Last week, the VN-Index rose 34.09 points to 1,301.39. The total trading value on the HoSE exchange reached VND 119,505 billion, up nearly 40% from the previous week. The HNX-Index ended the week at 218.69, up 4.56 points from the previous week. Liquidity on the HNX exchange reached VND 6,566 billion, up nearly 39% from the previous week.

According to statistics from the HoSE exchange, foreign investors net bought nearly 111 million units, with a net buying value of more than VND 2,923 billion. On the HNX exchange, foreign investors net sold 2.14 million units, with a total net selling value of nearly VND 10 billion.

On the Upcom market, foreign investors net sold for 5 consecutive sessions with 2.42 million units, net selling value of more than VND 29 billion. Thus, in the trading week from May 12-16, foreign investors net bought 72.73 million units on the whole market, corresponding to a net buying value of VND 2,884 billion.

Not sold out

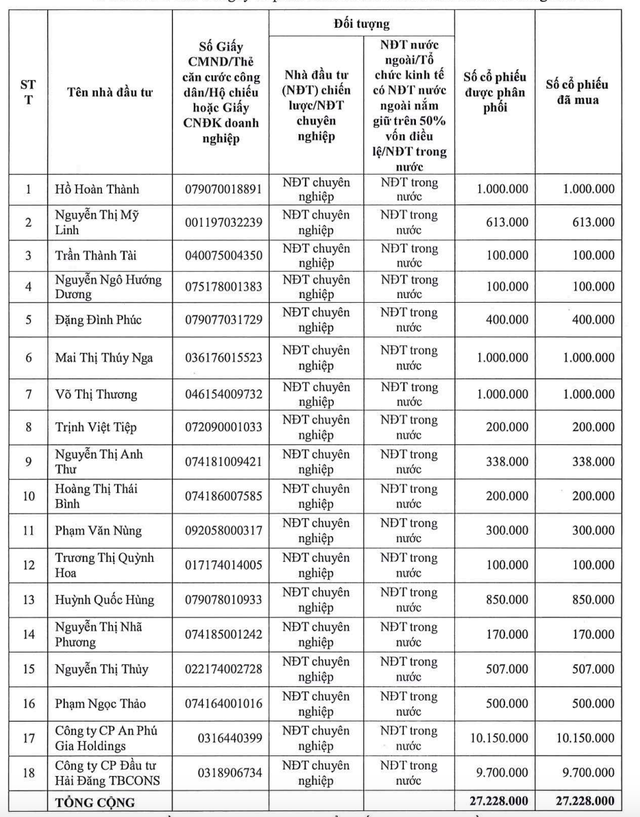

As of May 12, Binh Duong Business and Development JSC (stock code: TDC) had announced a list of 8 investors registered to buy, but in fact, only 6 investors bought, corresponding to 3,213,000 private placement shares at a price of VND 11,840 per share out of a total registered offering of 35 million shares, leaving 31,787,000 shares unsold.

TDC has about 7,772,000 shares left unsold in this private placement.

TDC continues to plan to distribute 24,015,000 of these private placement shares to 12 individual and institutional investors out of a total of 31,787,000 unsold shares. Of these, TBCONS Hai Dang Investment Joint Stock Company plans to buy 9.7 million shares, An Phu Gia Holdings Joint Stock Company plans to buy 10.15 million shares, and the remaining 10 individual investors will buy 4,165,000 shares.

Thus, even if more than 24 million shares are sold to 12 individual and institutional investors, there will still be about 7,772,000 shares left unsold in this private placement.

At the end of the private placement on May 15, TDC sold only 27,228,000 shares out of a total registered sale of 35 million shares, a ratio of 77.79% of the registered sale, with 7,772,000 shares left unpurchased by investors.

With the successful sale of more than 27.2 million shares, TDC raised only VND 322.4 billion compared to the plan to raise more than VND 414 billion and increase its charter capital from VND 1,000 billion to more than VND 1,272 billion.

