Mr. Ha Quang Tuan transfers 10 million Hanoimilk shares to his daughter

Ms. Ha Phuong Thao, daughter of Ha Quang Tuan, Chairman of the Board of Directors of Hanoi Milk Joint Stock Company (Hanoimilk, UPCoM: HNM), officially became a new major shareholder after receiving a transfer of 10 million shares from her father.

The transaction was executed on May 6, bringing Ms. Thao’s ownership to 22.52% of Hanoimilk’s chartered capital. On the same day, the market recorded a matching transaction of the same number of shares, valued at VND 100 billion, corresponding to VND 10,000/share, higher than the closing price of VND 8,800/share.

Following the transaction, Mr. Ha Quang Tuan‘s ownership decreased from 31.7% to 9.18%.

Chairman of NTL completes the sale of 2 million shares

Mr. Le Minh Tuan, Chairman of the Board of Directors of Urban Development and Construction Joint Stock Company (Lideco, HOSE: NTL), has completed the sale of 2 million NTL shares as registered, between April 10 and May 9.

Calculated based on the closing price of VND 15,000/share on May 9, Mr. Tuan could have earned approximately VND 30 billion from this transaction. As a result, his ownership in the Company decreased from 3.34% (equivalent to more than 4.1 million shares) to 1.72% (approximately 2.1 million shares).

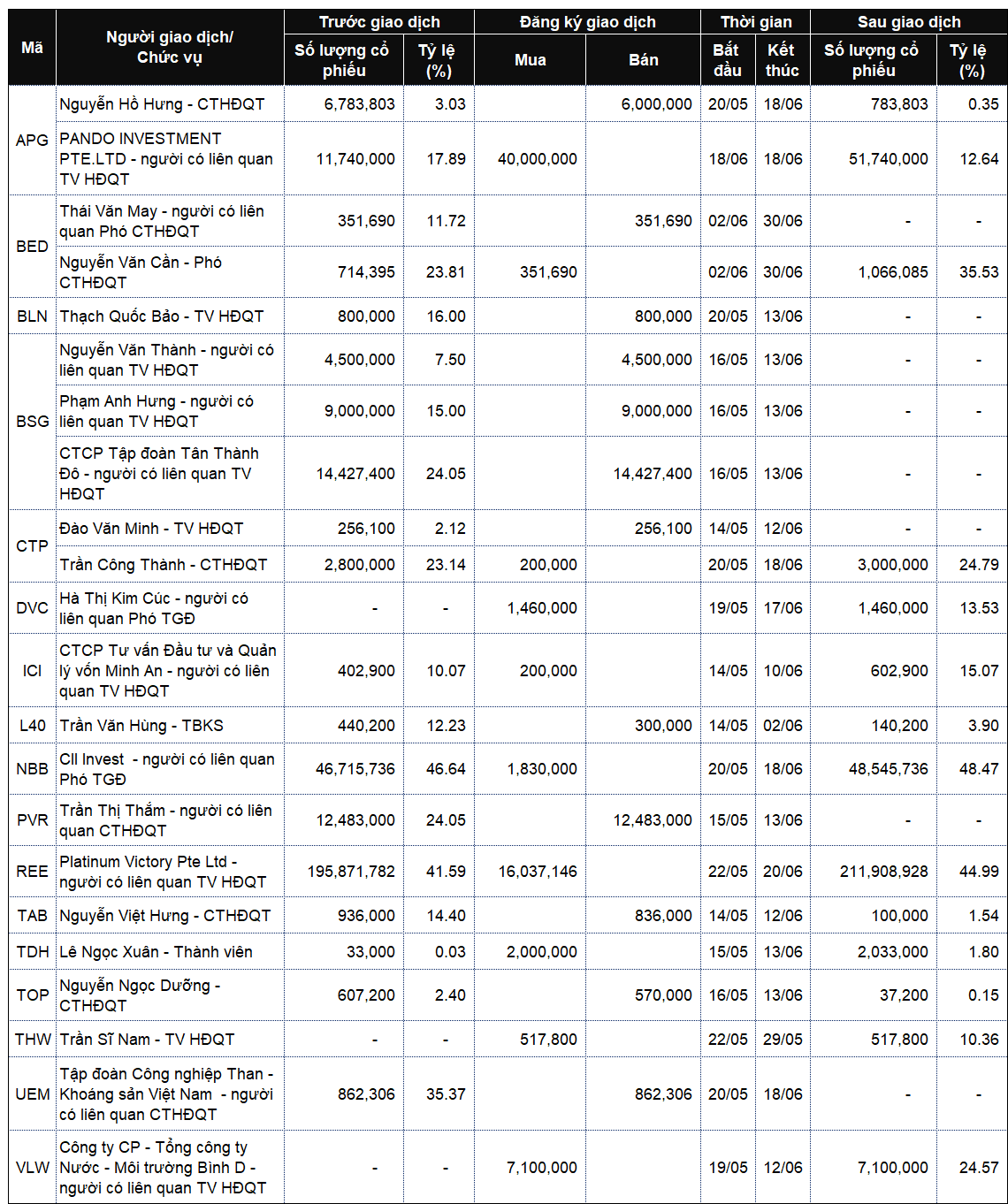

Foreign fund aims to increase ownership to more than 23%, while APG Chairman registers to sell almost all his shares

PANDO 1 INVESTMENT PTE.LTD Investment Fund has just announced its registration to purchase 40 million shares of APG Securities Joint Stock Company (HOSE: APG) from May 20 to June 18, aiming to increase its ownership from 5.25% to 23.14%, equivalent to 51.74 million shares. The purpose of the transaction is to restructure its investment portfolio.

