Image source: VietstockFinannce

|

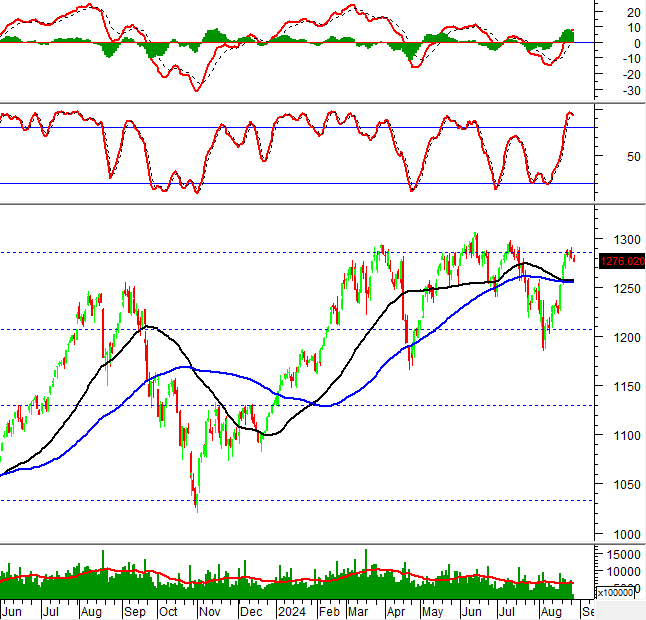

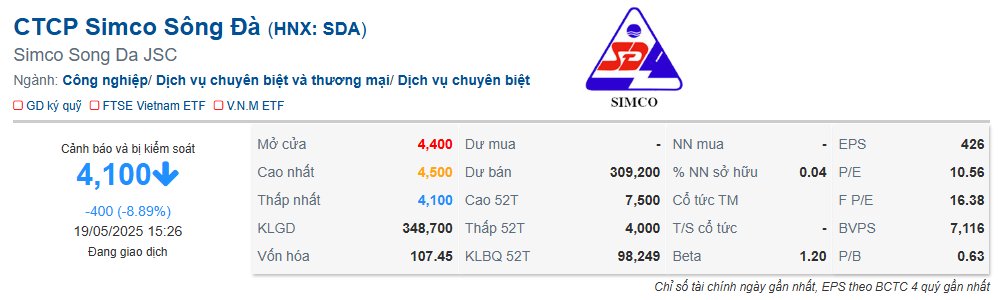

On May 19, 2025, SDA shares plunged to the floor price of 4,100 VND per share, with a matching volume of over 350,000 shares and a selling surplus of more than 309,000 shares at the floor price. This price is slightly higher than the previous low of 4,000 VND per share recorded in early April when the stock was impacted by news about tariffs.

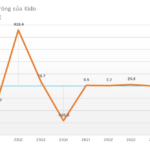

Prior to this, SDA shares had surged from the 4,500 VND per share range to over 6,300 VND per share in less than three weeks (a nearly 40% increase) starting in early February 2025, before reversing course and falling sharply. In late 2021, the stock had a remarkable rally, surging from below 5,000 VND per share in September to a peak of 75,000 VND per share in November 2021, a 15-fold increase, before declining to its current levels.

SDA attracted attention in late 2021 with a surge from below 5,000 VND per share in early September to a historic peak of 75,000 VND per share in late November – Image source: VietstockFinancne

|

Today’s plunge follows a decision by HNX to restrict SDA trading due to a delay in submitting its 2024 audited financial statements beyond the 45-day deadline. The stock will only be traded on Fridays, starting May 21.

Earlier, in early May, SDA received a warning for its 2023 audited financial statements, which included a qualified opinion from the auditor, while the company reported cumulative losses of nearly 77 billion VND as of December 31, 2023. The stock was also placed under surveillance for failing to submit its 2024 audited financial statements within 30 days of the deadline.

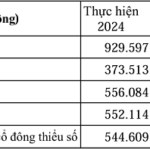

According to its self-prepared 2024 financial statements, SDA recorded a 41 billion VND revenue, an 8% decrease, and a net profit of 46 million VND, an improvement from a loss of over 29 billion VND in 2023. In the first quarter of 2025, revenue reached 4 billion VND, a 38% decrease year-on-year, but gross profit increased by over 100% thanks to lower costs of goods sold. However, interest expenses and management costs continued to weigh on the company’s performance, resulting in a net loss of nearly 30 million VND (compared to a loss of 226 million VND in the first quarter of 2024).

| SDA’s Financial Performance over the Last Decade |

|

|

– 16:13, May 19, 2025

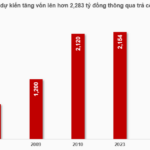

“Agriseco Prepares to Release Nearly 13 Million Shares as Dividends, Boosting Capital to Over VND 2,283 Billion”

AgriBank Securities Joint Stock Company (Agriseco, HOSE: AGR) is pleased to announce a dividend payout for the year 2024 in the form of a stock dividend. Over 12.9 million new shares will be issued, entitling shareholders to a dividend ratio of 100:6. This equates to a total value of over VND 129 billion. The ex-dividend date is set for June 2nd, 2024.

“Shareholder Meeting: Considering Multiple Payment Installments to Regain the Phuoc Kien Project”

At the 2025 Annual General Meeting held on the afternoon of May 17th, JSC Quoc Cuong Gia Lai (HOSE: QCG) will propose to its shareholders a target of VND 300 billion in pre-tax profit, a figure that is second only to the years 2010 and 2017, along with a record-breaking revenue. Most surprisingly, the company is proposing to change its name after more than 30 years of operation.

“Shareholder Meeting: Considering Multiple Payment Installments to Reclaim the Bac Phuoc Kien Project”

At the 2025 Annual General Meeting held on May 17, JSC Quoc Cuong Gia Lai (HOSE: QCG) will propose to its shareholders a target of VND 300 billion in pre-tax profit, a figure surpassed only in 2010 and 2017, alongside record-breaking revenue. The most surprising item on the agenda is the proposal to change the company’s name after over three decades of operation.

“The Post-Acquisition SII Strategy: Liquidating Assets to Fund Loans”

For years, SII has been operating at a loss, relying on funds generated from unusual loans backed by the sale of significant assets.