Nam Viet Joint Stock Company (ANV) recently experienced a significant change in share ownership. Doan Chi Thanh, the son of the company’s CEO Doan Toi, and also the director of business, had more than 1.36 million ANV shares sold by securities companies on May 15, reducing his ownership to 29.91 million shares, or 11.22% of the capital.

Prior to this, on May 9, Mr. Thanh also had approximately 1.3 million ANV shares sold in a similar manner. Additionally, on May 6, over 1.6 million of his shares were sold, bringing the total amount of shares sold by securities companies on his behalf to 4.3 million in the month of May alone.

Looking back at April, Mr. Thanh also experienced the sale of over a hundred thousand shares on the 15th and 28th of that month.

In contrast, Doan Toi, the company’s Vice Chairman and CEO, and father of Mr. Thanh, purchased 3 million ANV shares from April 11 to 18, increasing his holdings to 146.6 million shares, or 54.98%, solidifying his position as the largest shareholder of ANV.

The consecutive sale of the director’s shares by securities companies occurred following the announcement of potential 46% retaliatory tariffs on Vietnamese exports to the US in early April, causing concerns for the company’s tra fish export business.

In response to this development, Mr. Doan Toi sent a letter to shareholders, assuring them that the US is a potential market for the company, both presently and in the future, especially for their key products of tra and tilapia. He emphasized that Nam Viet will focus on expanding its presence in existing export markets other than the US, including China, the Middle East, Brazil, Asia, and Mexico.

On the stock market, ANV shares plummeted from the 16,500 VND/share range to 12,400 VND/share, a 25% loss, in the week following the US tariff announcement. However, the share price has since recovered and is currently trading around the 15,000 VND/share mark.

The Dominant Force in Binh Duong’s Water Industry Sets Sights on Acquiring Vinh Long’s Water Supply Company

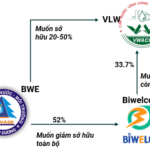

“Biwase, a leading water and environment corporation listed on the Ho Chi Minh Stock Exchange (HOSE: BWE), has announced a resolution by its Board of Directors on May 6th, regarding their decision to invest in Viwaco, a water supply company traded on the UPCoM Exchange (VLW). This strategic investment move underscores Biwase’s commitment to expanding its presence and strengthening its position in the water industry.”

The Final Bank to Dish Out Dividends in 2024

This bank is set to issue approximately 429.7 million shares as a dividend payout, equating to a substantial 16.8% ratio.