In the stock market, APG shares are currently trading close to the VND 12,000/share mark, up 39% in a quarter and more than doubled since the beginning of the year. At this price, the PANDO 1 fund needs to spend about VND 480 billion to complete the deal.

On the opposite side, Mr. Nguyen Ho Hung, Chairman of the Board of Directors of APG, has registered to sell 6 million APG shares, equivalent to nearly 90% of his holdings, to reduce ownership from 3.03% to 0.35% (equivalent to 783,803 shares). The transaction is expected to take place from May 20 to June 18, coinciding with the PANDO 1 fund’s registration to buy, most likely indicating a direct transfer between the two parties. If successful, Mr. Hung could earn about VND 72 billion.

Major shareholder related to Board member intends to fully divest from SaigonBus, causing share price to plunge

On May 14, three major shareholders, including Tan Thanh Do Group Joint Stock Company (TDCC), Mr. Pham Anh Hung, and Mr. Nguyen Van Thanh, announced their plan to sell all of their combined 27.9 million shares of Saigon Passenger Transport Joint Stock Company (SaigonBus, UPCoM: BSG) – equivalent to approximately 47% of the Company’s chartered capital. Specifically, Tan Thanh Do registered to sell more than 14.4 million shares, Mr. Hung registered to sell 9 million shares, and Mr. Thanh registered to sell 4.5 million shares. The transaction is expected to take place from May 16 to June 13.

All three shareholders mentioned above are related to Mr. Tran Ngoc Dan, who is currently the Chairman of the Board of Directors of Tan Thanh Do Group and City Auto Joint Stock Company (HOSE: CTF), as well as a member of the Board of Directors of BSG. Mr. Hung and Mr. Thanh are Mr. Dan’s brothers-in-law.

The news of the large shareholders related to the leadership’s plan to “fully divest” had a negative impact on the share price, pushing BSG shares down to the floor price. Based on the price of VND 12,200/share, the total value of the aforementioned 47% divestment deal amounts to more than VND 340 billion.

Wife of PVR Chairman registers to sell her entire 24.05% stake as the Company suspends business operations in 2025

Ms. Tran Thi Tham, wife of Mr. Bui Van Phu, Chairman of the Board of Directors of Hanoi PVR Investment Joint Stock Company (UPCoM: PVR), has registered to sell all of her nearly 12.5 million PVR shares, equivalent to 24.05% of the Company’s chartered capital. The transaction is expected to take place from May 15 to June 13, aiming to restructure her investment portfolio.

If the deal is successful, Ms. Tham will no longer be a major shareholder of PVR. Meanwhile, Mr. Bui Van Phu, the Chairman, still holds more than 2.7 million shares, equivalent to 5.23%.

At the close of the trading session on May 13, PVR shares stood at the reference price of VND 1,100/share with no transactions. Based on this price, Ms. Tham could earn nearly VND 14 billion if she sells all the registered shares.

