are These Numbers a Sign of Things to Come?

The decline of the once-dominant Toyota Vios has been quiet but not unexpected. In April, Vios sales dropped to 773 units, a nearly 26% decrease from March, knocking it out of the top 10. Cumulative sales for the first four months of 2025 reached 3,058 units—the highest in its segment—but this was still not enough to secure a spot in the overall top 10. Compared to the same period in 2024 (2,680 units), Vios sales have increased by 14%. However, this growth is mainly due to a strong start at the beginning of the year, as the past three months have shown a downward trend.

The rise of the VinFast VF 5 and VF 6 is challenging traditional choices like the Toyota Vios and Hyundai Accent, despite targeting different market segments.

The Hyundai Accent, which dethroned the Vios in 2023, is also facing a downward spiral. According to TC Motor, Accent sales reached 568 units in April, and cumulative sales for the first four months were 2,602 units, a roughly 16% decrease compared to the same period in 2024 (3,096 units). Having lost its advantage of offering a balance between price and features, with the price of the high-end trim now reaching 569 million VND, the Accent is no longer a cost-effective choice for ride-hailing drivers.

The Mitsubishi Xpander, a staple MPV for ride-hailing services, remains the segment leader but is facing a significant challenge. In April, sales dropped to 972 units, a 62% decrease from March (2,530 units), barely keeping it in the top 10. Cumulative sales for the first four months reached 5,363 units, about a 12% increase compared to the same period in 2024 (estimated at 4,772 units). However, this growth is mainly due to a surge in sales in March.

Many attribute this drop in sales to potential customers awaiting the release of the VinFast Limo Green, scheduled for official delivery in August 2025. The decline in sales of these traditional favorites coincides with the rise of VinFast VF 5 and VF 6, further emphasizing the shift in preferences towards electric vehicles, especially among ride-hailing drivers, who are attracted by the lower operating costs and generous incentives.

A conversation with a Xanh SM driver on May 18th underscored this point. He asserted that even after the end of the free charging period (expected in mid-2027), the operating costs for electric vehicles used for ride-hailing services would still be approximately 30% lower than their gasoline counterparts. This perspective is particularly noteworthy as ride-hailing drivers are known for their practical approach to cost calculations.

This practical mindset is further validated by Mordor Intelligence’s recent report, which showed that Xanh SM has expanded its market share, now nearing 40%, compared to Grab’s 35.57%. Xanh SM also leads in three critical indicators: the number of daily trips, gross merchandise value (GMV), and customer satisfaction—echoing the driver’s statement that both riders and drivers are increasingly choosing their platform.

Xanh SM’s surge in popularity coincides with the decline in sales of gasoline-powered vehicles traditionally favored by ride-hailing drivers.

This shift sends a clear message to Japanese and Korean automakers: their traditional value propositions are no longer enough. If Toyota continues to rely on durability, Hyundai on design, and Mitsubishi on spaciousness, they risk falling out of favor with Vietnamese consumers. This is especially true in the ride-hailing industry, where every kilometer traveled impacts the bottom line, and total cost of ownership (TCO) is the ultimate deciding factor.

The April 2025 sales figures may be an early warning sign. If electric vehicles continue to capture more than 25% of the market share in the second quarter—a trend currently led by VinFast—traditional sedans and MPVs could lose their last line of defense: ride-hailing customers. By then, the once-ubiquitous models may become more common in the used car market, and the unusual top 10 list of April could become the new normal.

The answer will become clear in the coming months. For now, the April rankings serve as a red flag, signaling a potential shift in the automotive landscape: “Slow down, or risk losing your crown.”

The Top 10 Best-Selling Cars of April 2025: VinFast Dominates, Xpander Almost Misses Out

The Vietnamese automotive market in April 2025 continues to be dominated by VinFast’s electric trio: the VF 5, VF 3, and VF 6. Meanwhile, there has been a shuffle in the internal combustion engine segment.

Why VinFast Can Break the Saturation of the Vietnamese Motorcycle Market

“Vinfast has expertly navigated the electric motorcycle market in Vietnam, delivering precisely what customers want,” says industry expert Nguyen Long Chau.