According to the initial offering plan, TDC will offer 35 million shares at a price of VND 11,840 per share, raising more than VND 414 billion. All of this capital will be used to repurchase TDC.BOND.700.2020 bonds before maturity.

List of 18 investors participating in the private placement.

Kien Giang Construction Investment Consulting Group Joint Stock Company (CIC Group, stock code: CKG) has just started the registration and payment period from May 14 to June 4, but has already planned to extend the time to distribute unsubscribed shares in the offering to existing shareholders.

Specifically, CIC Group has approved the extension of time to distribute unsubscribed shares according to the approved plan in the public offering of shares, with the maximum extension period not exceeding 30 days.

Previously, on May 6, CIC Group will finalize the list of shareholders to exercise the right to buy shares offered to existing shareholders at a ratio of 2:1, meaning that for every 2 shares owned, shareholders will receive the right to buy 1 new share at a price of VND 10,500 per share, with the registration and payment period from May 14 to June 4.

According to the plan, CIC Group expects to offer 47,629,680 shares to raise more than VND 500 billion. The proceeds will be used by CIC Group to pay VND 350 billion of bonds due, more than VND 105 billion to pay bank loans due, and the remaining nearly VND 45 billion to supplement other working capital.

DIC Corp continues to “sell paper for money”

Mr. Le Dinh Thang, Chairman of the Board of Directors and major shareholder of DIC Holdings Joint Stock Company (stock code: DC4) bought 956,886 DC4 shares out of a registered purchase of 1 million shares, thereby increasing his ownership to 12.39% of charter capital. The transaction was made from April 11 to May 10. Explaining the reason for not buying all the registered shares, Mr. Thang said that it was due to a change in investment plans.

On the opposite side, Construction Investment Joint Stock Company (DIC Corp, stock code: DIG) reduced its ownership in DIC Holdings. Specifically, as of December 31, 2024, DIC Corp owned 35.89% of the charter capital of DIC Holdings, but by the end of the first quarter of 2025, its ownership had decreased to 28.39%.

DIC Corp issued an additional 37 million shares to pay dividends in this period.

On May 30, DIC Corp will finalize the list of shareholders to pay 2024 dividends at a rate of 6% in shares, meaning that for every 100 shares owned, shareholders will receive 6 new shares. With nearly 610 million shares currently in circulation, it is estimated that DIC Corp will issue an additional 37 million shares to pay dividends in this period.

In addition to the plan to issue shares to pay dividends, at the 2025 Annual General Meeting of Shareholders, DIC Corp approved a plan to offer shares to existing shareholders at a ratio of 24.596%, corresponding to an offering of 150 million shares at a price of VND 12,000 per share to raise VND 1,800 billion.

The Bamboo Capital Group’s Shares Soar: Up 44.4% in 4 Days After a Slump Triggered by the Prosecution of Key Executives

The positive turn of events has breathed new life into the Bamboo Capital stock group, which had been reeling under intense selling pressure.

Market Beat: Foreign Investors Scoop Up VIC Shares, VN-Index Recaptures Green

The market regained its positive momentum, led by a few key stocks. By the end of the morning session, the VN-Index rose slightly by 0.12%, reaching 1,302.97. In contrast, the HNX-Index fell by 0.38% to 217.85. Despite the overall gain, the market breadth remained tilted towards decliners, with 369 stocks falling against 276 advancing ones.

“Vietstock Weekly: Uptrend Persists, Setting the Tone for a Bullish Week Ahead”

The VN-Index continued its upward trajectory, maintaining its positive momentum since crossing above the 200-week SMA. Accompanied by strong trading volumes above the 20-week average, this indicates robust participation from investors. This momentum was pivotal in propelling the index beyond the 1,300-point mark. Should the VN-Index sustain levels above this threshold in the coming weeks, it could potentially pave the way for a revisit to the March 2025 highs of 1,320-1,340 points. This zone also coincides with the highest peak since May 2022.