|

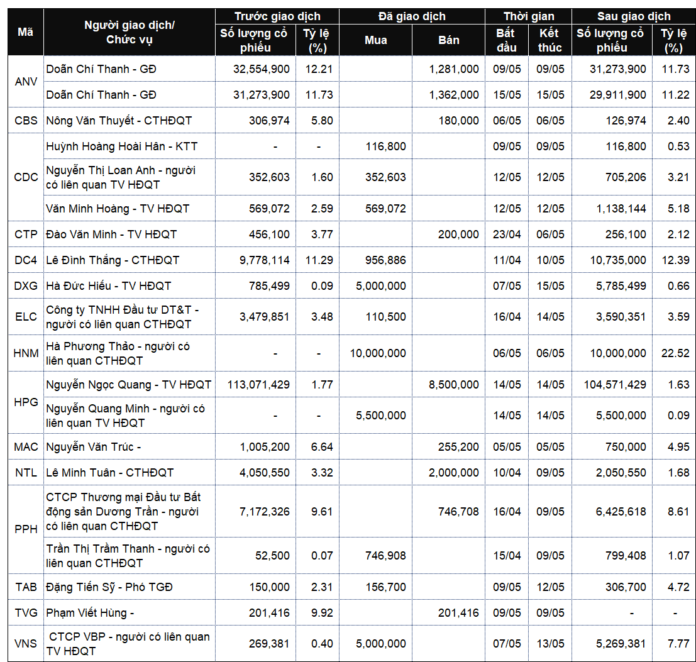

List of company leaders and relatives trading from May 12 to 16, 2025

Source: VietstockFinance

|

|

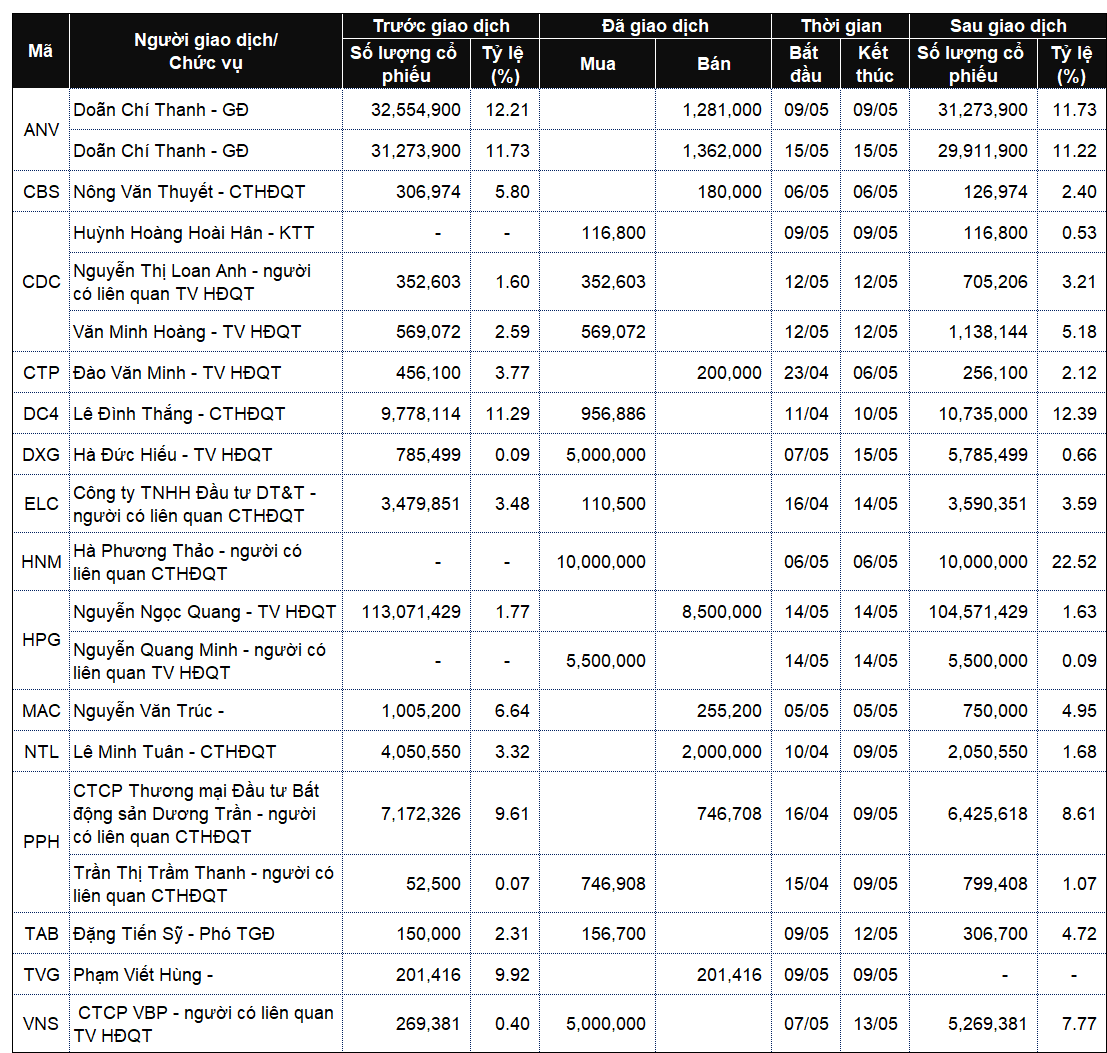

List of company leaders and relatives registering to trade from May 12 to 16, 2025

Source: VietstockFinance

|

“Maritime Enterprise Sets Sail with a June Dividend: A Whopping 4,000 VND Per Share”

With 40 million shares outstanding, Dinh Vu Port will dish out VND160 billion in dividend payments to its shareholders.

The Dominant Force in Binh Duong’s Water Industry Sets Sights on Acquiring Vinh Long’s Water Supply Company

“Biwase, a leading water and environment corporation listed on the Ho Chi Minh Stock Exchange (HOSE: BWE), has announced a resolution by its Board of Directors on May 6th, regarding their decision to invest in Viwaco, a water supply company traded on the UPCoM Exchange (VLW). This strategic investment move underscores Biwase’s commitment to expanding its presence and strengthening its position in the water industry.”